12 Ways To Use Gamification In Banking For Better Engagement

Gamification in banking can significantly increase your chances of success if you play your cards right (no pun intended). This strategy focuses on making key consumer activities like financial literacy, saving, and driving better, more engaging and fun. It does so by incorporating gamification elements and mechanics into products and services to engage and motivate them.

But how exactly do banks utilise gamification to improve their customer engagement? We’ve compiled several practical methods on how financial institutions can leverage gamification to ensure their customers are happy and engaged.

Table of Contents

Download your free

“Gamification Guide”

Get your PDF now and start transforming your approach to digital engagement!

#1. Increase customer financial literacy

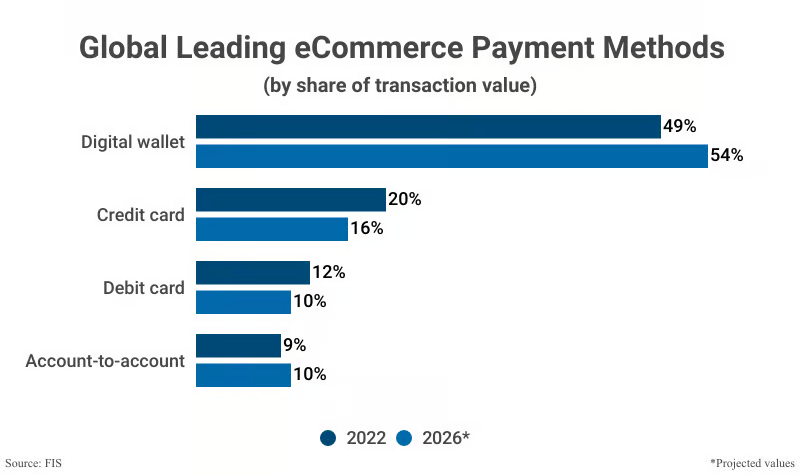

In 2022, Capital One revealed that almost half of all online shopping worldwide was done using digital wallets. This is over double the amount spent with credit cards at 20%.

Digital wallets were also the most popular payment method for buying things online. They made up 36% of online payments, compared to credit cards’ 26%.

Source: Capital One Shopping

Capital One predicts that by 2026, 54% of online shopping and 43% of buying things in stores will be done using digital wallets.

It’s astonishing to see digital wallets become more popular than credit cards, our go-to way to pay until recently. Digital wallets are definitely shining brighter than ever in the future. However, this also means that people must become more informed about the perks and perils of using these modern-day purses.

The good old days of cash

Personal finance was much easier before. Back in the day, you’re all good if you have cash in your wallet. But if not, well, too bad. These days, personal financial management is like entering a maze with all the multiple pathways available at your disposal.

No wonder so many of us find managing our money a bit of a headache.

Back then, the only option was to pay with cash or cheque. But now, you’ll have to choose from one of the following choices:

- Debit cards

- Credit cards

- Google Pay

- Apple Pay

- Samsung Pay

- And more…

This is what an average consumer faces whenever they make a transaction. But things are far more complicated for those in the investments and real estate industry. Financial institutions must understand that sometimes, simple is better.

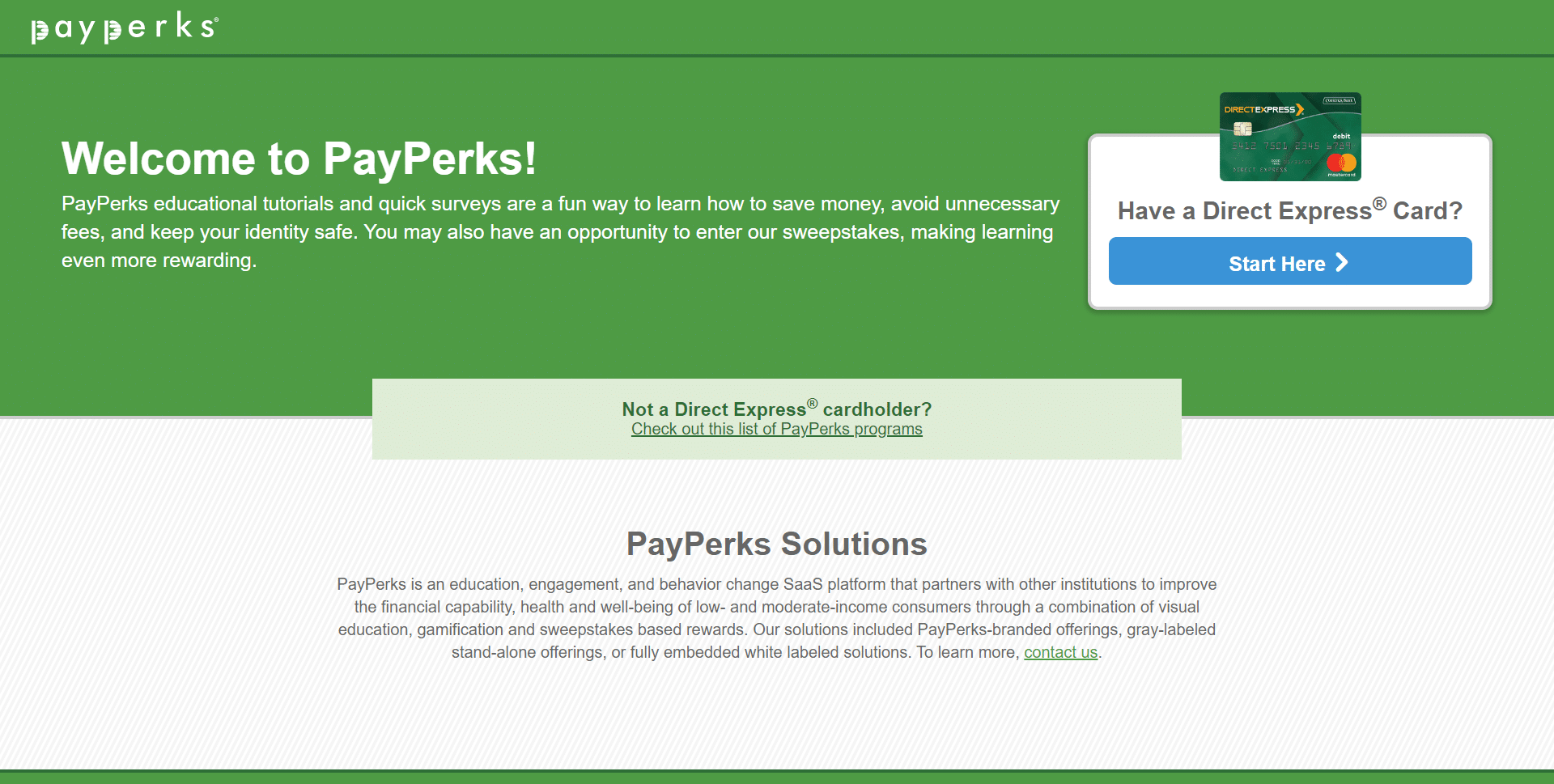

How Payperks improved the financial literacy of its customers

So, how can we make learning about financial management more engaging and less daunting? Gamification can make learning about money fun and accessible. In a world with endless options, finding simple ways to become financially savvy is becoming more critical than ever.

Let’s examine how PayPerks leveraged gamification to bolster their users’ financial literacy.

Source: PayPerks

PayPerks developed a SaaS platform to help their users manage their money. It uses a combination of lessons, games, and chances to win prizes to hook people on financial literacy. By teaming up with various organisations, they’ve created a better way for users to get better at handling their money. Ultimately, this leads to improvement in their financial health and overall happiness.

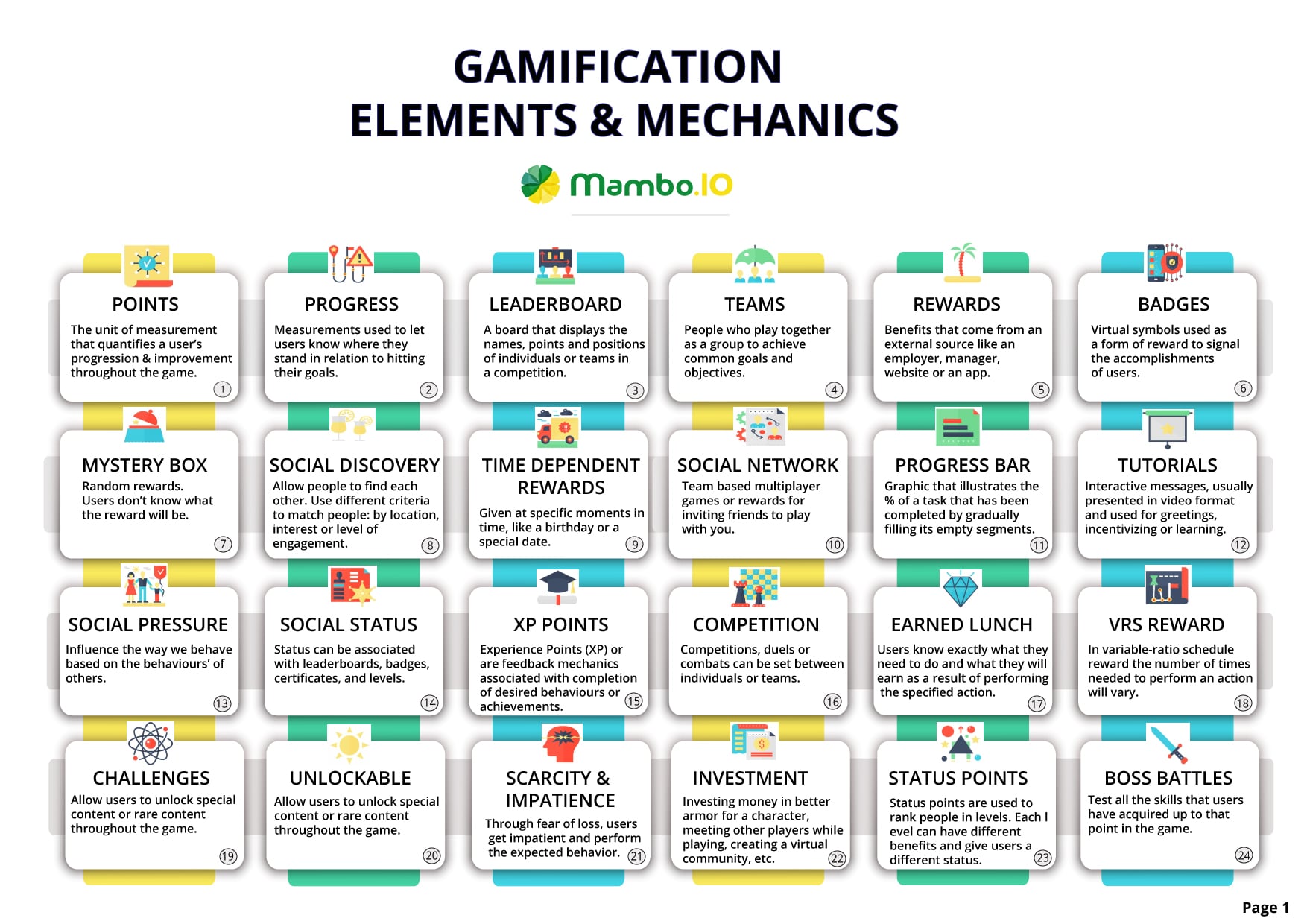

Download your free

“108 Gamification Elements and Mechanics”

Get your cheat sheet and have a quick reference at your fingertips!

#2. Encourage customers to increase deposits and savings

The book “The Richest Man in Babylon” shows us that the secrets to building wealth have stayed consistent throughout history. Despite our speedy evolution, the wisdom shared by Arkad, the richest man in Babylon, remains applicable even today.

Here’s a simpler breakdown of Arkad’s wisdom:

- Always pay yourself first by saving 10% of your income at all times.

- Live below your means and don’t fall into the “shiny object syndrome”.

- Don’t let your savings sit idle; let it work!

- Learn how to protect your assets and understand the risks involved in your investments.

- Look for ways to optimise your investments, like adjusting your mortgage terms.

- Plan your possible sources of income once you get old.

- Do your best to expand your earning potential through books, courses, and life experiences.

After reading the book, you’ll realise that Arkad’s wisdom is really simple: learn to earn, save, and invest wisely.

Using gamification to encourage deposits and savings

Gamification, when applied correctly, can transform how customers interact with their finances. Here’s how it can work:

- Make customers aware of when and where their money is going.

- Help customers set up savings goals and create commitment.

- Make customers understand why they are saving.

- Incentivise their savings as a priority activity.

- Change bad spending habits.

- Develop a financial backup plan in case things go south.

- Make saving and making deposits fun.

How PNC Bank’s “Punch the Pig” helped its customers save more

[youtube controls=2]Your YouTube URL [/youtube]

PNC Bank introduced an innovative example of gamification in banking with their “Punch the Pig” feature. This feature is part of a hybrid wallet system that combines checking and savings accounts to make money transfers easy. Here’s how they did it:

- Punch the Pig – Occasionally, a pig icon will randomly appear while you’re using their banking app. The idea is to “punch” the pig by clicking it, allowing you to send an amount to your savings account.

- Bill pays savings – You can set aside some money for savings whenever you pay your bills.

- Timed savings – Enables automatic daily, weekly, or monthly transfers.

Creative approaches like this can make saving an integral part of any customer’s life. In doing so, you’re encouraging them to cultivate better financial habits and helping them make their financial dreams come true.

#3. Understand your customers first, then motivate them

In the past, many people felt as if banks weren’t really paying close attention to what their customers needed. As anybody would expect, this led to major trust issues.

When people started asking themselves whether they really needed traditional banks, that’s when institutions started to change things. The banks realised that to win back their customer’s trust, they have to make them feel as if they’re part of the banking experience.

Personalization: the key to better customer engagement in banking

Banks have evolved from being just places to money repositories. Over time, they became partners in helping customers grow their wealth and achieve their life goals. This shift in perspective turned out to be a win-win situation for both the clients and financial institutions. This is because customers finally felt valued, all while banks saw their profits grow.

Ultimately, personalised banking became the new norm, with banks now going the extra mile to reward customers for their loyalty. Understanding and addressing customer needs became the cornerstone of a successful business strategy for many banks and fintech companies. Those who follow this ethos are bound to enjoy a more engaged and satisfied customer base.

The lesson behind all of this is simple: give customers what they want, and they’ll automatically return for more. This may mean giving out special treatments, rewards, or features that will make banking experience more convenient.

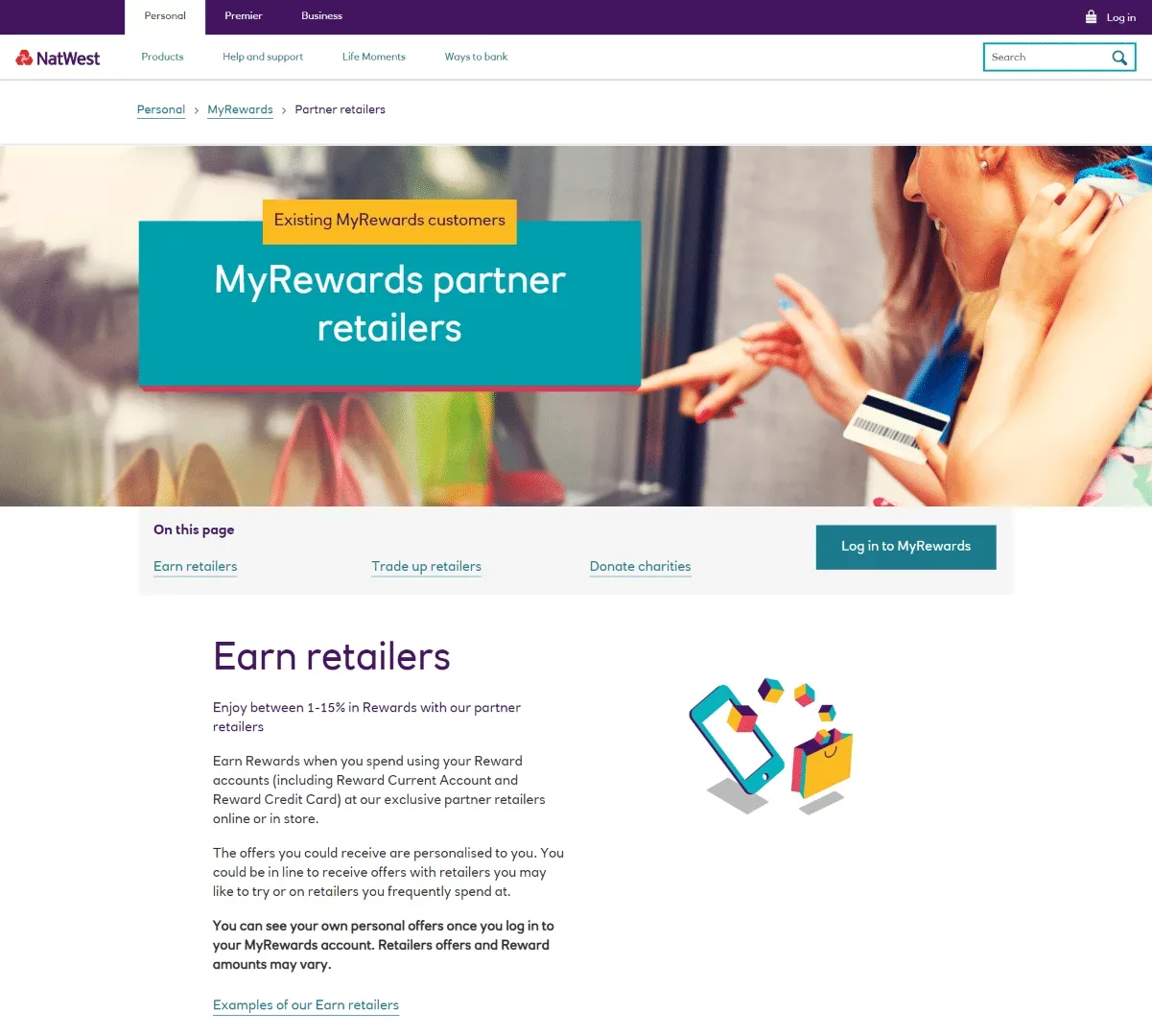

How NatWest’s MyRewards Program personalise rewards

NatWest’s MyRewards Program has done a pretty good job when it comes to implementing gamification to personalise its reward system.

Customers receive tailored shopping recommendations, and whenever they shop at any NatWest retail partner, they earn rewards. Those personalised recommendations and rewards make customers feel like the bank understands their needs. And as a result, they’ve started to trust NatWest more.

Source: NatWest

It’s critical to understand that each person is driven by motivation that’s uniquely theirs. Some like to earn more money, while some want to prioritise their health. The secret to engagement is to listen to their needs and use gamification to offer a range of personalised options.

#4. Set up goals and KPIs

Progress tracking is essential to life’s endeavours, especially concerning personal finance. But many people don’t know how to! Despite this, most are eager to learn and ensure that they’re spending and saving habits have improved.

Here’s another problem: most people fall into the trap of “If I save more, I’ll get richer!”. This notion traps them into believing that accumulating as much money as possible is all that matters. They don’t consider any strategies for optimising it.

Hoping for the best without a solid plan just isn’t going to cut it. Life has a way of throwing curveballs, like sudden illnesses or accidents, that can derail all anyone’s financial dreams. It’s a tough lesson that what we hope for doesn’t always come true, especially when we’re not prepared for the unexpected.

The best way to guarantee success in the long run is to be able to set up financial goals and key performance indicators (KPIs) to see your progress. Doing so helps you plan a more strategic approach to how you can achieve a specific financial goal.

Additionally, it also eliminates any vagueness from the equation. Setting up goals and KPIs will help you identify the following more clearly:

- Who must you become to be able to earn this amount at a given period of time?

- What do you need to do to acquire this amount?

- Where should you put your money?

- When do you want to accomplish your goals?

- How are you going to do it?

- Why did you even set up these goals in the first place?

By setting up goals and relevant KPIs, you can cut through the noise of vanity metrics. This helps focus on what truly matters in achieving your version of financial success.

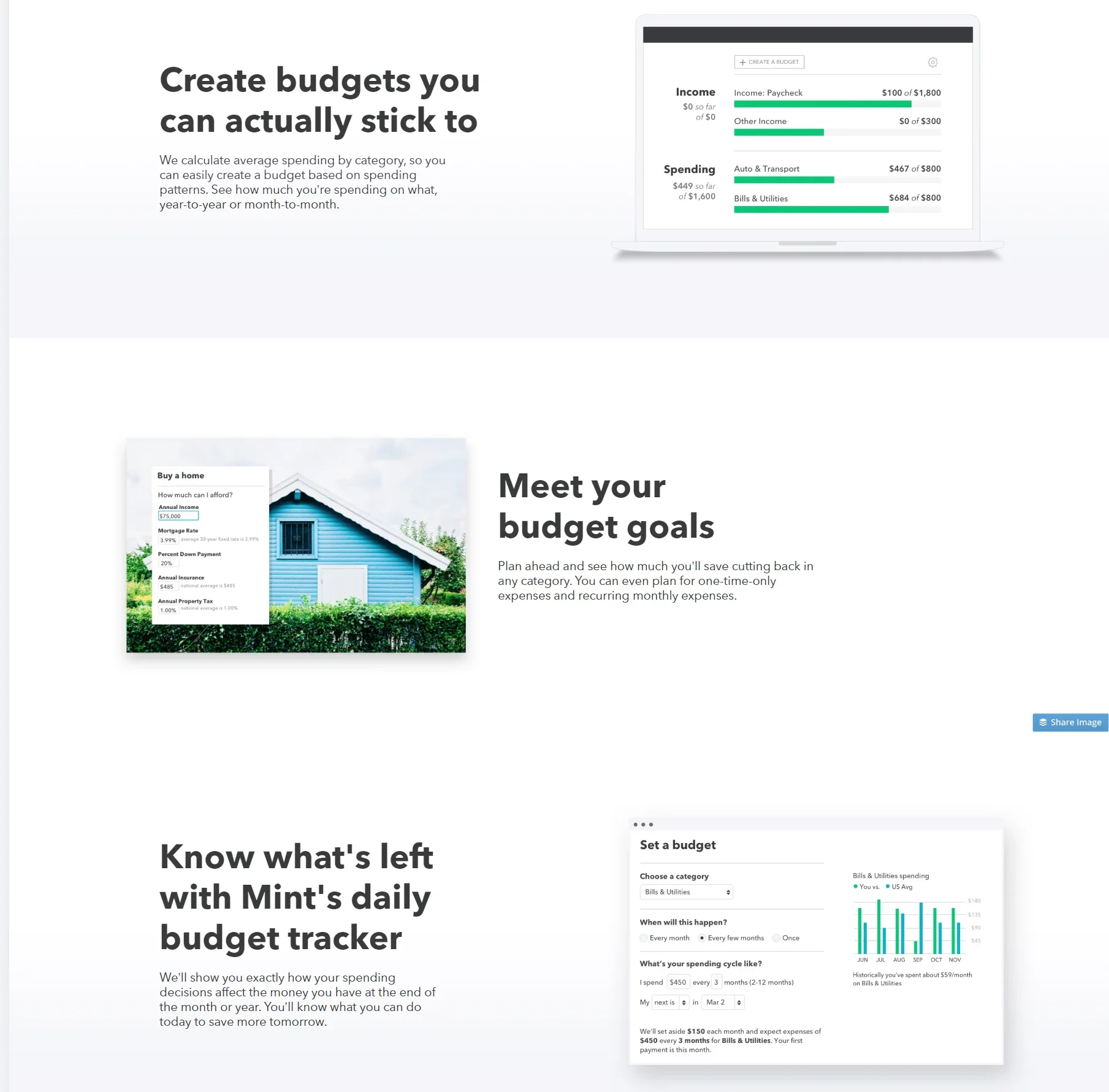

How Mint leverages goals and KPIs to help customers

Mint is a useful mobile app that helps people manage their money. It streamlines the process by sticking all your bank accounts in one place.

Source: Mint

The screenshot above tells us that Mint gives you a panoramic view of your current financial situation. This integration makes it easier for you to monitor you to:

- Save smarter

- Monitor your cash flow

- Track spending across various categories (bills, education, entertainment, etc.)

Users can create custom goals and budgets tailored to their financial objectives. The success of Mint shows how successfully they’ve leveraged gamification to make financial responsibility easier for their users.

#5. Find ways to improve your customers’ wellness while improving their finances

Did you know that over 1.4 billion people worldwide are at risk of developing chronic diseases? That’s 1 in every four people, which is quite alarming!

But why is this happening?

The answer is simple: sedentary lifestyle. In short, we don’t move enough.

We’re far more likely to sit or lie down instead of walking or moving around. Most people nowadays work from home instead of commuting everyday to the office. Not only that, the hobby of a modern person usually involves lying down and doom scrolling on social media. Have we mentioned how easy it is to order food from an app instead of picking up ingredients from the grocery store and preparing it?

An epidemic of inactivity

The World Health Organization (WHO) has something alarming to say about that. According to them, 1 in 4 adults worldwide doesn’t get as much exercise as they need. This level of inactivity is startling because it means that they have a 20% to 30% higher chance of dying earlier than those who stay active. Not only that, insufficient exercise enough can affect health systems, the environment, the economy, community happiness, and life quality.

Healthy habits lead to healthy bodies

The answer to this unhealthy problem is actually pretty simple: make it a habit to sit less and move more. However, it can be challenging for many people to develop new habits and stick to a routine, even if it means they’ll get better results. Creating these habits requires discipline, perseverance, focus, and ultimately, motivation; things that most people nowadays don’t have.

Majority of people nowadays rely on motivation to start their journey towards forming new and healthy habits. But keeping that motivation high is critical. Fortunately for you, this is the area where gamification shines the brightest. Gamification offers the right incentives to achieve any of your customers’ goals.

How Emirates NBD inspired motivation and physical wellness through their Fitness Account

[youtube controls=2]Your YouTube URL [/youtube]

The video above shows how Emirates NBD turned a simple idea into a win-win situation for fitness and finances. They introduced a fitness account that ties the number of steps you take directly to the interest rate on your account. This means that the more active you are, the better the interest rates you get.

Here’s how they used gamification to make this initiative possible:

- Tracking Steps: Every step you take is counted.

- Rewards for Activity: The more you move, the higher your rewards.

- Fun Challenges: Complete challenges to earn points you can redeem.

- Seeing Progress: Use progress bars to monitor how you’re doing.

- Levels of Achievement: Know where you stand with different levels.

- Making Routine Fun: Turn everyday tasks into exciting missions.

With this clever initiative, Emirates NBD boosted its deposits by over $4.37 million. Not only did they promote healthier living, but they also gave their users the freedom to choose their desired rewards.

#6. Use gamification to introduce new products or services

Product development doesn’t just stop once you’re done developing the product. In fact, it’s just the start of a long yet rewarding process. The next step is to create a bulletproof marketing strategy to ensure your customers receive your product well. This process will involve things like knowing your offer’s value proposition, audience, and identifying ways on how to properly launch it. If you get this step right, you’re one step closer to a profitable initiative.

Always remember that at its core, marketing and sales are all about communication. Sure, your marketing team might have a ton of creative ideas, but one thing they’ll all agree on is the need for exceptional communication skills to drive results and success.

Using gamification to launch and market new products

So, where does gamification fit into all of this? This strategy can significantly improve how you communicate your product to your customers. According to Harvard professor Gerald Zaltman, we do 95% of our purchases subconsciously. This goes to show that logic isn’t always in the driver’s seat whenever we make purchases: emotion does.

Gamification taps into this opportunity by leveraging basic human desires like achievement, ownership, social influence, scarcity, and curiosity. This works by integrating gamification mechanics and elements into your product launch and marketing efforts. If done correctly, you can nudge your customers towards your new product or service more engagingly. Additionally, this will mean that your customers will actively interact with it instead of just passively consuming it.

How Extraco Bank used gamification to market new online features

Extraco Bank, one of the biggest financial institutions based in Texas, found a clever way to introduce its new online features. They served over 140,000 customers at the time and faced the challenge of explaining the removal of free checking accounts while highlighting the perks of their new Bonus Account.

So what did they do? They embraced gamification.

Source: Extraco eBank

They did so to make it easier for customers to understand and get excited about the benefits they can enjoy. We’re talking about benefits like cashback on debit card purchases and monthly fee waivers for meeting simple conditions they’ve set.

Their strategy paid off big time. It skyrocketed their conversion rate from 2% to an impressive 14%. This is a prime example of how gamification can heavily influence customer behaviour and foster loyalty.

#7. Encourage customers to track their financial habits

Have you ever wondered why so many people nowadays are getting more obsessed with keeping tabs on their cash flow? That’s because when you know where your money goes, you can adjust your spending habits, which allows you to save more effectively.

Let’s jump into a hypothetical scenario to make better sense of this.

Emily has decided to put more money into her savings for her dream vacation. To do this, she started to do some digging into her spending patterns. After careful deliberation, she discovered she was dropping a small fortune on takeouts and deliveries. Now that she knows where most of her money goes, she decided to cut back on food deliveries. Eventually, she got the vacation she’d always dreamed of.

Healthy financial habits can lead to a fulfilling life. With the help of gamification, you can do just that for your customers.

How Monefy helps customers track their financial habits

Source: Monefy

Monefy is a good example of how successful the implementation of gamification in banking looks like. This app makes it easier for people to understand where your money flows and helps you manage your finances more effectively. Not only that, it’s completely customisable and filled with game-like elements like “-‘ and “+” buttons so you can document your spending quickly.

#8. Motivate customers to use online banking

Have you noticed how online banking has really taken off lately? According to Finder, a whopping 7 out of 10 people in the UK are now banking online. Not only that, 53% of UK adults use their phones to manage their finances. Also, over 36% of the population only use digital banks as of 2024.

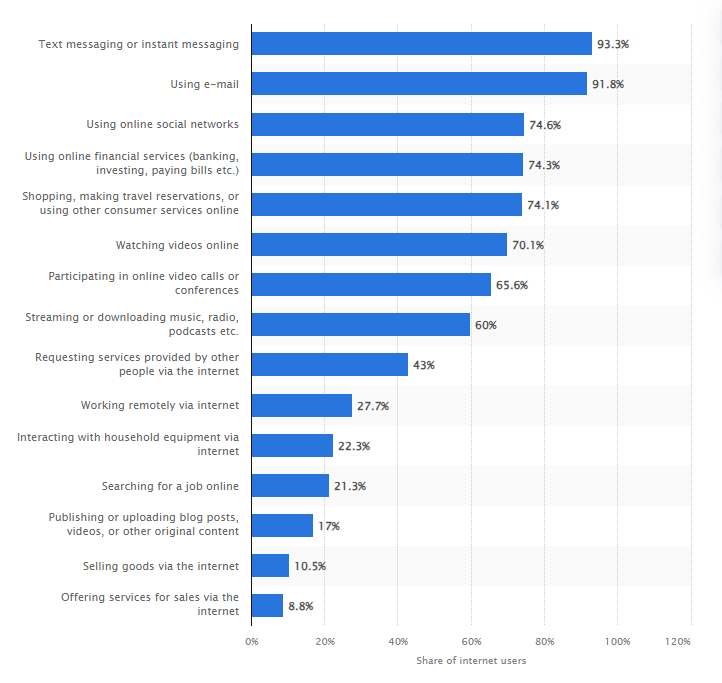

Here’s another interesting finding from Statista. Their findings show that Internet banking ranks as the fourth activity most people use the internet in 2021.

Source: Statista

As you can see from the chart above, online banking isn’t the top reason why people use the internet. However, it still occupies the fourth spot. It’s also worth mentioning that online banking is becoming one of the fastest-growing categories. This means the future of online banking is looking pretty bright.

Advantages of performing online transactions

So, why should you put more effort into encouraging customers to switch to online banking? Let’s take a look at some compelling reasons why:

- Cost: Traditional banks have to pay for physical spaces, employee salaries, and utilities, which are pretty expensive to run. With online banking, you can cut these costs, allowing you to enjoy higher savings interest rates or better annual percentage yields (APVs).

- Time: Online banking is quick and accessible anytime.

- Convenience: Checking your balances or making transactions can be done with a few clicks from anywhere.

- Reduced Risk: Digital transactions have less risk of encountering counterfeit money problems.

- Increased Profits: Money in the bank generates more revenue than money stored in the customer’s piggy banks.

Gamification can be the secret weapon of financial institutions if they want to make online banking more appealing to customers. They can do so by incorporating engaging stories and game-like elements to encourage their customers to make transactions through online banking.

How BBVA drove customers to their online banking platform

BBVA did a tremendous job in using gamification to make their banking app more engaging.

[youtube controls=2]https://www.youtube.com/watch?v=7PGAjzzbge0[/youtube]

Here’s how this scheme works:

- Learning rewards: Users get to earn points by watching educational videos and answering questions that help them understand the app’s features.

- Sign-up incentives: Points are awarded to users whenever they take simple actions like providing their contact information.

- Transaction bonuses: Performing online transactions rewards users with points and lets them unlock new missions and rewards.

- Prize: Once users accumulate enough points, they can then exchange them for enticing rewards, like tickets to football matches or downloads of movies and music.

#9. Incentivise customers to share ideas and suggestions

Keeping your customers happy is important regardless of your industry. If they’re not satisfied, they’re less likely to come back. Only 1 out of 26 customers will actually bother to tell a business about their bad experience. The overwhelming majority will simply walk away.

This means that simply selling your products isn’t enough for long-term success. You’ll need to listen to customer feedback so you can turn their insights into actionable improvements.

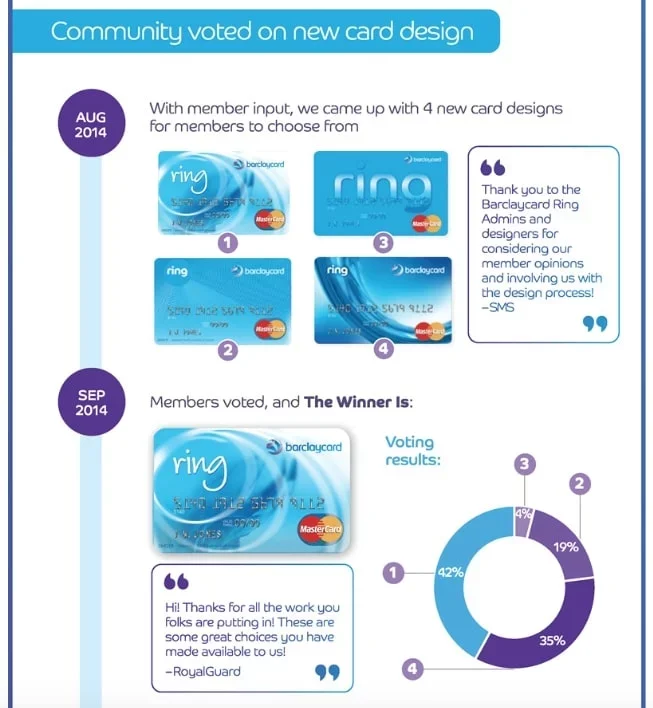

How Barclays listened to their customer and got better results

Barclays teamed up with Mastercard to introduce the Barclaycard Ring, a groundbreaking credit card designed to leverage input from its users. This card was built on community feedback and offered a straightforward and low-cost way to manage finances with benefits like low-interest rates and few fees.

Source: Askmrcreditcard

Cardholders can actively participate in voting on potential new features, designs, and rewards, and even where charitable donations should go. By seeing their ideas come to life on their own bank cards and services, customers feel appreciated. Not only that, they’ve also become more attached to Barclay and their products and services.

#10. Encourage good driving skills

Imagine getting rewarded with savings just for driving safely. Sounds great, right?

By simply being a careful driver, you can dodge daily annoyances like tickets, legal troubles, and even accidents. But what if you could score some sweet discounts on your insurance rates just by being more mindful of your driving?

This whole thing might sound too good to be true, but a handful of companies have leveraged gamification to encourage safe driving to customers.

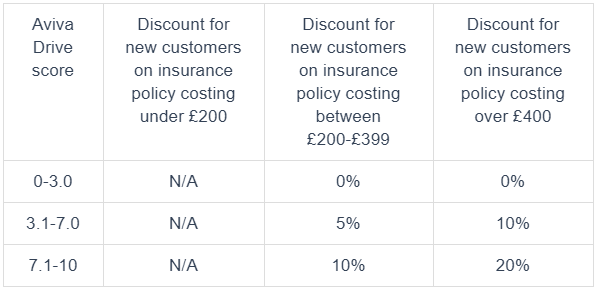

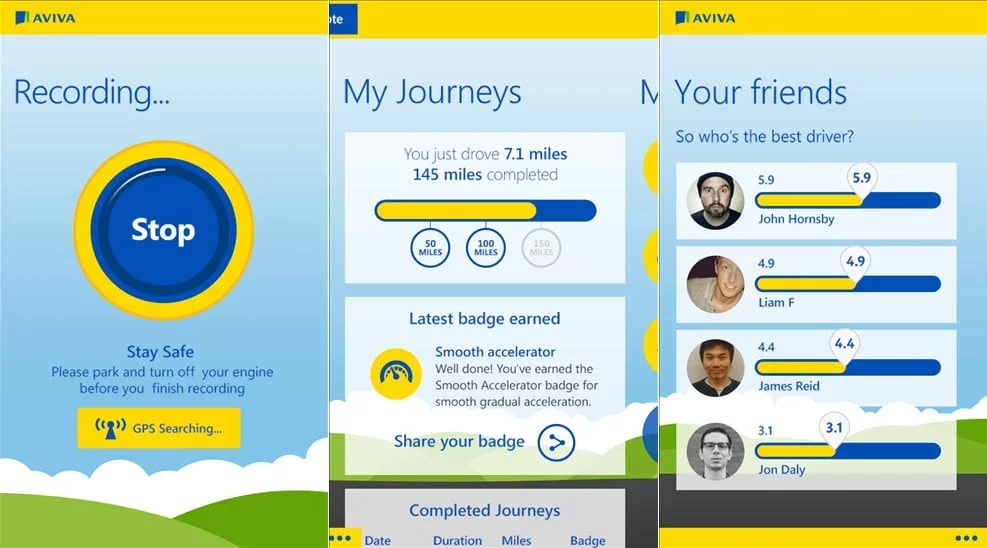

How Aviva encouraged safer driving

The Aviva Drive App is one of the best examples of gamification in banking, particularly in the car insurance industry. It utilises your phone’s GPS to track your driving habits. Simply hit “start” before you drive, and the app will begin tracking your driving behaviours like accelerations, brakes, and corners.

[youtube controls=2]https://www.youtube.com/watch?v=sWiRHgds19k[/youtube]

Once you’ve driven 200 miles using the app, it will offer tips to improve your driving safety. It will also give you a score from 0 to 10 that it’ll use to identify what discount you’re eligible for. How much you save will all depend on how high you score. This means the safer you drive, the more money you save.

Here’s how the insurance discount criteria works:

Now, let’s take a look at some screenshots of the Aviva Drive App’s dashboard. This dashboard contains features like progress bars, points, badges, and more to keep drivers engaged and motivated.

As you can see, it’s even possible to check your friends’ scores and share your badges! In their game, Aviva implemented many gamification mechanics such as progress bars, points, badges, missions, rewards and unlocking content to engage their audience.

How USAA encouraged safer driving

Here’s another example of gamification in banking done correctly. USAA teamed up with Honda to create the Honda Dream Drive app, which was designed to highlight risky driving behaviour in real-time. For instance, the app will let you know if you’re speeding towards a sharp curve or a school zone. You will then be given relative scores that you can turn into rewards.

Source: USAA

Both the Aviva Drive App and Honda Dream Drive make driving safer and more fun for customers looking to save more on their insurance. As a result, insurance companies get to save more by avoiding any potential accidents or paying for expensive claims.

#11. Build customer loyalty

It’s a no-brainer that effective customer engagement can significantly boost a company’s growth. A study made by Gallup shows that customers who are fully engaged with retail banking bring about 37% more revenue each year. This solidifies the fact that when customers feel connected, they’re not simply buyers anymore; they’re avid supporters of your brand.

Keeping customers has become more crucial than ever, especially now that countless other banking options vie for their attention. And sure, drawing in new customers might seem simple at first glance – just offer them something better than what they currently have. If there’s no loyalty involved, you can easily attract them to your offer and make them switch to your service.

But here’s the problem: other companies can do the same thing to you. To add salt to the wound, the Office of Fair Trading pushes consumers to shop around for the best deals. Ultimately, this means attracting new customers is only half the battle.

How to effectively retain your customers

The real challenge here is keeping customers. Once you’ve lured someone with a great offer, you’ll need to keep upping the ante to make the idea of staying with you worth their while. Unfortunately, initial perks or benefits won’t keep people around, nor does offering them the same old thing. If you want to prevent your customers from monkey-branching to your competitor, you’ll have to continuously innovate your offering.

The goal in customer retention is simple: boost customer lifetime value and make sure they feel valued and appreciated.

Long-term strategies are critical to retaining customers. This could mean offering them a range of banking services, providing VIP treatments based on their financial behaviours, or making it easier to manage their money. You will need to zero in on what they want and need. Then put all your efforts into providing it. More importantly, ensure they’re engaged and feel part of something bigger than they initially signed up for.

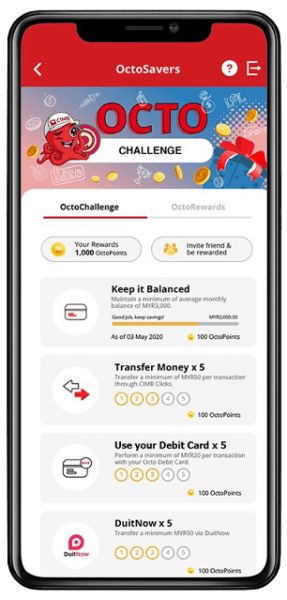

How CIMB Octochallenge used gamification

The CIMB Octochallenge is a clever application of gamification that makes banking fun and engaging for CIMB Bank’s customers. Customers can tackle challenges and missions through their mobile app and earn points for rewards and vouchers. They can use these rewards to purchase goods from big e-commerce names like Grab and Lazada.

Source: Moneythor

This initiative is a part of the Octosavers account, a digital savings account that rewards customers for online banking activities. By making baking a rewarding experience, CIMB has successfully increased brand loyalty and customer engagement.

#12. Reward purchase and transactions

Banks rely heavily on their customers. This means customers are the bank’s lifeblood and their most valuable asset. Because of this, banks have started offering rewards to encourage customers to use their platforms and ensure the bank stays up and running. This is a textbook approach even well-established banks use to make customers feel like they’re valued partners instead of just sources of income.

Examples of banking reward systems

Over the decades, banks have devised ingenious reward programs to keep their customers interested in their offerings. Here are some noteworthy examples:

N26

This digital bank has a “Refer a Friend” feature that allows you to invite a friend through their app. Once your buddy signs up and makes a transaction of at least €15, you both get €15.

Source: N26

Credit Suisse

This Swiss financial service company offers a Bonviva Rewards Shop, where you can earn points based on how much you spend on your credit card annually. You can then use these points for various prizes, such as air miles or kitchen appliances.

Bank of America

Their Preferred Rewards program has levels depending on your account balance over three months. For example, if you have a balance between $20,000 and $50,000, you get a 5% savings interest booster. In short, the more you save, the better rewards you get.

Standard Chartered Bank

This British multinational bank launched a “Twist and Win” promotional online banking app feature that allows credit card users to win surprise cashback rewards for their transactions. It’s pretty much a virtual gumball machine animation within an app where customers can “twist” and win cashback on their purchases.

Source: Standard Chartered Bank

Banks nowadays are stepping up their game with rewards programs to keep customers happy and encourage them to spend and save more.

Did you like what you’ve read? Click the link to check out our infographic on Gamification in Banking and Financial Services for more!

Final Thoughts

The fast-paced world of banking has forced financial institutions to evolve to keep their edge and beat their competitors constantly. However, the old ways of engaging customers are long gone and obsolete. Now, they’d have to make tremendous efforts to keep their modern customers engaged and satisfied.

But how can you adapt to this overwhelming task?

As Dave Chappelle once said: “Modern problems require modern solutions.”

Gamification is here to help. When applied correctly, gamification in banking is a fantastic strategy that fits into almost every aspect of business. It can grab your customers’ attention, teach them something new, and even build their loyalty to your brand.

Latest Posts

Machine Learning In Finance: 12 Essential Applications

The impact of machine learning on finance is significant. Thanks to this technology, financial institutions are now equipped to make efficient decisions. Through the analysis of data sets, machine learning […]

How To Create Interactive Compliance Training For Bank Employees

Banking compliance training isn’t just another task. It’s the stage where everything else performs. Banks must navigate a myriad of regulations and laws. After all, this is a trust-driven, high-stakes […]

How Fintech Apps Are Using Gamification To Increase User Engagement

Discover how gamification in fintech is revolutionizing financial engagement, making banking fun & boosting user loyalty.