Customer Retention Metrics: Unlocking Success And Loyalty

Many brands are willing to sacrifice other aspects of their business if it’s for the sake of boosting their customer retention metrics. After all, a single customer is worth several sales in revenue.

Sephora, for example, would let go of potential sales if it means keeping a customer for longer. They do this through their loyalty programs.

More specifically, they give free products to customers under certain conditions. Examples of these include being a customer for long enough or spending a certain amount on the brand.

As expensive as it may be, this strategy is almost always worth the expense due to its impact on customer retention metrics.

In this article, we’ll take a closer look at eight key customer retention metrics and how you can identify which are most relevant to your company. In addition, you’ll learn how to leverage these customer retention metrics and what strategies you can use to boost them.

Table of Contents

- What are customer retention metrics?

- 8 key customer retention metrics to track and measure

- How to identify which customer retention metrics are relevant to your company

- Using customer retention metrics to drive business growth

- Proven methods to keep customers coming back

- The bottom line: customer retention metrics

- Machine Learning In Finance: 12 Essential Applications

- How To Create Interactive Compliance Training For Bank Employees

- How Fintech Apps Are Using Gamification To Increase User Engagement

- Top Gamification Companies for Employee & Customer Engagement

What are customer retention metrics?

Customer retention metrics are key performance indicators (KPIs) that evaluate how well a brand is able to retain its existing customers.

They’re most useful for providing valuable insights regarding a customer’s relationship with a brand. That includes their loyalty, satisfaction, and overall engagement with the company.

Among the many customer retention metrics, customer retention rate (CRR) is perhaps the most well-known.

However, while it is the metric most representative of customer experience, there are many other customer retention metrics.

8 key customer retention metrics to track and measure

Often, a brand monitors not just one, not two, but several metrics to evaluate the success of its customer retention efforts. Each metric can tell a different story about a customer’s loyalty toward a brand, but some are more relevant than others. The customer retention metrics listed below, in particular, are typically the most relevant ones.

#1. Customer retention rate (CRR)

Overview

Customer retention rate (CRR) is arguably the most straightforward to express your success toward customer retention. After all, it directly measures the percentage of customers you successfully retained over a specified period.

It’s measured in percentages; the higher the value, the better the company is doing, retention-wise. CRR is often seen as one of the most impactful customer retention metrics in regards to profitability. In fact, a study by Frederick Reichheld of Bain & Company shows that a 5% CRR increase can lead to an increase of more than 25% in revenue.

Formula

The customer retention rate requires three pieces of data.

- The number of customers you have at the beginning of a specified period.

- The number of customers at the end of that period.

- The number of customers you acquired during the entirety of that period.

In addition, you must decide on the time range. At this point, you can use the formula.

Example

A software company had 500 customers at the beginning of June. Over the course of that month, 50 new customers subscribed to their services. Since some unsubscribed towards the end of the period, the total number of customers by the end of June was 370.

CRR = ((370 – 50) / 500) x 100

CRR = (320 / 500) x 100

CRR = 0.64 x 100

CRR = 64%

#2. Customer churn rate (CCR)

Overview

The customer churn rate (CCR) is practically the opposite of CRR regarding the formula. That’s because “churn” is how many customers you didn’t manage to retain.

Be that as it may, it indicates the same thing as CRR.

To be precise, it tells you whether your customer retention strategy and efforts are going smoothly or not and how you can improve them. A higher Customer Churn Rate means bad news, while a lower value is ideal. A high CCR, by default, would always suggest a low CRR. However, these two metrics aren’t entirely complementary as they don’t total 100%.

Formula

The customer churn rate requires only two pieces of data.

- The number of customers at the start of a period.

- The number of customers at the end of that period.

You need to decide on a time range. And with that, you can get the CCR with this formula.

Example

Take the previous example, where the subscription-based software company had 500 customers at the beginning of June and 370 at the end.

CCR = ((500 – 370) / 500) x 100

CCR = (130 / 500) x 100

CCR = 0.26 x 100

CCR = 26%

You may notice that the CCR and CRR don’t sum up to 100%. That’s because the CCR doesn’t count the customers acquired during the period. CRR does, hence the discrepancy.

#3. Customer lifetime value (CLV)

Overview

The customer lifetime value (CLV) is the average dollar amount that a customer can generate for the company. In short, it’s the estimated value of a customer over their entire lifetime with the brand, hence the name.

Formula

To calculate the customer lifetime value, you need three key data.

- Average purchase value – is the average amount of money your customer spends on each transaction. You can get it by taking the total revenue generated from all purchases within a specified period. You then divide it by the total number of sales.

- Average purchase frequency – is the average number of times a customer makes a transaction with your brand, be it a subscription or sale. Its calculation involves taking the total number of transactions within a specified period. You then divide it by the total number of unique customers in that same period.

- Average customer lifespan – is the average length of time a customer remains as your company’s customer. You can obtain it by taking the time difference between each customer’s first and last purchases and their average.

The formula for customer lifetime value is more complex because the three key data you require also have their own calculation. So, there should be four separate calculations.

The last of which will follow this formula.

Example

A subscription-based company offers three subscription plans. They cost $5, $10, and $20 respectively. On average, the company gets $6.50 for each customer. The brand only offers monthly plans, so the average purchase frequency per month is 1. However, customers, on average, renew for 11 months.

CLV = $6.5 x 1 x 11

CLV = $71.50

Here’s another example: Customers of an online clothing retailer spend an average of $14.60 for each order, either in bulk or by piece. On average, they purchase clothes from the retailer in three instances, again, either in bulk or by piece, every month. And on average, it takes four months before customers leave or churn from the clothing brand.

CLV = $14.60 x 3 x 4

CLV = $175.20

#4. Net promoter score (NPS)

Overview

The Net Promoter Score (NPS) is perhaps the most unique out of the eight metrics in this list. That’s because NPS is qualitative, meaning it’s based on subjective data like reviews.

To put it into perspective, its complement, quantitative metrics, is based on objective data or factual information. An example of this is the current number of your customers.

Still, it’s not any less impactful than CLV or CCR, but it’s not directly relevant to customer retention. It simply reveals how likely a customer is to recommend your company.

It’s relevant because if a customer is willing to recommend your brand, then it’s safe to assume they’re loyal. In a more technical sense, a higher NPS means you’re doing great regarding customer retention.

Formula

Though it’s based on feedback, there’s still a formula for NPS. However, you need only one piece of data—customer feedback. More specifically, you need the answer to the question:

“On a scale of 0-10, how likely are you to recommend our company?”

You then categorise these answers according to the score, namely:

- Promoters (9 – 10)

- Passive (7 – 8)

- Detractors (0 – 6)

Only once you’re at this point can you use the formula.

Example

In a survey of 1,000 respondents, 236 are categorised as Promoters, 684 are Passive, and 80 are Detractors.

Promoters % = 236 / 1,000 x 100 = 23.6%

Detractors % = 80 / 1,000 x 100 = 8%

NPS = 23.6% – 8% = 15.6

The NPS can range from -100 to 100 and is often shown as a number rather than a percentage value. Apple, for instance, had a whopping NPS of 72 in 2022.

#5. Repeat purchase ratio (RPR)

Overview

The repeat purchase ratio (RPR) is exactly as the name suggests. It’s the likelihood, represented as a percentage value, that a customer will purchase your brand repeatedly.

It doesn’t matter how many purchases they make, as long as it’s more than one.

Formula

To calculate the RPR, there are two pieces of data you’ll need, and those are:

- The number of unique customers.

- The number of customers with repeat purchases.

You can set a time frame. Unlike most metrics, it’s not necessary.

For example, you can count the unique customers and customers who made repeat purchases in June. In that case, the repeat purchase ratio would only apply to that period.

In any case, the formula is as follows.

Example

An online clothing supplier/retailer had a total of 1,000 unique customers in November. Out of these total customers, 450 ordered clothes in over one instance within that month.

RPR = (450 / 1,000) x 100

RPR = 0.45 x 100

RPR = 45%

This tells us that an estimated 45% chance a customer would make a repeat purchase. However, it doesn’t tell you anything about their level of loyalty to your brand.

After all, in this particular instance, a customer with only two purchases is no different from a customer with a million.

#6. Renewal rate

Overview

The renewal rate is the same as the repeat purchase rate, except it only applies to subscription- and contract-based brands. It’s the percentage of customers that opt to renew their contracts or subscription to the company within a specified period.

It provides the same insights as RPR and is likewise most helpful in figuring out if your customers, in general, are loyal.

Formula

The formula, as well as the key data, are also practically the same as the RPR. You need:

- The number of renewed customers.

- The total number of eligible customers.

It’s absolutely necessary to set a timeframe for this metric. After which, use the formula.

Example

A software-as-a-service (SaaS) company is selling a subscription-based management tool. In August, they had 1,000 customers whose subscriptions were eligible for renewal.

It’s important to note the keyword “eligible.” Suppose you’re measuring the renewal rate for August. You had a total of 1,500 subscribers at the time.

However, that doesn’t mean all of them are eligible. For example, those with a subscription that extends beyond August, like those with an annual plan, aren’t eligible for renewal.

You also don’t count them on the number of renewed customers. You’ll only count them as renewed or eligible for renewal when their subscription plan expires.

In any case, let’s say out of the 1,000 customers eligible for renewal, 780 renewed.

Renewal Rate = (780 / 1,000) x 100

Renewal Rate = 0.78 x 100

Renewal Rate = 78%

#7. Product return rate (PRR)

Overview

The product return rate (PRR) refers to the possibility that a customer will return a product. It’s comparatively less valuable for measuring the success of your retention efforts.

Nevertheless, it’s still relevant since a high PRR often results in a negative customer experience. Customer loyalty would, in turn, dwindle, and your strategies, as far as those customers are concerned, won’t be as effective. So, in a way, it offers valuable insights.

Formula

To measure the PRR, you need the following data.

- The total number of products sold.

- The number of products returned.

It’s common practice and advisable to set a timeframe for this calculation.

With that, you can get the PRR by using this formula.

Example

An online clothing retailer sold a total of 2,200 clothes in the month of November. Out of these products, 330 were returned.

PRR = (330 / 2,200) x 100

PRR = 0.15 x 100

PRR = 15%

#8. Time between purchases (TBP)

Overview

The time between purchases (TBP) measures the average time interval or duration between a customer’s consecutive purchases. It’s somewhat of a sub-metric to the repeat purchase ratio since it only applies to those who make repeat purchases with the brand.

Formula

The TBP involves two calculations. For this metric, you need two key data, namely:

- The number of repeat purchases for each customer.

- The total number of customers with repeat purchases.

You must also decide on a time frame. The first calculation requires the formula.

That will tell you the TBP of a customer. What you want is the average TBP of all your customers, which you can get with the following formula.

Example

Jane is a repeat customer of an online clothing retailer. She had made five separate purchases spread across an entire year.

TBP = 365 days / (5 – 1)

TBP = 365 days / 4

TBP = 91.25 days

Jane’s TBP is 91.25 days. Including Jane, there are a total of 450 repeat customers. Suppose the total TBP, including Jane’s, is 34,218.75 days.

Average TBP = 34,218.75 days / 450

Average TBP = 76.04 days

Again, these eight customer retention metrics are just some important ones you must remember. There are many others, but it makes sense to focus on the ones most matter. But what exactly makes a specific metric relevant to your company?

How to identify which customer retention metrics are relevant to your company

The renewal rate is an example of a metric that isn’t relevant to all types of businesses.

Granted, it might be crucial to contract and subscription-based companies. However, it doesn’t serve any purpose to sales-based companies, like an online clothing retailer.

The seven other metrics are the same, albeit not to that degree. That’s why you must know how to identify which customer retention metrics are most relevant to your brand.

With that in mind, here are some tips to figure it out.

Define your business objectives

A company will change its objectives depending on what it needs. And depending on those objectives, the relevant customer retention metrics may vary. With that said, before you go ahead and focus on any metric, make sure you have a definitive plan or objective in mind.

Benchmark against competitors and industry averages

There’s a good chance you’re already measuring the eight metrics above. However, that doesn’t necessarily mean you put a lot of importance on any of them.

Source: SaveMyCent

To determine the most important, consider comparing your existing data against the competitor and industry averages. If a specific metric is lower than the expected standard, it’s a good sign that this particular metric needs some work.

Analyse the customer journey

The customer journey refers to the series of interactions that a customer makes with the brand. Each retention metric plays a crucial role in a specific touchpoint of this journey.

So, map out and analyse the customer journey stages to determine which touchpoint/s needs some improvements. A customer retention metric becomes relevant in this case if it has a significant impact on those touchpoints.

Source: Forbes Advisor

Measure the metrics according to customer segments

While they might buy the same product, not all customers have the same behaviour or preference. Customer segments are what separate each type of customer.

Apart from their varying behaviour or preference, the performance of your customer retention metrics may also vary. One segment might not find your products to be satisfactory, so the product return rate is high. The other customer segment may discover your product to be at least acceptable, but they rarely make a repeat purchase.

Source: YouTube

Each segment will require you to focus on a different metric. So, make sure you measure your customer retention metrics according to the existing customer segments.

At this point, you should know exactly what to measure, so what’s left is the how.

Using customer retention metrics to drive business growth

Dish out promotions to customers that are about to churn

It’s common to show some promotions or ads to customers, but you should do so sparingly. There’s perfect timing, and that’s when they’re about to churn from the brand.

Source: Switch

You can tell if they’re about to churn if they haven’t purchased anything more extended than the estimated time between purchases.

Determine which products are most and least profitable

If your brand has several offerings, you want to know which generates the most revenue. That way, you can focus on improving instead of investing in products that were never destined to succeed. The product return rate is incredibly useful in this regard. After all, it tells you exactly which products are the least desirable or satisfactory to customers.

Identify the highest- and lowest-value customers

Like products, specific customer segments will have a higher overall value than the rest.

PRR is to products as CLV is to customers. To be precise, the CLV tells you what types of customers yield the most revenue to your company.

Find out what you’re doing wrong or right at any given time

Oftentimes, a retention rate chart will have spots where the rate is unusually high or low.

The same can be said to other charts of other metrics, like churn rate or lifetime value.

These spots represent the times where you did something particularly wrong or right. With this insight, you can avoid making the same mistake or using the same profitable tactic.

Source: Customer Lifetime Value

Craft more informed decisions regarding strategies

While it’s unfortunate, crafting strategies for customer success involves a bit of guesswork, if not a lot. Customer retention metrics, like many others, reduce the need for guesswork.

They allow you to make informed decisions, and strategies made from informed decisions often have higher chances of success.

CLV, in particular, is incredibly useful for strategy crafting. Most brands use CLV to determine whether a strategy is worth going for regarding return on investment (ROI).

Suppose you have an ad that, according to tests, can pull in a customer for every $150 fee. In any other scenario, it’s difficult to determine if the ad is worth running. Now, let’s assume you know, from your calculations, that your CLV is $200. In that case, you can conclude that the ad would yield a $50 profit per $150 investment. In other words, the ad is worth it.

Proven methods to keep customers coming back

Though you can boost your customer retention metrics significantly in many ways, having at least a few options is a good idea. Here are some suggestions.

#1. Personalization

Personalisation is when you tailor a customer’s experience to their preferences and needs.

In doing so, they become more accustomed to your offerings and are therefore more likely to remain one of your customers.

An excellent example is Netflix, a streaming platform that offers recommendations based on the user’s viewing history.

Source: Netflix

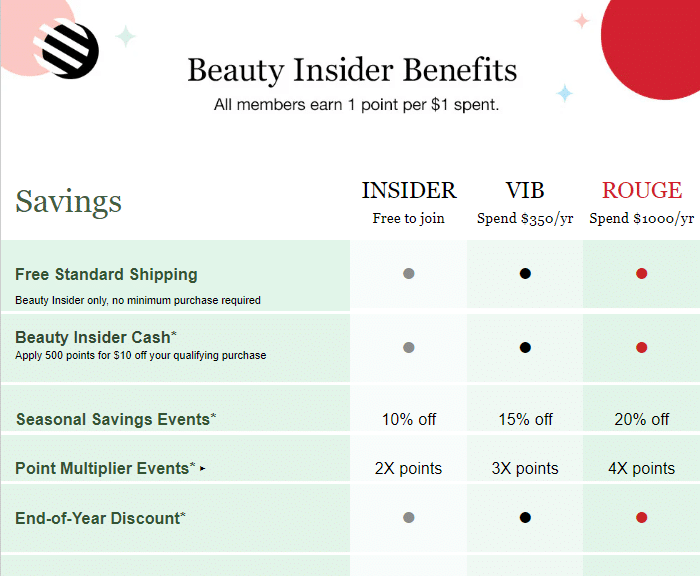

#2. Loyalty/reward programs

Loyalty/reward programs incentivise customers to repeat customers, whether it’s through discounts or freebies. That’s its entire point, and it works spectacularly.

Sephora, a global beauty retailer, is the prime example of this strategy’s success. They have a program called Beauty Insider, where they earn 1 point per $1 spent. Customers can then spend those points on rewards such as exclusive discounts and VIP access.

Source: Sephora

#3. Exceptional customer service

Exceptional customer service assures customers that they’ll be met with good support the next time they encounter an issue.

With that expectation, they would be more likely to return to your brand.

Zappos, an online clothing/shoe retailer, is renowned for its exceptional customer service.

Source: Zappos

#4. Proactive engagement

It’s been known that staying in regular contact with customers can help maintain a strong connection with them. Social media engagement and community building are some of the most common approaches to this tactic. A perfect implementation is when you create a Facebook page and post updates regularly to keep the members in touch with the brand.

Starbucks, in particular, is known for having a proactive and loyal customer base because of its mobile app. They use the app to engage with loyal customers through announcements, birthday rewards, and other functionalities.

Source: Google Play Store

#5. Occasional surveys or feedback forms

Customers who realise that you care about their opinion are more likely to stick to your brand. Surveys and feedback forms are the perfect way to express such sentiments.

Tesla, for example, is known to seek feedback regularly from customers.

Source: Tesla

#6. Gamification

Gamification is the implementation of game elements in an otherwise non-game platform or channel. In a way, it’s a combination of all the methods above.

For starters, a common gamification tactic that resembles loyalty programs is the achievement system. It’s a system where customers are given points whenever they accomplish tasks. Examples of such tasks include buying from the brand or giving a review.

Gamification may also involve proactive engagement. The leaderboard system is a great implementation of this, as it allows users to compete and interact with one another.

Duolingo, a language-learning platform, utilises this strategy by giving users achievements, badges, and levels as they complete lessons and demonstrate proficiency. It provides a sense of accomplishment, encouraging them to continue learning through the app.

Source: Duolingo

The bottom line: customer retention metrics

Customer retention rate, churn rate, lifetime value, and renewal rate are just a few examples of customer retention metrics. Each one carries a lot of significance to a company.

But while that may be the case, one will always be more relevant than the others. That’s why you need to decide that carefully based on your current objectives.

An understanding of these metrics, as well as their importance, is key to that goal. Hopefully, this guide provided much-needed clarification regarding these metrics.

At the end of the day, you’ll always need to boost these metrics, regardless of your business goals and objectives. If you’re curious how gamification can help, request a demo with Mambo now.

Download your free

“Gamification Guide”

Get your PDF now and start transforming your approach to digital engagement!

Latest Posts

Machine Learning In Finance: 12 Essential Applications

The impact of machine learning on finance is significant. Thanks to this technology, financial institutions are now equipped to make efficient decisions. Through the analysis of data sets, machine learning […]

How To Create Interactive Compliance Training For Bank Employees

Banking compliance training isn’t just another task. It’s the stage where everything else performs. Banks must navigate a myriad of regulations and laws. After all, this is a trust-driven, high-stakes […]

How Fintech Apps Are Using Gamification To Increase User Engagement

Discover how gamification in fintech is revolutionizing financial engagement, making banking fun & boosting user loyalty.