How To Create Interactive Compliance Training For Bank Employees

Banking compliance training isn’t just another task. It’s the stage where everything else performs. Banks must navigate a myriad of regulations and laws. After all, this is a trust-driven, high-stakes sector.

Non-compliance can lead to dire consequences for banks. From enormous fines to tarnished reputations, even criminal charges in worst-case scenarios. Nobody wants their bank facing those issues.

Navigating banking regulations can feel like a maze. The countless rules seem quite daunting. But don’t be disheartened.

In this article, we’ll demystify compliance training for banks. We’ll tackle potential challenges and share proven tactics to conquer them.

Table of Contents

Download your free “Gamification Guide”

Download the Mambo Gamification Guide for detailed insights and actionable strategies to enhance engagement and performance.

Understanding compliance training

Compliance training plays a key role in the banking sector. It helps staff at all levels to comprehend and stick to complex regulations. By equipping employees with useful, actionable knowledge, it allows them to do their jobs well. It also reduces the risk of non-compliance.

The significance of compliance training in banking has surged lately due to the industry becoming more global and complex. The rise of extraterritorial enforcement, multiple regulatory regimes, and digital banking have moved us into a new regulatory setting. This exposes banks to risks from both local and overseas authorities.

Banks need thorough compliance programs and training to navigate this intricate environment successfully. They must cover every applicable law and regulation.

A strong grounding in compliance training is crucial for employees to grasp this regulatory climate fully. It also enables them better to understand the high integrity level their work demands.

The high stakes of non-compliance

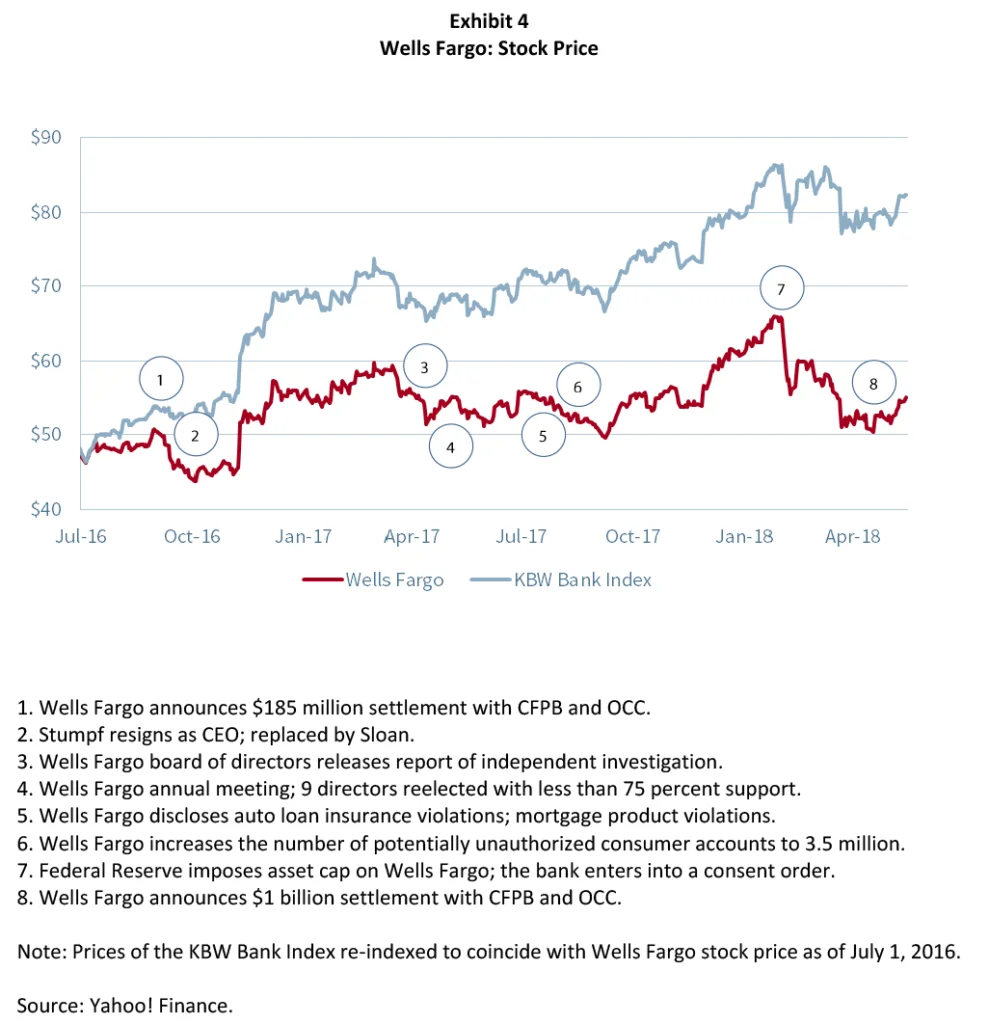

The devastating costs of ignoring compliance rules can’t be overstated. Take the Wells Fargo disaster in 2016, for instance. Due to high-pressure sales targets, employees fabricated millions of unauthorised bank and credit accounts. The fallout was devastating- a whopping $185 million fine and huge reputational loss.

In addition, thousands of jobs were lost, and CEO John Stumpf was forced to resign. This crisis showcased the terrifying risks of weak compliance policies and a sales-at-any-cost culture. It emphasised the importance of thorough compliance training to prevent such disasters, safeguarding the company and its clients.

Understanding the price of neglect

Skipping on compliance training can leave you millions out of pocket in fines and lost business. Let’s unpack the real monetary bite of non-compliance:

The sting of financial losses

Non-compliance can hit you with big fines and penalties. It can even bring lawsuits.

In 2020, financial institutions worldwide coughed up over $13 billion in regulatory fines alone. And that’s not even counting legal costs and damage to reputation.

Facing the music legally

Banks must juggle many regulations, from anti-money laundering laws to data privacy rules. Getting these wrong can land you in serious legal hot water, even criminal charges for those involved.

Legal bills can pile up to millions of dollars. Some whopper cases have even landed at more than $100 million.

The blow of reputation damage

Damage to reputation hits hard. In our trust-based world, any compliance lapse can seriously impact a bank’s reputation. When customer and stakeholder trust is lost, it can stir up chaos for a bank’s future and success.

Non-compliance errors can trigger a decline in customer trust, resulting in lost profits and market share. Imagine this: A high-profile bank’s stock value plummeted 20% following a prominent compliance infringement.

The flaws of standard training

Typical compliance training modes often lean on tedious lectures and a passive learning setting, leading to poor memory retention and slight behaviour changes. Stuffing employees with heaps of information through long lectures can result in cognitive overload. That makes it tough to grasp and remember vital points.

Moreover, inactive learning spaces, where employees are expected to soak up details without active involvement, can be challenging. They don’t foster critical thinking or practical knowledge use.

Standard training programs are often hindered by the absence of efficient measurement methods. Without dependable techniques to gauge understanding or track improvement, it’s hard to determine if employees have truly comprehended the topics. Determining if they can apply them to real-life situations could also be difficult.

Consequently, typical training methods fail to bring substantial and enduring behavioural alterations. This is concerning since these methods are vital for maintaining consistent compliance within a company.

Discover new training paradigms: Transforming dull checklists into dynamic learning experiences

Compliance training was a tiresome but required task at one time, with staff members ticking boxes just to finish their courses. With today’s complex regulations, this outdated mindset has been shown the exit. Technological advancements have evolved training modules into engaging and impactful learning opportunities.

Use tech tools to boost compliance training

Tech has revolutionised compliance training. By harnessing learning management systems (LMS), companies can effectively deliver, track, and assess training activities. Plus, LMS enables tailored learning experiences, enhancing relevance and engagement for each employee.

Additionally, technology offers real-time insights into training completion rates, helping companies spot potential weak spots or areas to enhance. This data-focused strategy facilitates targeted interventions, ensuring everyone receives the necessary training.

Turning compliance into competence

With exciting interactive e-learning modules and gamification, modern compliance training transcends mere memorisation. It has evolved into a practical skill-building platform promoting ethical decision-making. It also caters to individual learning styles, crafting personalised learning journeys based on role and expertise level.

Grasping the bigger picture

Compliance training should go beyond regulations. It should cultivate critical thinking, ethical decision-making capacity, and detailed knowledge about banking products and services among employees.

Developing competencies

Effective compliance training starts from comprehending the bigger picture – understanding individual roles, the implications of non-compliance, and how compliance underpins the total risk management strategy.

Simplify the world of banking compliance

Let’s make banking compliance easy to grasp. We’ll tackle complex regulations such as Dodd-Frank, Basel III, and KYC that all bankers need to know.

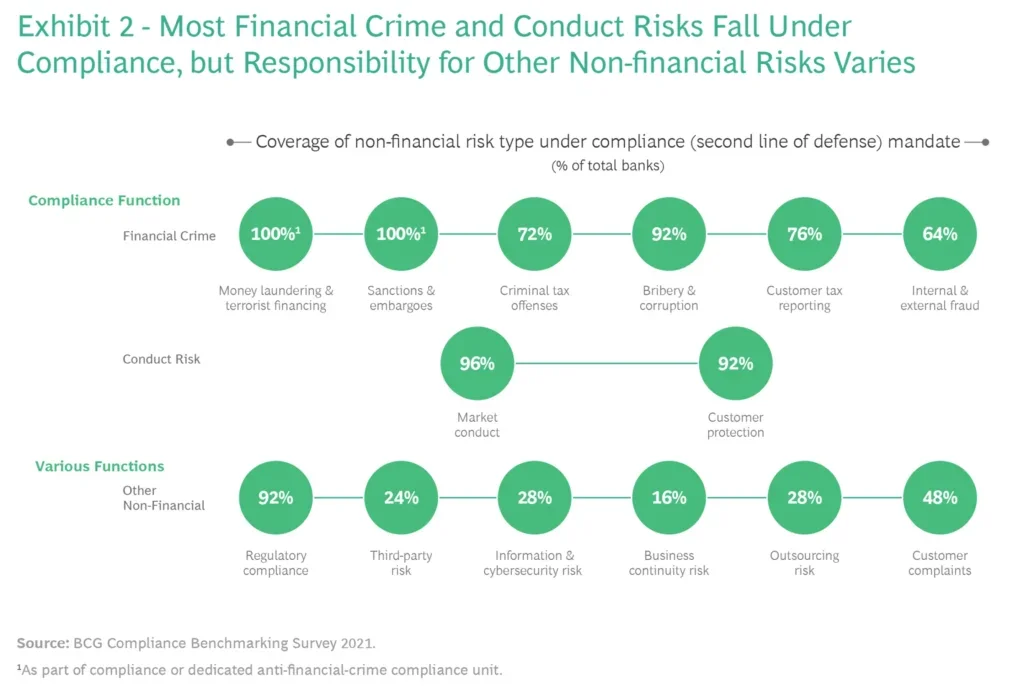

Anti-money laundering (AML)

Why should we care about AML? Ever heard of it? Essentially, AML focuses on stopping the dirty money flow and catching those funding terrorism.

So, how do we do this? Banks need to build strong AML programs. Think of it like setting up a robust security system at home. They need to do their homework, spot anything fishy, and keep detailed records.

Now, have you ever wondered what happens behind the scenes? Basically, banks function like detectives. They perform due diligence, which is just a fancy way of saying they check out their clients thoroughly. When something odd pops up, they have to report it. And, boy, keeping records is like maintaining a diary of every single transaction.

Sadly, the system’s not foolproof. That makes AML essential but challenging. It’s like an ongoing chess match against financial crime. We have to keep tweaking strategies to stay one step ahead.

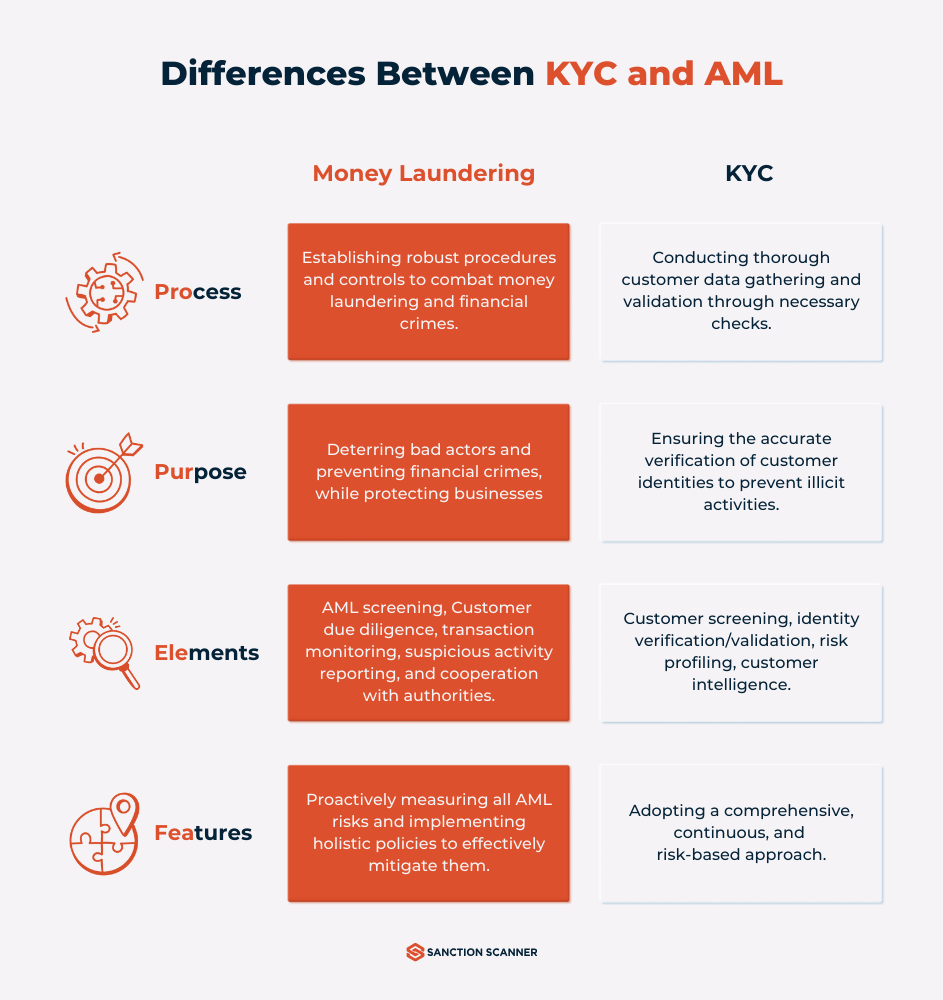

Know your customer (KYC)

Ever heard the saying, “Trust, but verify”? That’s the gist of KYC. It’s not about suspecting everyone who walks in. You just need to know your business partners. So, what’s KYC all about?

First, it’s about verifying customer identities. Think checking IDs, asking for proof of address, and maybe doing background checks. But it doesn’t end there. KYC is ongoing. Banks constantly monitor transactions and assess the risk of shady activities.

Now, you might ask, “Why all this hassle? What’s the worst that could happen anyway?” Trust me, the consequences can be brutal. We’re talking big fines, operational restrictions, and a tarnished reputation that takes years to fix. Plus, the potential for aiding money laundering or other financial crimes.

Source: Sanction Scanner

Dodd-Frank Act

Do you still remember the 2008 financial crisis? The one that shook the world economy and left many struggling? That chaos led to the Dodd-Frank Act. But what exactly does it do?

For starters, it gave regulators more power to oversee financial institutions. Think of it as giving them sharper teeth. Strengthening capital requirements means banks have a bigger cushion to absorb losses in crises. Like having a bigger safety net.

One major thing that came out of that is the Consumer Financial Protection Bureau (CFPB). This dedicated agency protects us from unfair financial practices. Ever been duped by hidden fees? CFPB is on that.

Now, if someone tries to skirt these rules, what happens? The consequences can be pretty steep. We’re talking heavy penalties, doubled down scrutiny, and possible restrictions on your operations. Basically, this is like getting served a red card in soccer—you’re out.

Source: Oracle

Basel III

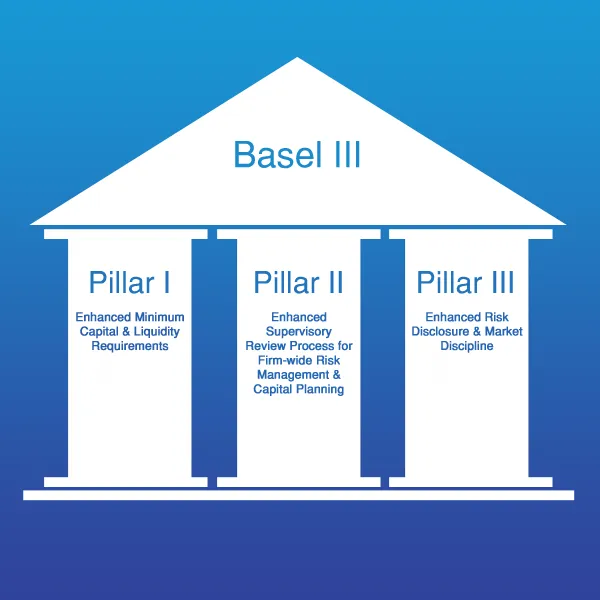

Why do we have the Basel III? To bolster regulation, supervision, and risk management in banking.

What are the rules? Higher capital needs, improved risk management, and better liquidity standards.

Penalties for ignoring rules? Banks could face capital shortages, regulatory sanctions, and lost market confidence.

Source: Medium/Saujan Gyawali

General data protection regulation (GDPR)

Ever had that eerie feeling someone’s watching you online? Or noticed your personal info floating in the digital void? Yeah, it’s unsettling.

That’s where the GDPR steps in, like a privacy superhero. In tech terms, GDPR ensures data minimisation. This means companies can only collect the data necessary for their purpose. No more hoarding user info just in case.

So, GDPR is basically a set of rules for how companies handle your personal info. Treat it like your digital Bill of Rights.

For example, if there’s a data breach, they’ve gotta let you know. No more secrets.

But you’re probably wondering, “What happens if a company breaks these rules?” Well, the GDPR doesn’t play around. The fines are huge – up to 4% of a company’s global earnings or €20 million, whichever’s greater.

Source: IoTDunia

Emerging threats: a constantly shifting landscape

Financial institutions deal with new compliance challenges practically every day. It’s like getting trapped in a perpetual game of whack-a-mole. Just when you think you finally have all the issues covered, another infuriating problem pops up elsewhere.

You have to manage risk and ensure data security, all at once. And as if that’s not enough, you’ll need to deal with the tech jargon. You have words like “phishing” and “malware” — those may sound familiar. But what about “zero-day exploits”?

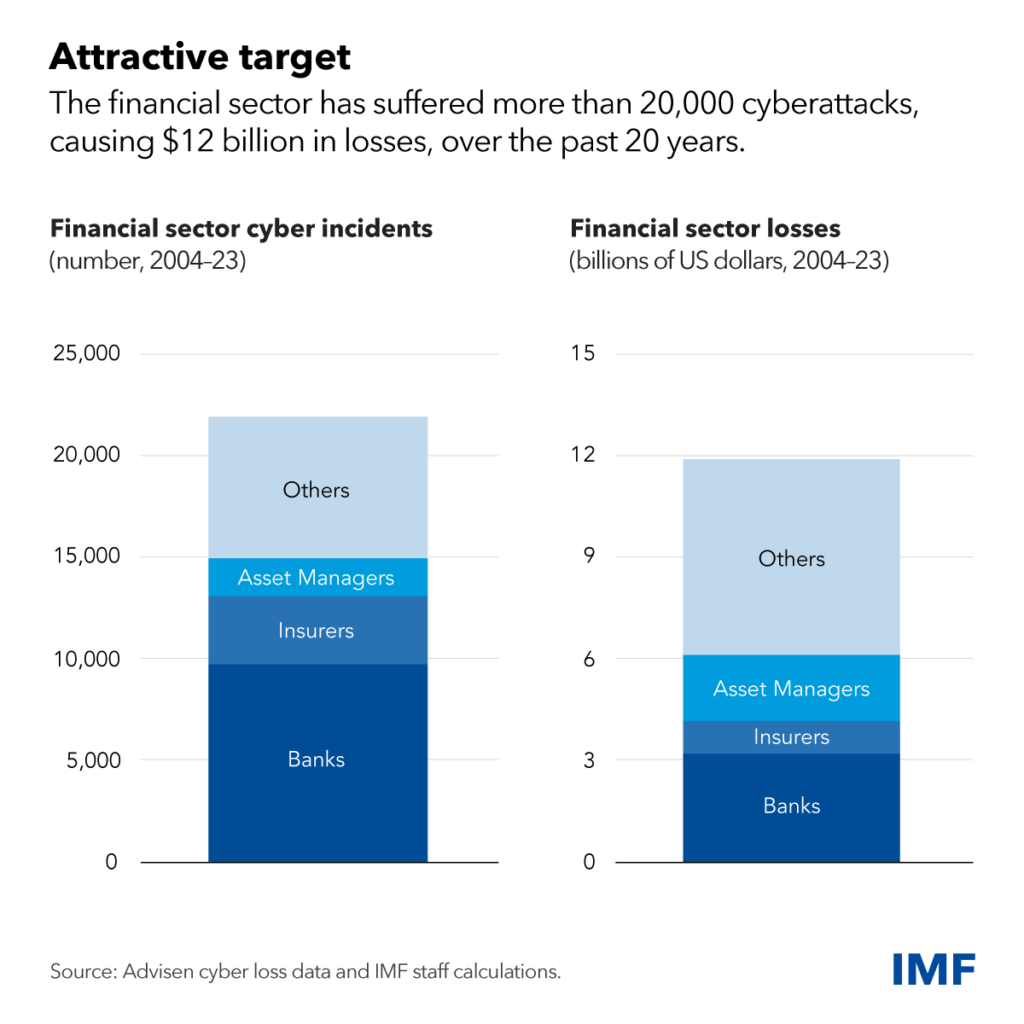

Cyber threats and data breaches are increasing, putting a lot of pressure on banks. They must safeguard sensitive info and implement robust security measures.

Ransomware attacks have also emerged as another threat. Hackers seize control of a bank’s systems, demanding payment for release. It’s not just a financial risk. This also jeopardises customer trust and may harm the bank’s reputation.

AI’s role in bank decision-making poses another concern. Sure, it boosts efficiency and precision, but it might lead to bias and discrimination without careful monitoring.

The surge of online banking and mobile apps necessitates stronger cybersecurity. Banks must stay alert and regularly update their security protocols to prevent hacking attempts and data breaches. It’s a constant race against emerging threats.

Global vs. local compliance: a delicate balancing act

Navigating the intricate world of international rules and local laws can be tricky, especially with the rapid globalisation of financial markets. Banks must juggle compliance mandates from the multiple countries in which they operate.

International standards like Europe’s GDPR and the US’s Bank Secrecy Act provide a sturdy foundation for data protection. They also protect users through their anti-money laundering regulations. Yet, these may not always sync with local laws or customs in other world regions.

For instance, privacy laws vary from country to country. Banks have to intricately tread these waters to ensure compliance, all while respecting local norms.

Embracing tech: a solution for regulatory compliance

Tech advancements bring along a slew of tools that aid regulatory compliance. The arsenal ranges from AI-powered risk management systems to blockchain for transparent, tamper-proof record keeping.

Dialogue with regulators: building the bridge

Building a rapport with regulators can significantly boost compliance efforts. Continuous dialogue can iron out misunderstandings and discrepancies in interpreting regulations.

Moreover, this tandem approach can streamline processes and yield better results. Regulators gain insights into a bank’s challenges, while banks benefit from the regulators’ expertise.

Culture: the invisible hand in compliance

A bank’s culture plays a pivotal role in compliance. A bank steeped in ethical values is more likely to stick to regulations.

Leadership sets the tone – promoting integrity and ethical conduct. Regular training and communication reinforce these values across the organisation.

Download your free “108 Gamification Elements and Mechanics”

Get your cheat sheet and have a quick reference at your fingertips!

Benefits of compliance training

Compliance training is a gift that keeps on giving to organisations. It eases navigation through tricky regulations and nurtures a climate of honesty. A well-rounded compliance training plan acts like a shield, reducing risks, safeguarding work environments, and protecting delicate data.

Less risk, more reward

One of the standout benefits of compliance training is its knack for slashing the potential of legal penalties and fines. Guiding employees around the maze of laws and regulations helps dodge expensive legal pitfalls. It equips them with the tools to behave ethically during conflict, enabling balanced judgements and decisions. When employees are clear on their responsibilities, they tend to align their actions to avoid negative repercussions.

Safety first in the workplace

Compliance training is the secret ingredient for a safer workplace. It sets a clear roadmap for handling compliance issues and highlights the importance of reporting them. Many organisations blend compliance training into their health and safety blueprint, aiding employees in understanding their rights and responsibilities. It serves as a guidebook to the associated policies and processes, reinforcing safety as a community responsibility.

Protecting your data

Data protection training is necessary for business compliance programs in the digital age. If your job involves handling personal data, this training is your guard. It outlines the do’s and don’ts if a data breach happens and the consequences of breaking data protection laws. Beyond safeguarding customer data, it ensures employees aren’t inadvertently disclosing sensitive info.

Compliance training isn’t just a tool to avoid fines or lawsuits. It fosters a proactive compliance culture, equipping staff with the knowledge to serve customers justly and stick to internal codes of conduct.

Compliance training ensures the organisation keeps a solid compliance management system while also playing a crucial role in change management. Most importantly, it enables the leadership to uphold compliance culture while executing their business strategy.

Challenges in implementing compliance training

Even with the clear advantages of compliance training, financial institutions frequently stumble over hurdles. Let’s explore some common snags in compliance training for bank staff.

Boosting employee engagement

Employee engagement in compliance training often proves to be a stumbling block. Compliance training can seem dull and lengthy to many staff members, causing a dip in motivation and interest. This can lead to information not sticking or not being used in their day-to-day roles.

To leap over this, banks need to create engaging, applicable, and dynamic training. Training can grasp employees’ attention and spur active involvement by weaving in real-world examples, case studies, and engaging components.

Keeping content relevant

Another sizable hurdle in compliance training is making sure the training hits home. Generic, blanket training programs often don’t address the distinct compliance risks and trials different departments and roles within the bank encounter.

To combat this, banks should tailor their compliance training to fit the needs of each employee group. A deep dive into the compliance risks connected to different roles is essential. Tailoring the content can ensure training fits perfectly.

This makes the training more effective and engaging for employees. It also helps them understand and apply their compliance duties. They can then incorporate these duties into their daily tasks.

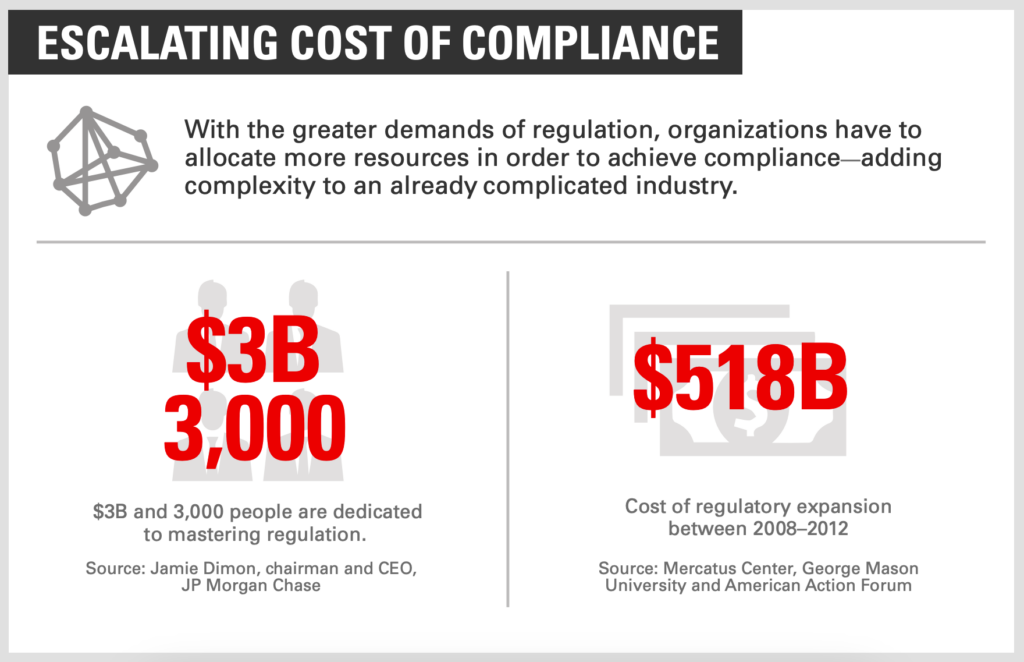

Allocating resources

Rolling out expansive compliance training programs requires substantial resources, including time, money, and human capital. Banks often struggle to set aside the necessary resources for effective training. This becomes especially true with other priorities and budget limitations looming.

Banks must place compliance training at the heart of their risk management plan to tackle this. This may mean setting aside dedicated resources for the training, whether a team or a budget. Using tech, such as e-learning platforms and automated tracking systems, can make the training process more efficient. On top of that, these can take the strain off company resources.

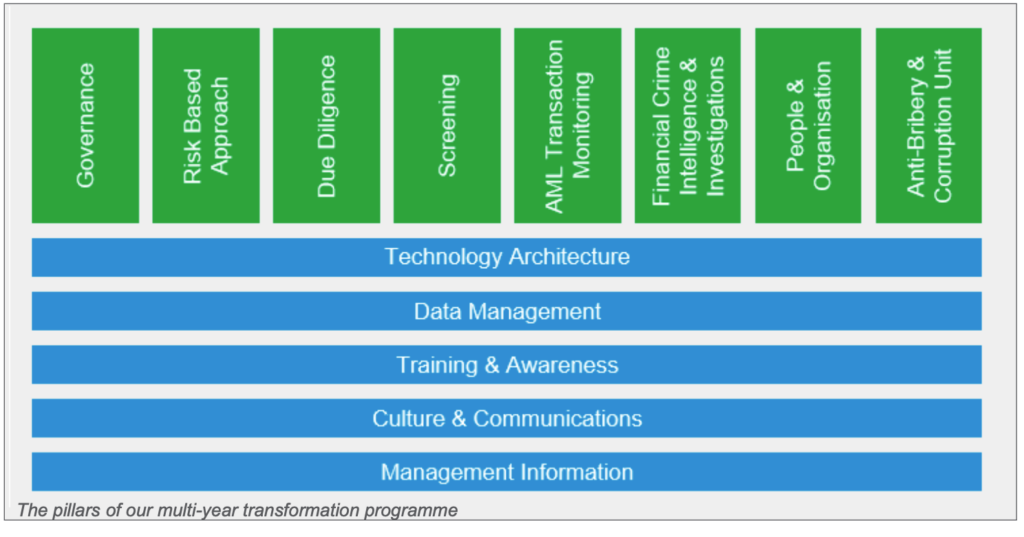

Source: Oracle

Roadmap to effective compliance training

Forming a compliance-oriented culture in banks requires more than just meeting regulatory criteria. Adopting a comprehensive training approach is key. This includes:

Continuous training

Neatly packaged, timely updates keep pace with dynamic regulations and industry shifts.

Personalised training

Individual banks come with unique risks and requirements. Tailored training programs cater to these specified needs.

Technology use

Tech advancements offer innovative compliance training delivery methods like e-learning platforms or simulated scenarios.

Employee involvement

During training, it’s not enough for employees to take in information; active engagement enhances learning.

Utilising reinforcement

Training shouldn’t stop at course completion – regular reinforcement and performance assessment ensure knowledge application and retention.

5 engaging tactics for effectiveness in innovative compliance training

With captivating strategies and current trends, here are more solutions for memorable compliance training.

#1. Microlearning

Compact, focused learning boosts retention and suits busy schedules. Breaking complex topics into short, focused modules makes learning manageable.

For instance, comprehensive Anti-Money Laundering (AML) training can be split into mini-sessions. These could include identifying suspicious transactions or visually breaking down customer due diligence procedures.

#2. Scenario-based learning

Experience compliance challenges firsthand through realistic simulations and case studies. This hands-on method, best illustrated in reviewing customer accounts for potential red flags, enforces required skills and critical thinking.

#3. Adaptive learning paths

Personalised learning journeys based on personal performance lead to better outcomes and increased interest. Adaptive learning platforms like LMS365 tailor the material and difficulty to fit each individual’s needs.

#4. Mobile-first design

For on-the-go professionals, mobile-compatible training makes access easy. With offline capabilities, mobile learning platforms allow for anytime access, integrating learning into daily routines.

#5. Data analytics

Refining training programs through analytics reduces risks. Tracking learner progress, identifying training gaps, and measuring effectiveness means training stays adaptive and responsive to learner needs.

Cultivating a culture of compliance

Compliance isn’t just about meeting the minimum required standards – it’s a mindset. A culture valuing compliance embedded in daily operations is key to long-term success.

Make compliance training fun with gamification

Ever pondered how weaving in game-like elements can make learning a thrilling experience? Let’s explore.

Unwrapping the gift of gamification

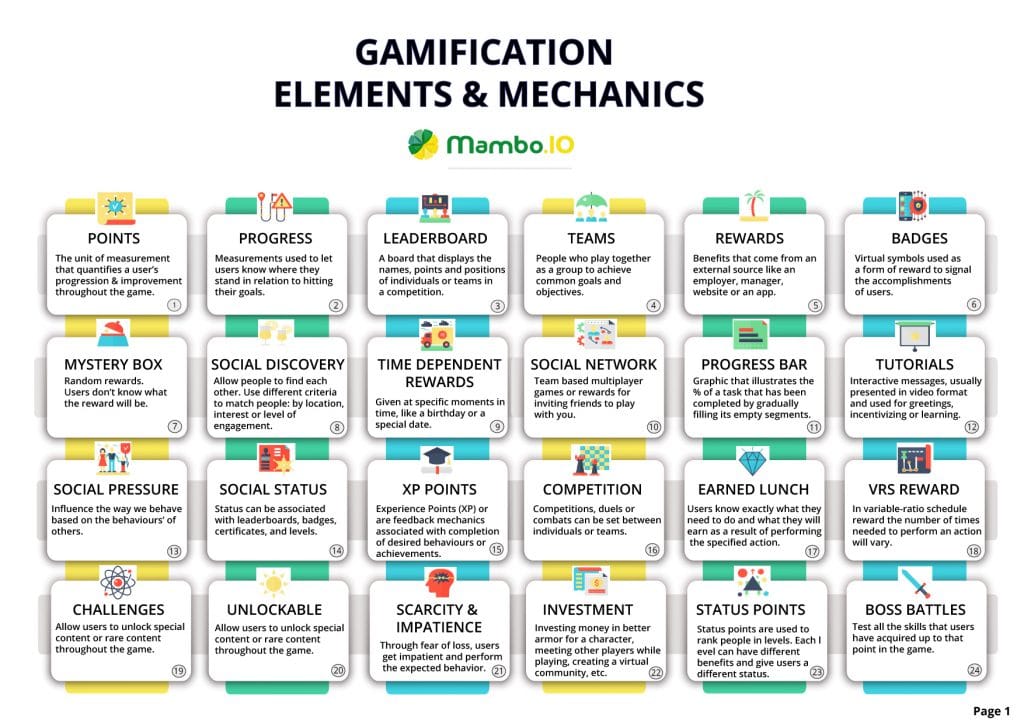

Are you familiar with points, badges, leaderboards, challenges, and rewards? Here’s how we use them to pep up your learning journey:

Points

Collect points by ticking off your tasks, getting questions right, or hitting milestones. You get instant feedback and a satisfaction boost — talk about motivation!

Badges

Picture badges as shiny symbols of your newly acquired skills. They stoke your thrill for social recognition and inspire you to keep earning and flaunting more.

Leaderboards

Leaderboards, a scoreboard, rank your performance, instilling a dash of healthy competition. As you see your name rising, the content suddenly becomes more captivating!

Challenges

From quick quizzes to knotty problem-solving, the thrill of challenges adds a dash of urgency and excitement to your learning curve.

Rewards

Imagine getting tangible rewards like gift cards or exclusive extra content. Or intangible ones like virtual achievement certificates. What a rush, right? Rewards push you to stay active and outdo yourself.

Level up with motivation

Make learning fun with gamification, which taps into our drive to do tasks for sheer joy rather than looking for external perks.

Let me break it down for you:

- Freedom of choice: Gamification lets learners pick their journey, giving them control, which makes their progress feel truly theirs, increasing engagement.

- Victory points: Setting goals and giving feedback through points and progress bars helps learners measure their growth. This sense of achievement encourages even more engagement.

- Social connections: Leaderboards and team challenges bring a sense of community. Feeling connected to peers can energise learners and increase their involvement.

Adding these game-like aspects can make your training programs thrilling and rewarding experiences. This enhances learning and cultivates a lifelong passion for constant growth.

Gamification in bank compliance training

Demystifying KYC Problems

Gamification introduces fun and interactive challenges in understanding and following KYC regulations. Imagine partaking in simulations where you must verify customer identities based on certain documents. This immersive experience helps spot potential fraud and strengthens the importance of close checks.

Tackling AML through simulations

Engaging simulations help you unravel the complex AML regulations. You’ll monitor and report transactions virtually, identifying signs of money laundering from given data. This practical experience sharpens your ability to recognise shady operations and understand the reporting process.

Adventures in risk assessment

Gamification transforms risk assessment into exciting quests needing strategic decision-making. You might find yourself managing a high-risk client relationship, navigating through successive decisions, mishaps, and wins. Continuous feedback helps you reflect and learn from the repercussions of your actions.

A battle to stay updated

Staying on top of ever-changing regulations is no easy feat, hence the gamified “Regulatory Updates Battle”. You’ll contest time-limited quizzes and flashcard games covering new compliance laws and standards in it. Leaderboards and high-score badges add a dash of competition, fostering continuous learning.

Real-life examples of gamified compliance training

Take a peek into companies winning with gamified compliance training. Discover how innovative approaches are reshaping employee engagement and effectiveness.

Standard Chartered Bank

This bank unveiled an exciting way to learn compliance rules: “The Compliance Challenge.” It’s a game series featuring quizzes, case scenarios, and simulations.

Rabobank

Rabobank brought learning to life using a gamified anti-money laundering (AML) compliance training platform. It utilises stories and interactive scenarios to bring key concepts to life.

DBS Bank

While not specifically for compliance training, DBS has an internal gamified learning platform, the “DBS x AWS DeepRacer League,” developed in collaboration with Amazon Web Services.

This initiative is focused on upskilling employees in artificial intelligence and machine learning through gamified learning experiences, where participants engage in programming and model racing competitions.

Barclays

Barclays has utilised gamification for compliance training. They partnered with Skillcast to create a gamified learning platform specifically designed to assess employee knowledge retention, mainly focusing on information security.

And Barclays isn’t just stopping there. They’ve applied gamification to other compliance training areas. Pretty cool, right? These efforts ramp up employee involvement and knowledge retention.

OCBC Bank (Singapore)

OCBC Bank launched a gamified learning platform, “OCBC Future Smart.” This program takes a snooze-fest of a textbook and revamps it into a lively, interactive video game. It touches on all the nitty-gritty stuff. It can be anywhere from regulatory rules to the intricate dynamics of cybersecurity. It even throws in some things about anti-money laundering.

HSBC

Then there’s HSBC with its “Conduct Counts” program. They add a dash of fun to promote ethical behaviour and compliance with regulations. Honestly, who knew compliance training could be engaging?

BNP Paribas

BNP Paribas has implemented a gamified learning platform. They developed a digital solution called “Digit’learning” that incorporates gamification elements to enhance the training of their branch advisors.

This platform includes features like earning stars and a leaderboard to foster employee competition and engagement. This initiative has been used effectively to increase expertise in various subjects.

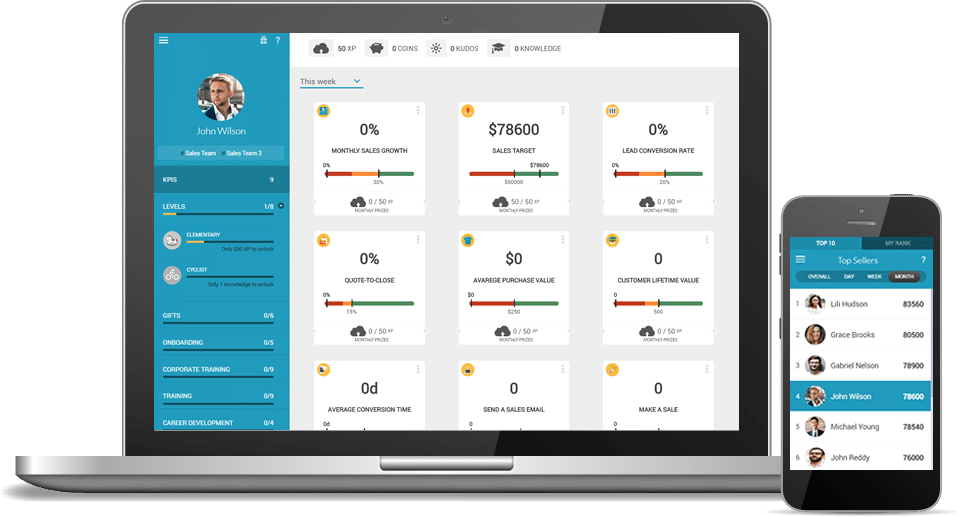

Mambo.io: your gamification partner for better compliance training

Change your idea of boring lectures and monotonous slide shows. Mambo.io is much more than just a learning platform. It’s your ticket to making compliance training exciting and engaging.

We’ve created a flexible platform for all industries. Even though we’re champs at understanding financial sector complexities, we know every industry has quirks. From the unique challenges of modern banks to the diverse needs of different sectors – we’ve got you covered.

What Mambo.io brings to your team

- Engaging gamification: We turn training into a thrilling journey with points, badges, leaderboards and rewards. Your team will be inspired to learn and retain information.

- Custom learning paths: Our platform adapts to individual learning styles.

- Real-time progress tracking: Keep an eye on your team’s progress. Find out who’s excelling and needs a bit more help, and see the impact of training on overall compliance.

The benefits of Mambo.io

- Increased engagement: Dull training leads to disinterested employees. Mambo.io sparks interest and motivation, making compliance training something your team will enjoy.

- Better knowledge retention: Interactive and fun experiences create lasting memories. Our platform ensures your employees remember their training long after it’s over.

- Decreased risk: A well-trained team is your best weapon against costly compliance breaches. With Mambo.io, your team will make informed decisions and stay on top of regulatory changes.

- Happy employees: Investing in engaging training shows your team you value their growth. This boosts morale and fosters a culture of ongoing improvement.

Conclusion: your compliance journey never ends

Banks must be on their toes in a world of rapid regulation changes. Modernise training and invest in your team’s compliance know-how. Interesting e-learning tools, interactive simulations, and bite-sized learning chunks increase engagement and knowledge retention.

Focusing on continuous education and development reduces risks and protects your reputation.

You know, there’s something special about a well-informed employee. Kinda like having eyes in the back of your head. They’re always on the lookout for potential snags. Making smart decisions? Check. Upholding integrity? Check.

Learn more about our engagement solutions and start your journey to a more dynamic and effective compliance training program. Contact us now!