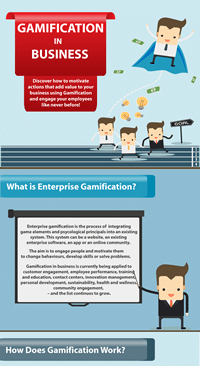

Gamification In Banking And Financial Services

Gamification in banking and financial services has innovated how financial institutions interact with customers. Banks and financial services exist to help people achieve their goals or alleviate their financial burden. While many of these institutions succeeded, many still struggle to provide what their customers actually want and need.

Because of this, many customers are struggling to trust these banks. Not only that, the presence of unmotivated employees can significantly affect the company’s overall profitability and performance.

Creating a successful organisation through financial well-being and workforce performance

Here’s one uncomfortable truth that folks involved in banking and financial services must face.

People see banking and financial services as either a problem or a solution.

These institutions have two major battles to fight to sway public opinion in their favour.

First, they must design programs that help customers manage their finances better. The more they can provide people with the tools they need to thrive financially, the better. Additionally, forming a supportive relationship with customers can guide them towards financial stability and peace of mind.

Second, they must ensure their teams are performing at their best. This is because a motivated and efficient workforce is the backbone of any successful organisation. When employees are in the right environment where they can grow and sharpen their skills, they thrive. And once they become more efficient at their jobs, they’re bound to make a huge difference in your organisation’s success.

How gamification can help in banking and financial services

Gamification in banking and financial services can dramatically transform both customer engagement and employee performance. By making financial tasks and workplace challenges more engaging, this approach can breathe new life into the traditional banking experience.

This infographic will show you how financial institutions leverage the power of gamification to set themselves apart. In doing so, they continue positively impacting their customers’ and employees’ lives, families, homes, and dreams.

Low engagement & performance are two sides of the same problem

Low engagement often leads to poor performance and vice versa. Whether for your customers or employees, staying engaged can be quite the challenge in today’s super busy world. It’s important for customers and employees alike to stay connected and perform their expected actions well.

But here’s the thing – low engagement & performance are deeply interconnected. Let’s take a closer look into why customers and employees feel disconnected from banks and financial services. More importantly, let’s examine deeper into what this means for your business.

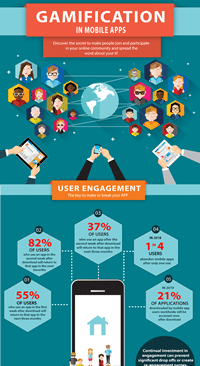

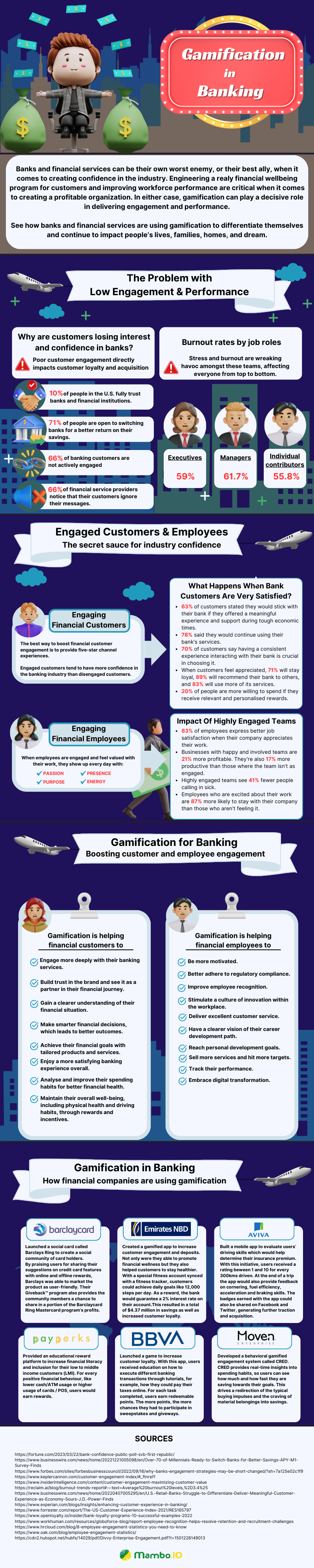

Why are customers losing interest and confidence in banks?

Poor customer engagement is all about trust and motivation – or the lack of it. This is a big deal because it directly impacts how loyal clients are and how many new ones you acquire. Here are some critical statistics showing customers losing confidence in their banks:

- Nowadays, only 10% of people in the U.S. fully trust banks and financial companies. That’s a significant fall from 2020, when about 22% of folks felt confident in these institutions.

- 71% of people are open to switching banks for a better return on their savings. Moreover, 31% are more inclined to change their primary financial provider within the following year.

- 66% of banking customers are not actively engaged, making them 50% more likely to switch banks.

- 66% of financial service providers notice that their customers ignore their messages.

Burnout rates by job roles

Let’s discuss what’s happening inside the banks, particularly with the teams that keep things running. Stress and burnout are wreaking havoc amongst these teams, affecting everyone from top to bottom. Bankers are stressed due to factors like heavy workloads, unclear roles, and not receiving enough feedback, to name a few.

Here’s a closer look at burnout levels across different roles:

- 59% in executive roles feel burned out.

- 61.7% in managerial positions feel burned out.

- 55.8% in individual contributors.

It’s clear that both customers and employees are facing serious challenges, and it’s something financial institutions must address head-on.

Engaged customers & employees are the secret sauce for industry confidence

Unfortunately, building trust and confidence in the financial industry doesn’t happen overnight. Doing so is more about creating lasting connections and making every interaction count.

Let’s look at how engagement with customers and employees plays a crucial role in strengthening the financial sector.

How to boost financial customer engagement

The best way to boost financial customer engagement is to provide five-star experiences across all channels. Doing so will keep your customers engaged and invested in their relationship with your services and organisation. Engaged customers tend to have more confidence in the banking industry than disengaged customers.

The impact of high satisfaction across all channels among banking customers

A supportive and understanding banking environment is guaranteed to boost customer confidence. Not only that, this experience fosters trust and loyalty that benefits everyone involved. Here’s how high satisfaction across all channels impacts banking customers:

- 63% of customers would stick with their bank if they offered a meaningful experience and support during tough economic times.

- Additionally, 78% said they would continue using their bank’s services.

- 70% of customers say having a consistent experience interacting with their bank is crucial in choosing it.

- When customers feel appreciated, 71% will stay loyal. Not only that, 89% will recommend their bank to others, and 83% will use more of its services.

- 20% of people are more willing to spend if they receive relevant and personalised rewards.

Making financial employees feel valued

Ensuring your banking team is fully engaged with their work isn’t just beneficial; it’s essential. When they feel valued and are genuinely passionate about their roles, it will reflect in their daily attitude and output. They will show up daily with the following:

Passion

Engaged employees are eager and ready to tackle challenges. They actively seek to innovate and improve, which inspires everyone to make better decisions.

Purpose

Employees with clear goals know exactly what they want to accomplish, and their strong willpower helps the whole team succeed.

Presence

It’s very easy to lose focus nowadays. But if someone stays focused, they can really pay attention to their work.

Energy

You can expect employees who feel appreciated to bring a positive energy to the workplace. This doesn’t mean they’re always busy, but they keep on pushing forward, even when work gets hard.

The power of high employee engagement

Banking and financial service providers must realise that creating an environment where employees feel engaged and appreciated is critical. This leads to a high-performance culture in the workplace, less downtime, and a stronger commitment to the company’s success. Coincidentally, this is where gamification in banking and financial services shines the most.

Let’s look at some statistics showing how high employee engagement can lead to positive results.

- 83% of employees express better job satisfaction when their company appreciates their work.

- Businesses with happy and involved teams are 21% more profitable. They’re also 17% more productive than those where the team isn’t as engaged.

- Highly engaged teams see 41% fewer people calling in sick.

- Employees who are excited about their work are 87% more likely to stay with their company than those who aren’t.

Gamification in banking can boost engagement effortlessly

Introducing game-like elements into banking isn’t just for fun. It’s a strategic move to enhance involvement and satisfaction for both customers and employees. Let’s explore how gamification transforms the financial landscape by meeting diverse needs and fostering a positive environment.

How gamification in banking and financial services benefits your customers

Contrary to popular belief, gamification in banking and financial services isn’t about playing games. Implementing this strategy is more about making your customer’s banking experience rewarding and educational. When banks and financial service providers properly use gamification, they can

- Engage more deeply with their banking services.

- Build trust in the brand and see it as a partner in their financial journey.

- Gain a clearer understanding of their financial situation.

- Make smarter financial decisions, which leads to better outcomes.

- Achieve their financial goals with tailored products and services.

- Enjoy a more satisfying overall banking experience.

- Analyse and improve their spending habits for better financial health.

- Maintain their overall well-being, including physical health and driving habits, through rewards and incentives.

How gamification in banking and financial services motivate employees

Gamification can transform how employees work and operate, thus encouraging them to have the following traits:

- Increase motivation.

- Better adherence to regulatory compliance.

- Improve better employee recognition.

- Stimulate a culture of innovation.

- Ability to deliver excellent customer service.

- A clearer vision of their career development path.

- Reach personal development goals.

- Sell more services and hit more targets.

- Track their performance.

- Embrace digital transformation.

The idea of using gamification in banking and financial services goes way beyond making banking fun. It revolves more about creating meaning for customer and employee engagement and fostering trust between them and your organisation.

Gamification in banking – How financial companies are using gamification

Gamification in banking and finance services is all about adding game-like elements to the serious world of banking. By doing so, you make the monotonous processes involved in banking more fun, engaging, and enjoyable. It changed how we deal and interact with financial institutions, from earning rewards for saving money to competing in challenges.

Let’s check out some noteworthy examples of how successful implementation of gamification in banking and financial services should look like.

Barclays Bank

Barclays introduced a social card named Barclays Ring to build a community among cardholders. They reward participants for sharing their ideas on improving credit card features with online and offline perks. This initiative allowed Barclays to market the product as user-friendly. Additionally, the Giveback™ program lets community members get a share of the profits from the Barclaycard Ring Mastercard.

Emirates NBD

Emirates NBD developed a gamified app to boost customer engagement and savings while encouraging users to lead healthy lifestyles. The app works by linking a fitness tracker to a special savings account. Customers who hit goals like walking 12,000 steps daily earned a 2% interest rate. It was so successful that it led to $4.37 million in savings and a massive boost in customer loyalty.

Aviva Italy

Aviva Italy developed a mobile app to check how good their customers are behind the wheel. If they meet specific criteria, Aviva can lower their insurance costs. After driving 300km, the driver will receive a score and feedback on taking corners and saving fuel. Additionally, sharing driving badges on social media helped spread the word, allowing more people to join the trend.

Payperks

Payperks offered a rewards platform focused on teaching financial literacy to people with lower to middle income (LMI) ranges. To promote better financial decisions, they reward users for every positive behaviour they make. These behaviours include using their cards more than cash ATMs and many more.

BBVA

BBVA launched a gaming app to increase customer loyalty. This app teaches them how to make various banking transactions properly through tutorials. One such example is how they could pay taxes online. For every task completed, customers earn redeemable points, which they can use to participate in sweepstakes and giveaways.

Moven

Moven rolled out a behavioural gamified engagement system called CRED. It gives real-time insights into customers’ spending habits so they know how well they’re doing towards their savings goals. It turns the urge to buy something into the excitement of saving impulsively.

Gamification can change how customers and employees interact with banks and financial services

Gamification can change how customers interact with banks and financial services when implemented correctly. From disengaged consumers who aren’t as interested in your offerings, they’ll turn into patrons who will willingly advocate your business. This strategy can also motivate them to do mutually-beneficial actions like saving, investing, and tracking their spending habits.

More importantly, gamification can significantly improve how employees deal with their work. By using this approach, you can encourage them to perform better and make smarter choices. Motivated employees are also precious to any business; every company wants to keep such high-performers. So, creating a culture where everyone aims to perform their best through gamification is always a good idea.