How Fintech Apps Are Using Gamification To Increase User Engagement

Let’s face it. Does the phrase, “Eagerly looking forward to my next budget update!” resonate with you? Probably not.

Handling our money often feels like a relentless, monotonous struggle. Although necessary, it’s certainly unexciting. What if there’s a more pleasant approach? Can we suggest an enjoyable one?

Say hello to gamification, a novel approach transforming the tedious universe of finance into an intriguing and enjoyable task. It’s like infusing your financial app with a dash of enchantment from a Mary Poppins scene. With gamification, every interaction turns into a delightful experience. Okay, it might not sing and dance literally, but you get the drift.

Table of Contents

Download your free “Gamification Guide”

Download the Mambo Gamification Guide for detailed insights and actionable strategies to enhance engagement and performance.

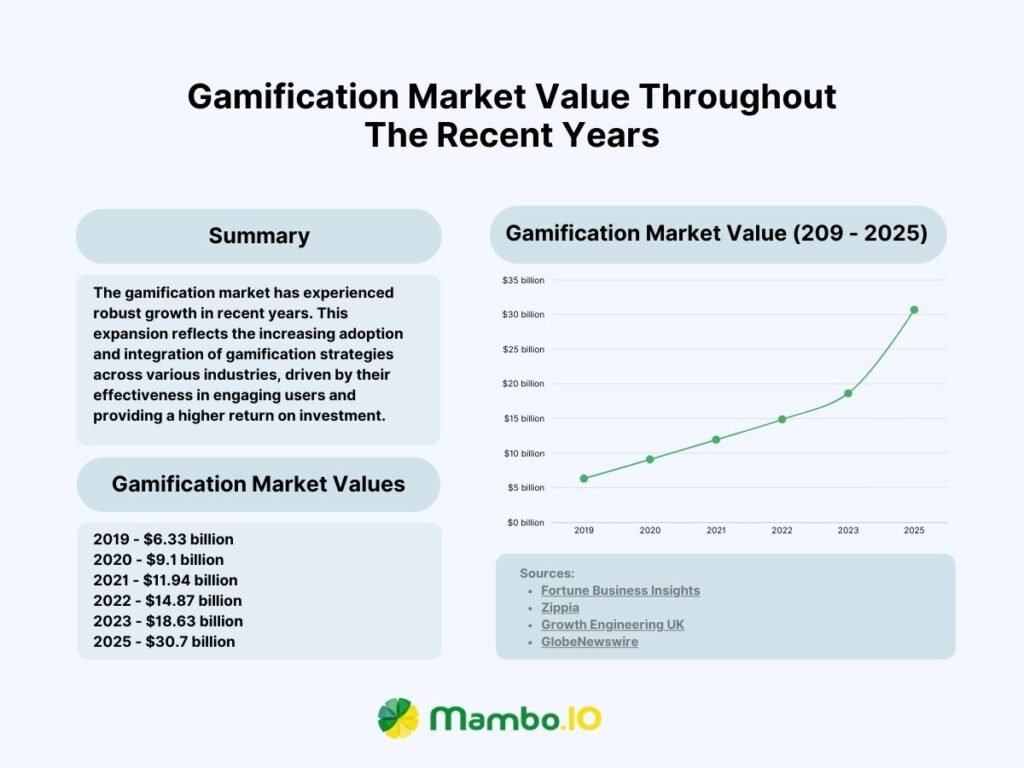

Gamification's meteoric rise: the numbers don't lie

Research from MarketsandMarkets reveals quick growth in the worldwide gamification sector. The industry’s worth is expected to rise from $9.1 billion in 2020 to approximately $30.7 billion in 2025. This indicates the escalating demand for interactive and enjoyable financial solutions.

Gamification in fintech: what's the big deal?

Let’s demystify what gamification in fintech signifies. Picture a fun-driven aspect of recurrent games. This could be in the form of earning points or badges, leaderboards, and progress updates. Now, integrate these into financial technology applications.

As a fintech enterprise, why does this matter? The reason is gamification isn’t merely for aesthetics. It resonates more with our inherent human tendencies.

Humans naturally enjoy challenges, crave accomplishments, and find joy in comparison. Gamification utilises these traits to encourage us in areas considered uninteresting or overwhelming. An example is in managing finances.

Gamification decoded: fun meets finance

Imagine gaining points for sticking to your budget or earning a badge for clearing your credit card debts. This is what gamification brings on board, making financial tasks seem like mini-quests with actual rewards.

But here’s the fascinating part: gamification isn’t just for the fun of it. It is an influential resource that can reshape how your users engage with their finances. It simplifies understanding of complex financial terms, promotes good money habits, and helps users achieve financial objectives. Already, half of the leaders in digital financial services transformation embrace gamification.

Gamification: a proven success strategy

Gamification in fintech has been proven to be effective. For instance, following the introduction of gamification, Extraco Bank saw a whopping 700% increase in customer acquisition. It also reported a 13% and 14% rise in its App Store and Google Play ratings, respectively.

Gamification could be your secret strategy if you aim to heighten user engagement. It can help distinguish your app from the rest of the fintech offerings. It can also foster a loyal customer base for your financial app. Overall, gamification is a powerful strategy to achieve these goals in the fintech industry.

How gamification works in fintech: a behind-the-scenes look

Here are the 7 key elements to consider when gamifying your fintech app:

#1. Listing desired financial behaviours

The day’s first order is to set a target for our users. What’s their end goal? Is it saving for a once-in-a-lifetime trip? Clearing bothersome student debts? Constructing a financially safe house for their later years?

These behaviours are not just hazy notions. They’re the engine that drives the gaming experience. They offer users a purpose, a reason to keep returning to your application.

#2. The power of points

Points are the currency of gamification. But not all points are created equal. Here’s what to consider:

- Name: Make it catchy and relevant to your brand. “Coin,” “Gem,” or even your company’s mascot can work.

- Type: Are they experience points (XP) for levelling up, redeemable points for rewards, or giftable points for social interaction?

- Expiration: Do points expire, creating urgency, or accumulate indefinitely?

- Allocation: How many points for each action? Balance generosity with keeping the system challenging.

Remember, points can be redeemed for more than just virtual rewards. Offer higher interest rates, waived fees, increased transaction limits, or exclusive loyalty perks. Make those points valuable!

#3. Drafting the blueprint

Now we’ve established the endpoint, we need a route guide. Gaming-oriented apps regularly use visual elements. These can be progression bars, graphs, or even digital terrains to show users the ground they’ve covered.

Consider it a game where you watch your avatar level up or gain new skills. The same logic applies here. Visualised progression tracking makes the journey towards monetary goals more concrete and rewarding.

#4. Rewards and triumphs

We all love some recognition. Gamification enhances this feeling by giving points, badges, or digital awards for finishing tasks or reaching particular milestones.

These digital rewards appeal to our inherent need for acknowledgement and accomplishment. They create a feeling of achievement that inspires users to persist, even when obstacles arise.

Tangible fintech perks

The scope of rewards isn’t limited to the virtual and real-world benefits alone. We’ve taken it a step further by attaching rewards to physical gains.

- Highest interest rates: Achieve financial milestones in the app and unlock the best interest rates available, boosting your savings growth.

- Waived fees: Enjoy a seamless experience with card or transaction fees waived as a reward for your consistent engagement and achievements.

- Enhanced transaction limits: Hit specific goals within the app and access higher transaction limits, making your financial operations smoother and more efficient.

- Loyalty rewards: As you continue to engage and accomplish tasks, you’ll unlock exclusive loyalty rewards, ranging from priority service to bespoke experiences tailored just for you.

This strategy ensures that your efforts are consistently celebrated, making each achievement a step towards greater financial benefits and more personalised experiences.

#5. Scoreboards and social sharing

We’re socially inclined beings, and we do enjoy some harmless rivalry. Gaming-based apps commonly feature leaderboards that let users see their standing compared to their friends or other users.

Don’t underestimate the power of social sharing. Who doesn’t enjoy sharing their successes online? Gaming apps can exploit this by allowing gamers to post their achievements, landmarks, and advancements to their online circles.

#6. Personalisation and customised challenges

Please remember every user’s journey is unique. Some are just starting their monetary voyage, whereas others are already financial experts. Gamifying allows you to customise the experience for each specific user. It enables you to propose personalised challenges and quests that maintain their interest and motivation.

Think of it like having a private financial guide who knows precisely what you need to achieve your objectives.

#7. Feedback and alerts

Lastly, we need to keep the energy alive. Gaming-based apps utilise regular feedback and notifications to keep users in the know. They also celebrate victories, steering users towards their objectives and reminding them of pending tasks.

Consider it as having your cheering team always available to offer motivation and support.

10 Real-world examples of gamification in fintech

To better understand the impact of gamification in fintech, let’s explore some real-world examples of successful implementations:

#1. Revolut

Revolut isn’t your typical bank—it’s a trailblazer in fintech, proving that finance can be revitalised and fun. Their secret weapon? Gamification. According to Revolut, users engaging with game-themed features are 2.5 times more likely to stay active.

What are the key features of Revolut?

Here’s how Revolut leverages game dynamics to reshape the finance world:

Engaging users with challenges and rewards

- Challenges and incentives: Imagine a treasure hunt for your finances. Accomplish tasks to receive rebates, reduced prices, or perhaps digital currency. This is an enticing deal that’s hard to decline.

- Progress updates: Visualize your financial dreams. Interactive graphs and progress indicators chart your journey. It’s both motivating and aesthetically pleasing.

- Referral initiatives: Give a referral, get a perk. Plus, your friend gets one, too. Everyone benefits.

Building financial habits through gamification

- Streaks and emblems: Think of it as your financial trophy case. Regular logins, hitting savings goals, and earning badges. It’s like a digital showcase for your financial victories.

- Savings vaults: Make saving money exciting. Set goals and watch your virtual vault fill up. Each deposit feels like levelling up in a game.

- Cryptocurrency investments: Engage with crypto; don’t just buy it. Revolut makes it simple with real-time updates and user-friendly graphics.

- Customised insights: Your finance coach at your fingertips. Revolut offers tailored advice for smarter decisions, making financial management more engaging.

Revolut shows that finance can be immersive, exciting, and rewarding. It’s a literal game-changer.

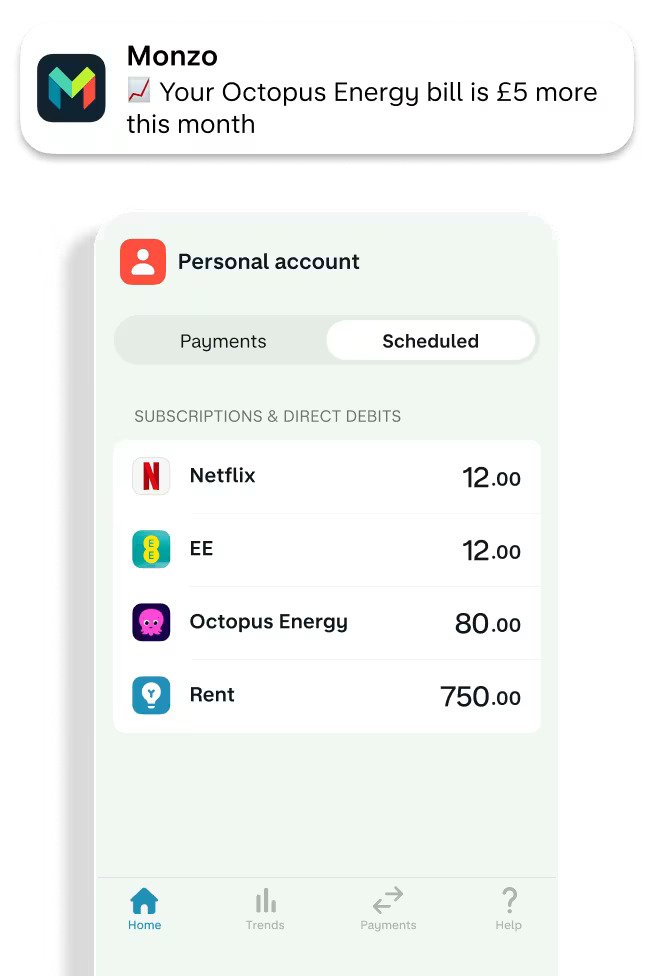

#2. Monzo

Monzo, a UK-based virtual bank, is a perfect specimen of effective gamification. They have converted routine banking into an enjoyable game, demonstrating that finance doesn’t have to be tedious.

What are the key features of Monzo?

Here’s how Monzo employs game dynamics to provide a distinct banking experience:

Personalised financial goals: choose your adventure

- Customised financial objectives: Choose your financial adventure. Create “Savings Pots” for specific aims. Monzo data shows that customers using gamified savings pots save about 30% more.

Real-time feedback and financial control

- Instant updates and notifications: Your finances operate like a video game. Every transaction triggers an immediate alert. Helps you stay abreast of your expenditure.

- Budgeting tools: Budgeting just got intriguing. Monzo auto-categorizes your spending, simplifying money management.

- Visual illustrations and insights: Graphs and charts are your financial control panel. They illustrate your spending habits in a visually soothing manner.

Community and rewards: building positive habits

- Community engagement: It’s collective, not individual. Monzo’s community forum lets you interact with others, share goals, and root for each other.

- Rewards for positive habits: Good behaviour is rewarded monetarily.

Monzo shows us that banking can be interactive, fun and rewarding. Making financial management a game elevated user experience and enhanced their customers’ financial well-being.

#3. PayPal

PayPal, a fintech behemoth, has gamified its platform, transforming financial management into a rewarding activity.

What are the key features of PayPal?

Here’s how PayPal employs gamification to make banking more enjoyable:

- Referral schemes: Refer friends and earn monetary rewards. Everyone benefits.

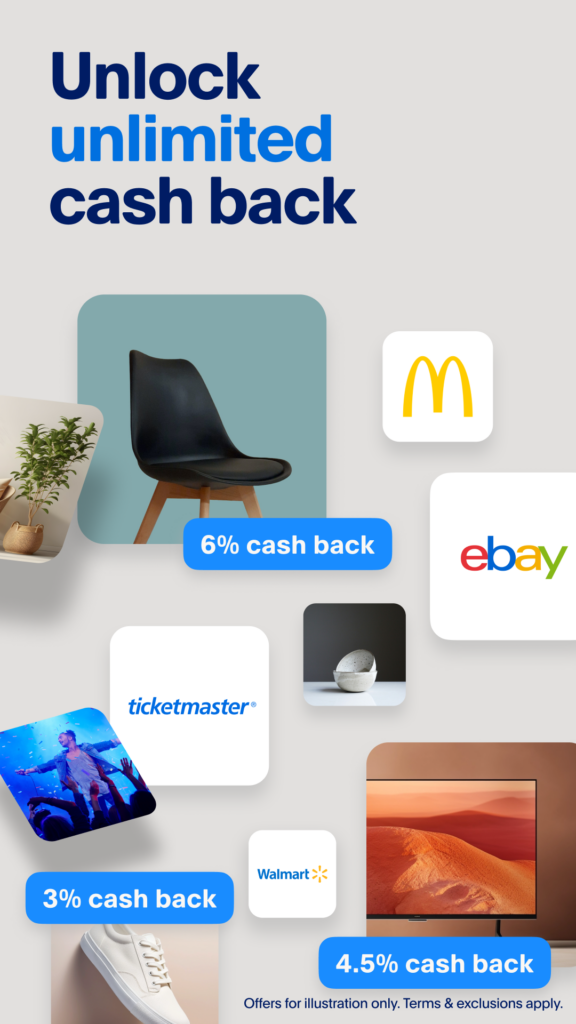

- Loyalty schemes: Shop using PayPal and receive more than just your purchases. Cashback and discounts transform spending into a rewarding game.

- User engagement attributes: PayPal sends notifications and alerts. It feels like a motivational finance coach guiding you to rewards.

- Interactive dashboards: Track your spending and watch your savings flourish. Visual graphs and progress bars simplify the journey of finance.

PayPal shows that gamification is not a mere catchphrase. It’s a strategy that boosts user engagement, nurtures loyalty, and makes finance management enjoyable.

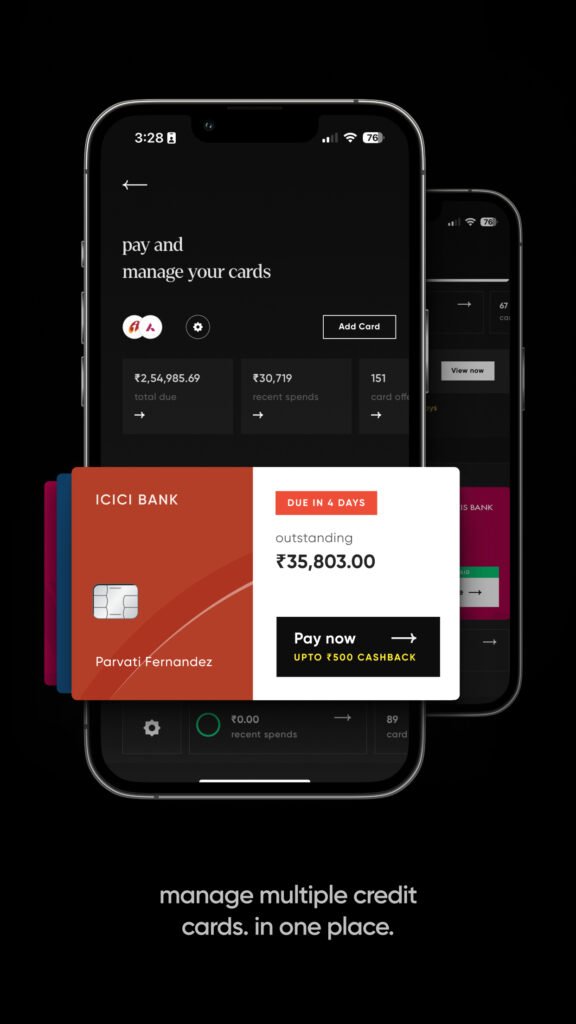

#4. CRED

CRED, an Indian fintech firm, has made credit card payments exciting. Their magic ingredient? Gamification. CRED reports a 50% decrease in late payments and a 25% increase in timely payments due to gamified bill payments.

What are the key features of CRED?

Here’s how CRED converts bill payments into a rewarding activity:

- Reward system: Pay bills and accumulate points. Trade points for discounts, exclusive events, and more.

- User engagement: CRED makes bill payments a game where paying bills makes you a winner.

- Interactive interface: CRED’s interface makes banking captivating.

- Exclusive access and benefits: Bill payments provide rewards and exclusive experiences.

- Community and social sharing: Join the CRED community and share your successes.

CRED’s gamification strategy increases customer loyalty, timely payments, and user engagement. It’s a triple win.

This fintech app demonstrates that even the most routine financial tasks can become fun and rewarding experiences. They’ve leveraged gamification to enhance user experience, and it’s a lesson all fintech companies can learn from.

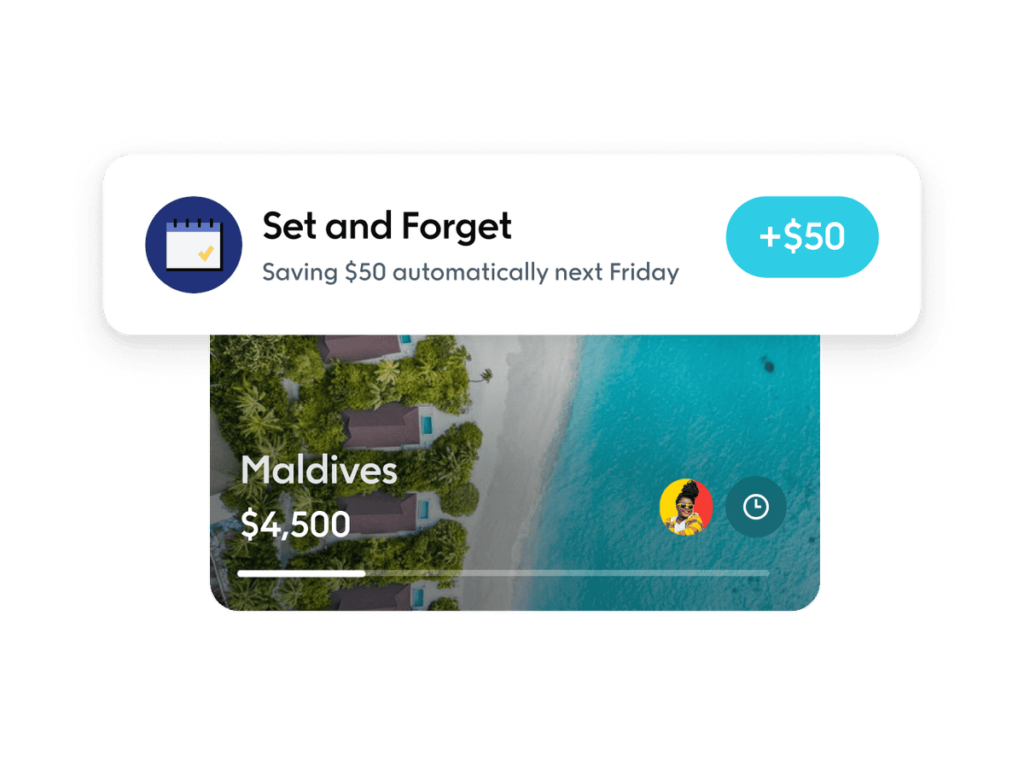

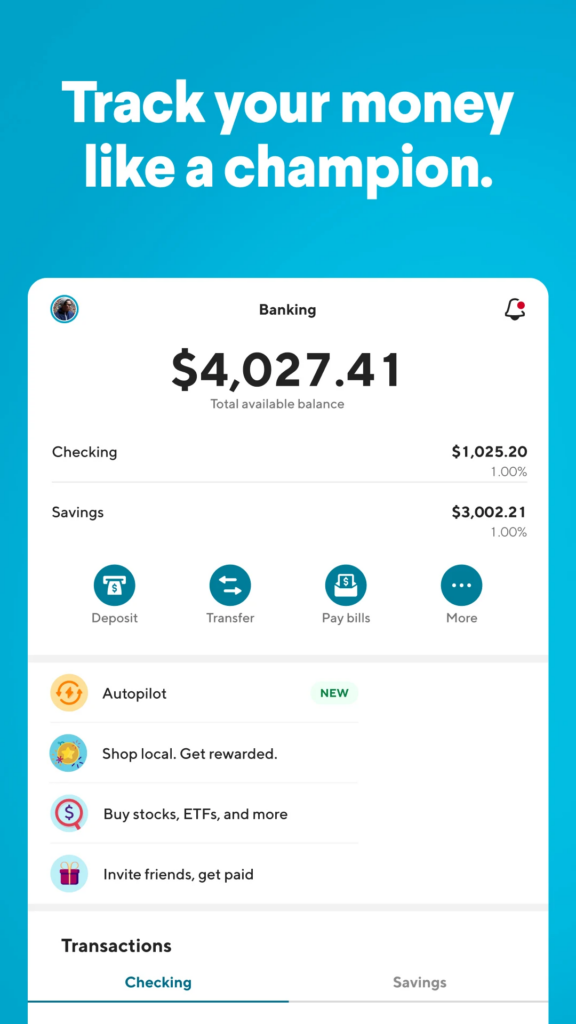

#5. Chime

Chime, the American fintech marvel, is making huge strides in demonstrating that money-saving doesn’t have to be mundane or bulky. By leveraging the power of gamification, they’ve successfully transformed banking into a captivating and enjoyable process.

What are the key features of Chime?

Here’s a peek into how Chime has turned financial health into a rewarding experience:

Automating your financial wins

- Making saving fun: Chime has ingeniously made savings a breeze. Their auto ’round-up’ function acts like your undercover financial accomplice, subtly accumulating your loose change without causing a stir.The “Save When You Get Paid” feature allows you to mechanise your savings. This gives you a proactive edge in your financial battle. It’s a simple, automatic, and effective technique that feels like a winning streak in a strategic game.

Financial education with a fun twist

- Knowledge and incentives in finance: Chime goes beyond just promoting savings. It’s about imparting wisdom. They offer personalised push notifications and alerts that function like a tailored financial mentor, nudging you towards improved money management habits.Their referral system is an exciting group endeavour – enlist friends, garner incentives, and triumph over financial objectives collectively. It’s proven that gamification can enhance participation rates in financial literacy programs by as high as 80%.

User-friendly interface and community building

- Appealing user interface: Chime’s application is meticulously crafted, keeping you at the helm. Monitor your progression through graphic illustrations that evoke the sensation of advancing in an enthralling game.Establish milestones and objectives and observe your triumphant journey towards achieving them. It’s more about the voyage than the endpoint.

- Creating a sense of community: Chime extends beyond just being a banking app to encompass a thriving community. Share your monetary victories with your loved ones and share mutual accolades. Think of it as a virtual gesture of appreciation for your financial prudence.

Chime exemplifies that a dash of fun and thrill can radically transform the financial arena. By incorporating entertaining elements into routine banking, they’ve successfully made financial health a more attainable and pleasurable experience for all.

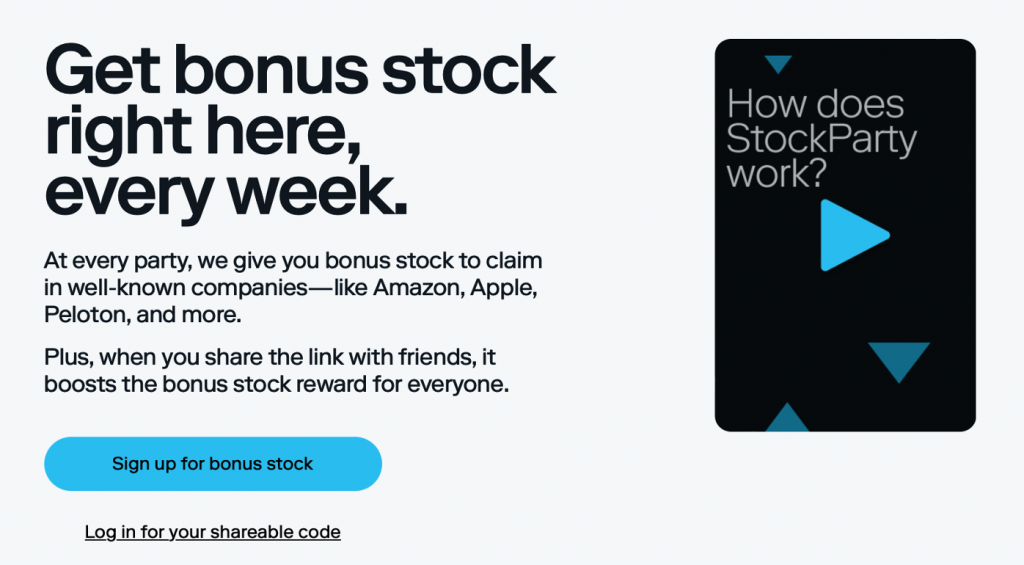

#6. Stash

Stash, a personal financial tool, believes investment should be simple and entertaining. They’ve cleverly gamified the process, making money management seem more like a game than a daunting task.

What are the key features of Stash?

Here’s how Stash is making a game out of finance:

Gamified financial education

- Learning games and competitions: Stash transforms financial education into enjoyable games. Participate in quizzes, accumulate points, and possibly win monetary investment rewards. It’s reminiscent of school but with more exciting rewards. Stash’s data suggests that users engaging in these gamified learning activities are 35% more inclined to raise their investment.

- Tracking your achievements: Monitor your financial objectives to grow. Visual indicators of progress and key milestones offer insight into your progress. A powerful nudge that you’re heading in the right direction.

Building community and celebrating wins

- Incentives and bonuses: Who can resist a bonus? Stash rewards you with cash for setting up regular investment plans or introducing friends. It’s like being financially prudent comes with a paycheck.

- Social interaction and camaraderie: Investment need not be a lonely journey. Stash allows you to network with fellow investors, exchange accomplishments, and learn from each other’s experiences. It’s a fiscal support network with a social twist.

- Milestone badges: Earn badges as if you’re on a gaming adventure. Invest for the first time, save a certain sum, or finish learning modules. It’s a pictorial marker of your financial milestones.

Making financial management a breeze

- User-friendly dashboard: Stash’s dashboard is stylish and user-friendly. It’s designed to make money management as straightforward and engaging as possible. It feels more like a financial arcade instead of a drab old bank.

Stash is living evidence that incorporating gaming into financial tech succeeds. They’ve turned a usually intimidating chore into a thrilling journey. Making managing finances enjoyable and interactive enables users to master their financial destiny.

#7. Google Pay

Google Pay knows how to party. Especially during Diwali. Their stamp collection feature turned financial transactions into a festive game. Users earned stamps with each transaction, redeemable for cash rewards. During their Diwali stamp collection campaign, Google Pay reported a 60% increase in transaction volume.

What are the key features of Google Pay?

Let’s see how Google Pay uses gamification to inject excitement into everyday finances:

Turning transactions into treats

Rewards and incentives: Google Pay loves to give back. Scratch cards offer immediate wealth through cashback, discounts or even cash awards. Every purchase turns into a mini-lottery. Recommend Google Pay to a friend, and both of you reap rewards. It’s a financial win-win for all involved.

Friendly competition and interactive fun

- Points and leaderboards: Turn spending into a sport. Accumulate points with every transaction, ascend the ranking chart, and flaunt your economic expertise. A healthy rivalry with a lucrative spin, indeed.

- Interactive interfaces: Google Pay knows how to keep things interesting. Seasonal games and challenges make transactions feel like a quest. Track your progress towards rewards with visual progress bars. It’s like levelling up your finances, one purchase at a time.

Community building and data-driven improvements

- Social sharing and community engagement: Brag about your rewards on social media. Share your scratch card wins and invite others to join the fun. Some challenges even involve teamwork, making financial goals a shared victory.

Google Pay’s festive gamification is more than just fun and games. It’s a strategic move with impressive results.

- Engagement soars as users interact more with the app.

- Customers stick around, enjoying the rewards and excitement.

- Google Pay gathers valuable data to improve user experience.

The icing on the cake? Say goodbye to the drudgery of paying bills and welcome gaming fun.

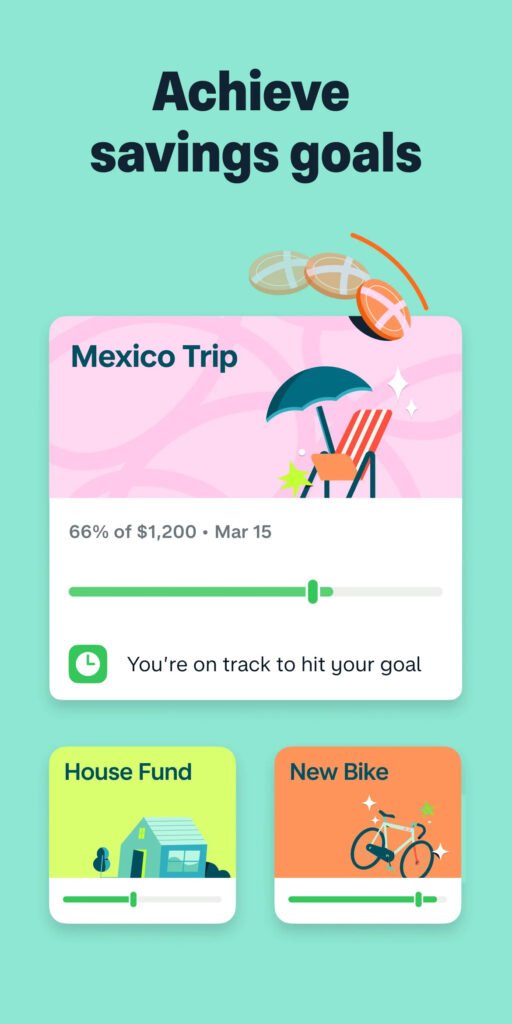

#8. Qapital

Consider Qapital as a fun-loving coach for your fiscal health. According to internal reports from Qapital, those who adopt systematic savings methods stash away an average of 20% more, which is no small feat. By transforming the task of saving money into a thrilling game, this app demonstrates that handling finances doesn’t have to be a dry affair.

What are the key features of Qapital?

Here’s how Qapital turns the mundane act of saving into an exciting adventure:

Your goals, your rules

Personalised goal establishment: You are in charge of your savings journey. Establish distinct objectives, whether an exotic holiday, a brand-new vehicle, or the contingency fund you’ve been contemplating. With Qapital’s visualisation tools, your financial goals become a quest within your reach.

Automated savings with a fun twist

- Systematic saving: This is about automating your virtuous habits. Round up your shopping expenses, conserve some of your income, or even initiate savings when you clock in at the fitness centre. It’s a hassle-free method to save while being immune to the habit of overthinking.

- Motivation boosters and challenges: Everyone appreciates a bit of motivation. Qapital bestows points and badges as you reach your saving goals. Partake in challenges to escalate excitement and match your abilities against friends or yourself. It’s akin to a financial wellness contest but with fewer sweats and more benefits.

- Instant alerts: Be informed with instant updates about your savings. Think of it as having a personal cheerleader encouraging every tiny step towards victory.

Track your progress and share your wins

- Progress monitoring: Observe your savings bloom like a digital tree. The progress bars from Qapital simplify the process of tracking your growth. It’s a visual reinforcement that your hard work is bearing fruit.

- Social engagement: Share your fiscal victories with your loved ones. Think of it as a virtual applause for your financial wisdom. A dash of healthy rivalry never did anyone any harm, isn’t it?

The efficiency of Qapital proves how introducing game-like elements in financial technology can revolutionise the process. It transmutes the mundane task of saving into an enticing challenge, thereby making it more appealing and accessible for all.

#9. SoFi

SoFi, a notable entity within the fintech realm, demonstrates that fiscal affairs need not be monotonous. They’ve adopted the principles of gamification, breathing life into the arena of financial management, making it an exciting, rewarding journey.

What are the key features of SoFi?

Here is an insight into how SoFi leverages gamification to inject fun into finances:

Earn as you learn

- Rewards and point system by SoFi: Picture this as a loyalty program for your finances. Accumulate points by conducting routine fiscal activities, such as depositing funds or utilising your SoFi debit card. Subsequently, redeem those points to claim attractive perks like cash back, vouchers, or even limited edition experiences. It’s a universal gain.

Friendly competition plus financial education

- Rankings and social visibility: Unleash your internal contender. Gauge your performance against other SoFi users via our leaderboards. Flaunt your accomplishments on social platforms and revel in your financial success. It’s a fraternity of ambitious individuals encouraging one another.

- Learning modules featuring games and quizzes: Acquiring financial knowledge needn’t be tedious. SoFi’s engaging quizzes and games make it enjoyable. Augment your finance acumen and collect badges simultaneously. It’s akin to school but with reduced homework and increased rewards.

Personalised challenges and stronger friendships

- Customised challenges and landmarks: SoFi presents tailored challenges hinged on your aims. Achieve these markers and access rewards. It’s like a fiscal workout session, where instead of building muscles, you’re building wealth (or at least inching towards it).

- Active community and social involvement: SoFi extends beyond just an application–it’s a community. Be a part of groups, converse with fellow users, and exchange suggestions. It’s a virtual hangout spot for your financial conversations. And don’t miss out on the thrilling contests and events where you can bag prizes simply by showcasing financial wisdom.

SoFi has aced the art of gamification. SoFi’s internal data reveals a 15% surge in user engagement and a 10% increase in new user uptake, attributed to gamified challenges and incentives. By amalgamating finance and entertainment, they’ve developed an app that users find irresistible.

#10. Acorns

Acorns, the mini investment application, demonstrates that investment is not daunting. According to Acorns’ data, individuals utilising the round-ups feature invest an additional $500 annually. They’ve made this process enjoyable, making it user-friendly for everyone.

What are the key features of Acorns?

Let’s delve into how Acorns applies game-like features to assist in the expansion of your resources:

Micro-investing made easy

- Round-ups: This is more than your regular money jar. Acorns takes your transactions to the next dollar and invests the loose change. It’s tantamount to a game where each card transaction contributes to your financial growth.

- Accomplishments and rewards: Who can resist a good compliment? Acorns offer you bonuses for achieving certain goals or bringing in new customers. It’s akin to earning a medal for fiscal responsibility.

Visualising and personalising your financial journey

- Visual confirmation and progress monitoring: Witness your investments blossom via vibrant diagrams and progression trackers. This visual cue of your expanding wealth makes saving and investing feel gratifying.

- Adaptability and individualisation: Dictate your financial journey. Set your ambitions and investment approach. It resembles choosing your protagonist in a video game, but the reward is a secure financial future.

Growing financial confidence

- Instructional content: Acorns isn’t solely about investing; it’s also a learning platform. Their “Grow” platform provides tailored financial education. It’s comparable to a financial-intensive course, minus the strict taskmaster.

Acorns’ game-like approach isn’t merely amusement. It’s a tested method to instil financial enthusiasm in individuals. Newcomers to investment find it less daunting and more interactive. The application promotes frequent engagement, transforming saving into a routine. Financial knowledge enables users to make educated decisions.

Benefits of gamification in fintech

There’s more to gamification than merely enjoyable activities. It’s a potent catalyst for growth among fintech firms. As per an analysis by P&S Intelligence, financial applications incorporating gamification techniques see a spike in user interaction up to 40%. It’s beneficial for both the companies and their users, and it is essentially a win-win situation.

Beginning with engagement, the idea is to convert ordinarily monotonous financial tasks into thrilling quests. This hooks in users and keeps them revisiting your platform. Research indicates that implementing gamification in finance management apps escalates user involvement by 54% and boosts saving habits by 22%.

The fintech gamification trifecta

In the ever-changing fintech landscape, gamification is a potent engagement weapon. Below, we explore three core elements of the fintech gamification trifecta.

- On to financial awareness: Gamification breaks down complicated ideas into understandable, interactive lessons, making education enjoyable. Users have become more prudent with their finances.

- Incentivising is crucial: Achievements, accolades, and leaderboards stoke engagement. They inspire users to meet their financial objectives, whether accumulating savings or trimming down debts. Gamification methods have been able to augment user action on banking platforms by a staggering 207%.

- Customisation is key: Gamification curates a unique experience for each user, negating the generic, one-for-all approach. This makes users feel recognised and appreciated.

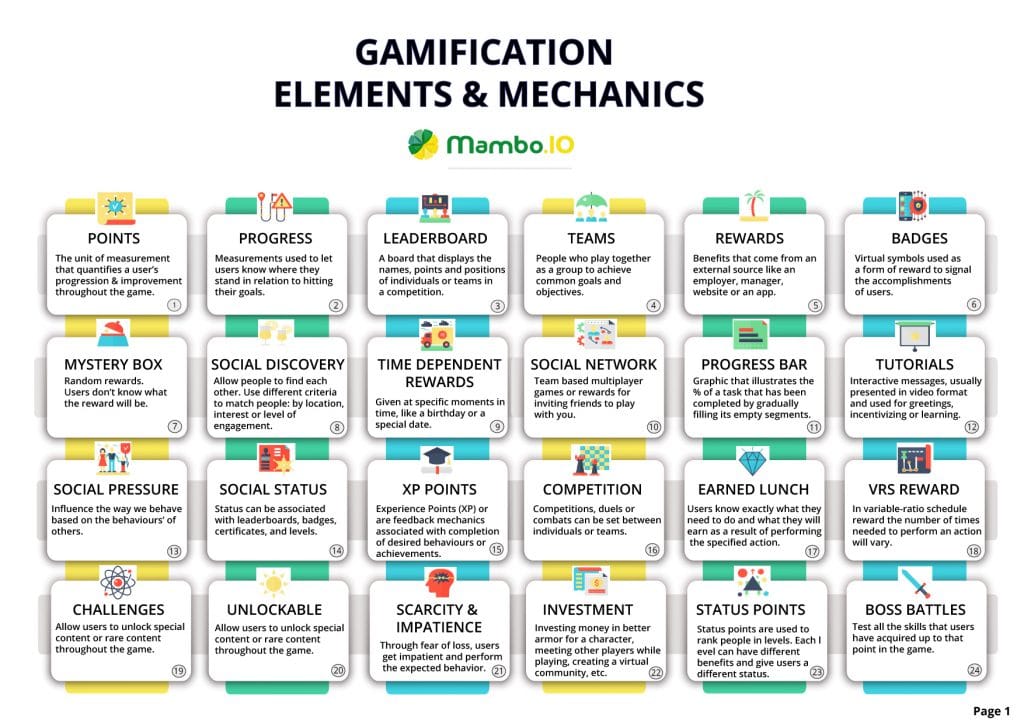

Download your free “108 Gamification Elements and Mechanics”

Get your cheat sheet and have a quick reference at your fingertips!

The bottom-line boost of gamification

The aftermath? Elevated brand fidelity. Users develop an affinity for the app, leading to a longer stay. Decreased attrition rates and augmented customer lifetime value translate into business success. A financial application that embraced gamification witnessed a 700% surge in user interaction compared to one without it.

How Mambo is helping fintech apps

Truth be told, finance isn’t typically the most exciting subject. But that’s where Mambo.io steps in to shake things up. We’re not just an ordinary software company. We’re an enthusiastic, game-centric team, passionately believing finance should be stimulating and not daunting.

Mambo.io is far more than just a gamification platform. It’s a treasure chest with features engineered to infuse vibrancy into your fintech offerings. We provide the resources to forge tailored engagement strategies, establish transparent objectives, offer feedback, and reward users for their monetary dealings.

Consider us as your fintech genie, brandishing our magic wand of gamification to metamorphose tedious chores into thrilling quests. Here are ways we can help:

Transforming everyday banking with gamification

- Mobile banking apps: Let’s face it: most people don’t love checking their balance. But what if they could level up their financial skills while doing it? Mambo.io has the solution. It morphs regular activities into an engaging game featuring tasks, progress monitoring, and virtual prizes for basic responsibility.

- Personal finance management (PFM) apps: Viewing budgeting as a task may hinder you, yet Mambo.io changes this mindset. It morphs your money management app into a personal financial advisor, applauding successes and encouraging wise spending habits.

- Investment apps: Simplify complex financial concepts with gamified tutorials and simulations. Reward successful trades and offer investment challenges to keep users engaged.

Enhancing financial processes with gamification

- Loan apps: Streamline the loan application process with interactive guides and milestones, making it less intimidating.

- Digital wallets: Incorporate game elements and rewards for smart spending and saving habits to make managing digital transactions fun and secure.

- Security and fraud prevention apps: Enhance user engagement by rewarding cautious behaviours and providing interactive guides to recognise and prevent fraud.

- Customer service apps: Transform customer service experiences by gamifying call centre tasks and offering rewards for quick and effective resolutions.

Building a culture of learning

- Financial literacy apps: Educate customers about complex topics with interactive quizzes and modules. Award points for completed lessons to boost financial confidence.

- Investment education apps: Make investment education engaging with gamified tutorials, interactive simulations, and rewards for completing challenges.

- Retirement planning Tools: Gamify saving for retirement with progress visualisations, reward milestones, and educational challenges to keep customers engaged with their financial future.

Simplifying financial management

- Home buying and mortgage apps: Simplify the home-buying process with interactive guides, milestone rewards, and education on mortgage management.

- Credit management education: Encourage good credit management habits with interactive lessons and rewards for maintaining or improving credit scores.

- Budgeting tools: Transform budgeting into a fun and engaging experience with gamified tracking, goals, and rewards for staying within budget.

- Wealth management and financial planning: Offer personalised financial advice and planning tools that reward users for setting and meeting long-term financial goals.

Empowering bank employees

- Call centre motivation: Turn those repetitive tasks into a rewarding game! Offer points for hitting call targets, quickly resolve customer inquiries and build a leaderboard to foster friendly competition.

- Sales team supercharge: Boost sales of specific financial products with targeted challenges, competitions, and even real-time recognition of wins.

- Onboarding made fun: Turn onboarding into a tailored quest where new hires earn rewards as they learn critical policies and procedures.

FAQs about gamification in fintech

1. Could you explain gamification and its application in financial technology?

Gamification introduces game-like features into areas typically devoid of gaming elements. In fintech, this idea manifests by infusing attributes like point gathering, badge earning, progress monitoring, and reward receiving into online financial tools and apps.

2. Why should fintech companies consider implementing gamification?

Gamification can offer substantial advantages for fintech businesses, such as:

- Boosting interaction and user continuity

- Promoting healthy financial habits, such as increasing savings and clearing debts

- Simplifying intricate financial ideas

- Cultivating consumer allegiance

- Standing out in a competitive app market

Research indicates that adding game elements to finance apps can boost user interaction by as much as 40%.

3. What are some examples of how gamification is used in fintech apps?

Some common gamification elements used in fintech include:

- Points, badges and rewards earned for completing financial tasks or reaching milestones

- Progress bars and visual tools to track advancement toward savings or debt payoff goals

- Leaderboards and social features to leverage people’s competitive drive

- In-app challenges and quests to guide user actions

- Interactive financial education using quizzes, simulations, etc

4. Which fintech companies are successfully using gamification?

Many well-known fintech incorporate gamification, such as:

- Revolut: In-app challenges, savings goals, rewards for streaks

- Monzo: Visual spend tracking, automatic budget categorisation, savings pots

- Qapital: Rule-based saving, goal visualisation, social sharing of wins

- Acorns: Round-ups for investing spare change, milestone rewards

- SoFi: Points for financial actions redeemable for cash/experiences

- Stash: Stock-back incentives, automated investing, and thematic investing portfolio

5. How effective is gamification for driving results in fintech apps?

Very effective! Some stats from the article:

- Revolut users who engage with gamification are 2.5x more likely to stay active

- Monzo customers who use gamified savings features save 30% more

- CRED saw late payments drop 50% when they gamified bill payment

- Stash users participating in gamified education are 35% more likely to invest more

6. What does the future hold for gamification in the fintech space?

The use of gamification in fintech will likely evolve to include:

- Highly personalised challenges/rewards using AI and machine learning

- Deeper social integrations to engage friends and build community

- Omni-channel experiences across wearables, smart home devices, etc.

- More focus on responsible, ethical implementation to support user wellbeing

7. How can a fintech get started with implementing gamification?

Partnering with a gamification platform like Mambo.io is a great place to start. Mambo provides the tools and expertise to help FinTech define their engagement goals and target behaviours, then design and implement effective gamification solutions tailored to their unique app and user base.