Product Portfolio Management: From Definition To Frameworks

Many large businesses offering multiple products can attribute their success to diversifying their portfolios. That’s because diversification has always been one of the most effective ways to sustain and grow a business. Some focus on the spin-offs of their flagship products. While others spread their influence through assortments of products directed to multiple target markets.

This is where product portfolio management shines the brightest.

Why?

That’s because they will do everything it takes to ensure all their products perform at their peak. Managing the direction and success of multiple product lines isn’t easy. But with the help of product portfolio management, companies can guarantee the health of their products throughout their life cycle.

Let’s dive deep into everything you need about product portfolio management, from its objectives to the top product portfolio management tools.

Table of Contents

What is a product portfolio?

A product portfolio is a collection or range of products or services a business offers. It is a company’s set of offerings that can meet its customers’ needs and preferences. Each product within this portfolio serves a specific purpose and targets a particular market segment. Furthermore, these individual solutions contribute to the organisation’s overall business objectives as a part of a product set.

Product portfolio simplified

Let’s try to simplify product portfolios using an apt analogy. Imagine you’re a highly-esteemed chef preparing a menu for your restaurant to cater to various tastes and preferences. Because of this objective, you’ll work harder to offer a balanced and enticing selection of dishes to your patrons. Each food you serve must have its unique flavour and presentation if you want it to look mouth-watering and palatable.

Successful companies do their best to maintain impressive and well-maintained product portfolios. Some may offer a specific set of one or two products that cater to a particular niche, like Michelin. They’re widely known as the tire company that ranks selected restaurants worldwide with their famous “Michelin Stars.” The gain and loss of these dining ratings have been instrumental to the success and downfall of many restaurants worldwide.

However, other companies will have expansive portfolios of products catering to a broad customer base. One example is Coca-Cola, which offers its widely popular soft drinks and other beverages like coffee and sports drinks. Other companies like Amazon have diverse product portfolios, targeting customers in different markets. Their portfolio includes retail, advertising, AI assistance, consumer electronics, and more.

A well-structured portfolio includes various characteristics, like product features, price points, and target audiences. Such diversity helps companies accommodate a broader customer base and provide valid options for customers with different preferences and requirements.

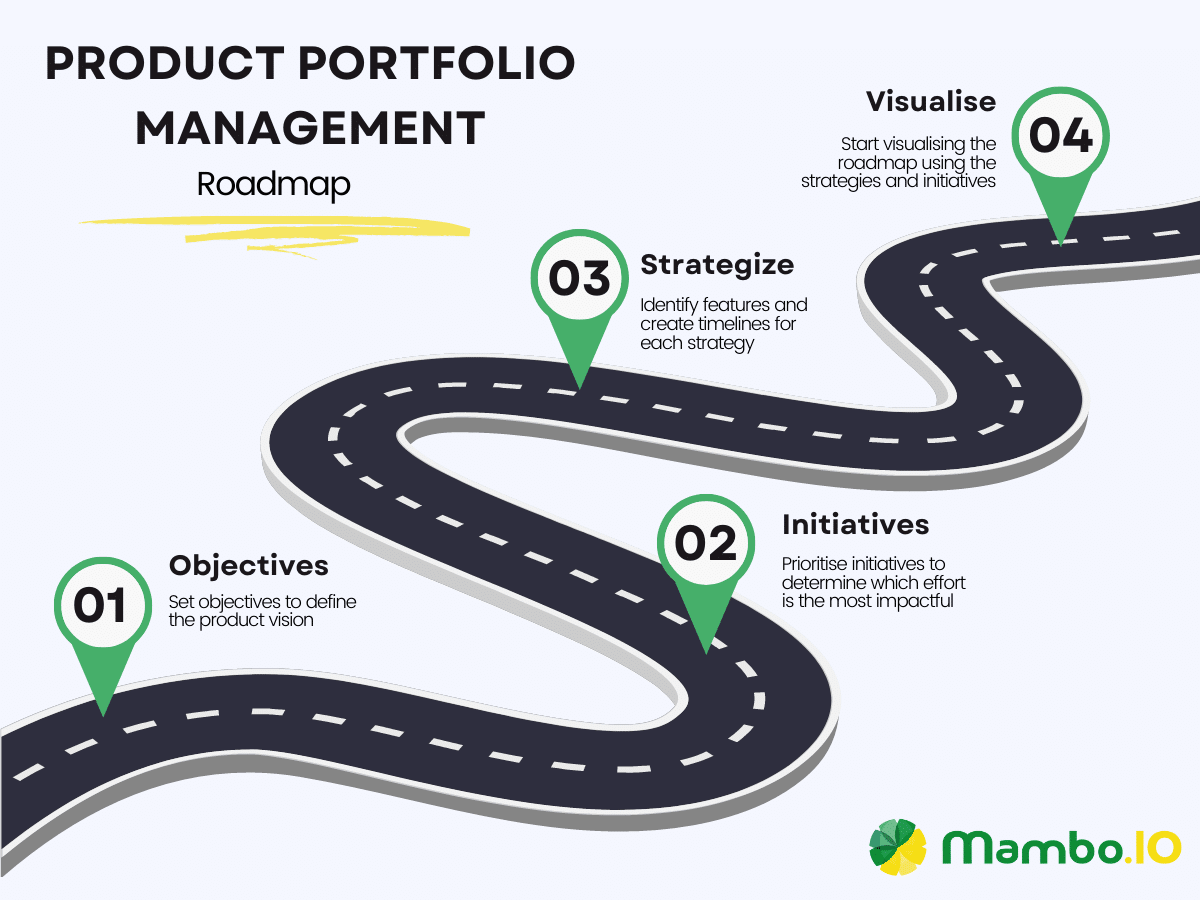

What is product portfolio management?

Product portfolio management is the strategic process of overseeing and optimising a company’s product portfolio. This task involves deciding which products the company should continue or discontinue. It also entails allocating the budget to the right places to ensure the portfolio is well-managed and balanced.

Every company needs effective portfolio management to ensure the performance of every product or solution in such a competitive market. This practice also means putting talents and resources into the most profitable products. In short, not all good ideas survive the development process, and not all released products stay viable over time. Once the wheat is separated from the chaff, product portfolio managers can champion the winners and widen their margins.

What are the tasks involved in product portfolio management?

Product portfolio management is a complex task requiring managers to make nuanced yet impactful decisions. Let’s review some of the critical elements of product portfolio management.

#1. Product portfolio analysis

This is a comprehensive evaluation of all the products created or distributed by a company. It involves analysing the product portfolio’s current state, including each product’s performance, profitability, and market position. It aims to assess and devise potential future marketing strategies for every product.

#2. Strategic planning

With product portfolio analysis, product portfolio managers can strategically plan to determine a compelling product portfolio management strategy. They are expected to develop actionable strategies to help guide the management and growth of the company’s product lines. They must also align the entire portfolio with the organisation’s overall business strategy to maximise its value, competitiveness, and profitability.

#3. Resource allocation

As mentioned, product portfolio management requires allocating the company’s resources accordingly. This includes the budget, personnel, and technology for different products based on factors like strategic importance and potential returns. To put it simply, resource allocation is all about prioritising investments and making trade-offs for the benefit of the portfolio.

#4. Development of new products

Managing product portfolios also involves evaluating and selecting new product ideas ripe for development. Additionally, managers must tune in with the market trends and assess whether those ideas fit the portfolio. Doing so ensures a continuous flow of innovative and competitive products down the pipeline.

#5. Product lifecycle management

Products go through multiple stages during their lifecycle, starting with their introduction and eventual decline. Product portfolio managers will see that each product’s strategies are adjusted to mitigate risks and maximise profitability.

#6. Portfolio optimisation

Markets aren’t as stable as they once were back in the day. This is one of the prominent reasons why companies must prioritise making swift and crisp portfolio decisions. Because of this, product portfolio managers will have to adjust their product’s direction per the dynamic market trends through portfolio optimisation.

Product portfolio management is no easy feat, and it involves tons of strategic decision-making and continuous evaluation of the portfolio’s performance. But when executives can make the right decisions, they can steer their products to a path that achieves the company’s business objectives. Thankfully, optimal product portfolio management can do just that.

What is the objective of product portfolio management?

The primary objective of product portfolio management is to ensure the company’s resources are invested in the right places. In short, it aims to balance the risks and growth of the business’s product lines. Doing so will require robust strategies to ensure everything goes according to plan.

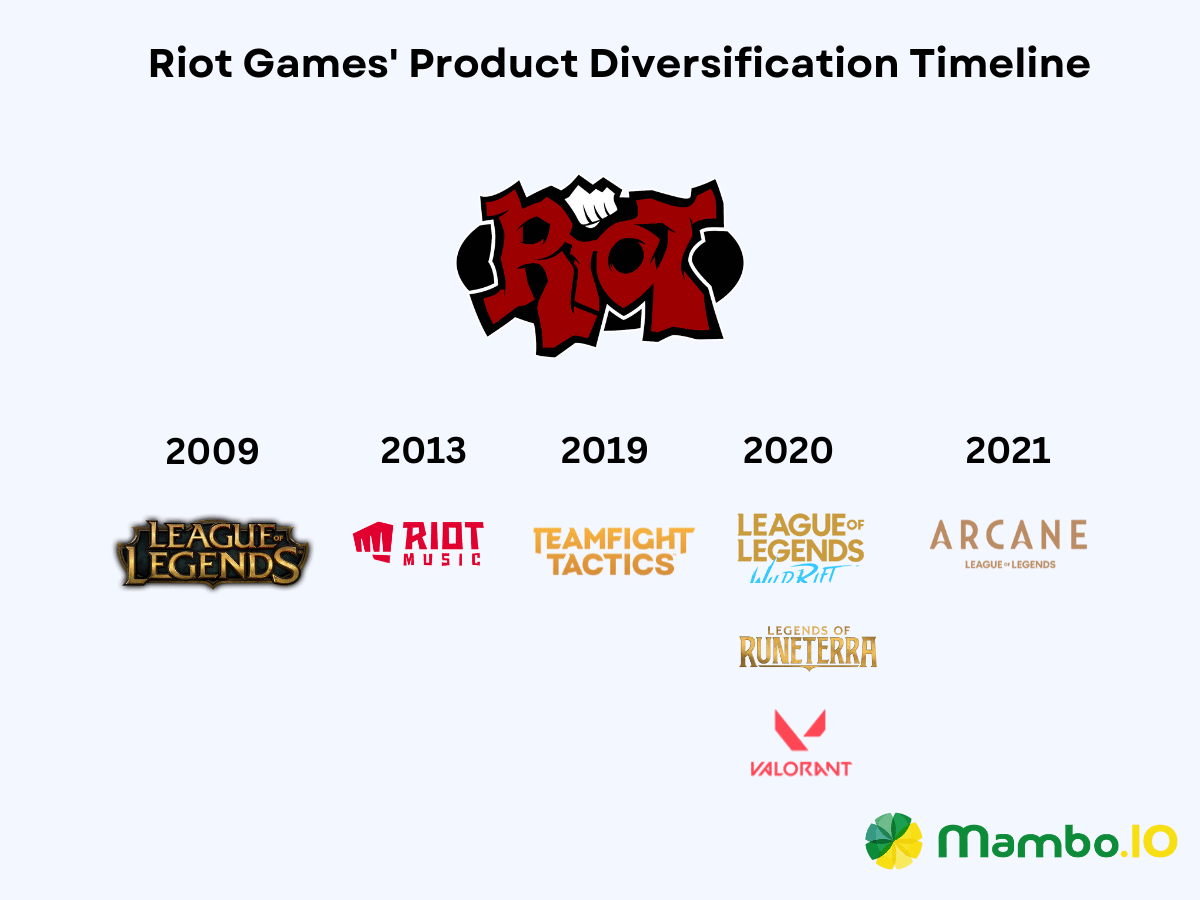

Take a look at Riot Games, which developed and published the widely popular game League of Legends. This company now has a diverse portfolio built around its flagship product through a hard-hitting product portfolio management strategy. After a decade since its release, they’ve started to venture into new markets such as music, TV series, and mobile games. Riot Game’s portfolio diversification has proven highly effective, judging from how well-loved their games and entertainment offerings are today.

Companies may take their product portfolio management to the next level and acquire other businesses to expand their domain. Take Disney as an example, which has collected various media companies such as Lucas Films, ESPN, Hulu, and 21st Century Fox. Of course, not all companies are titans like them, so relatively more minor companies must choose the right strategies based on their business goals.

Benefits of product portfolio management

Product portfolio management offers compelling benefits to companies who effectively wield it. It provides a centralised overview of the company’s entire suite of products instead of just focusing on the individual ones.

And unlike individual product management, a portfolio approach eliminates competing initiatives and agendas for product development. A portfolio approach adopts a broader perspective, eliminating conflicting ambitions and divergent product development agendas.

Ultimately, effective product portfolio management initiatives yield several key advantages:

- Alignment of the product portfolio with business goals

- Efficient allocation of resources

- Reduction of dependence on a single product or market segment

- Expansion of market share, spotting new opportunities, and meeting customer needs for increased revenue

- Informed decision making

- Quick adaptation to changing market conditions, customer preferences, and competition

- Customer satisfaction through diverse offerings

- Formulation of a unique value proposition that stands out from the competition

Product portfolio management frameworks

There are several prevalent and valuable product portfolio management tools. Each of these product portfolio management tools has a slightly different approach. The best-known frameworks used up to this day are the following:

#1. Ansoff matrix

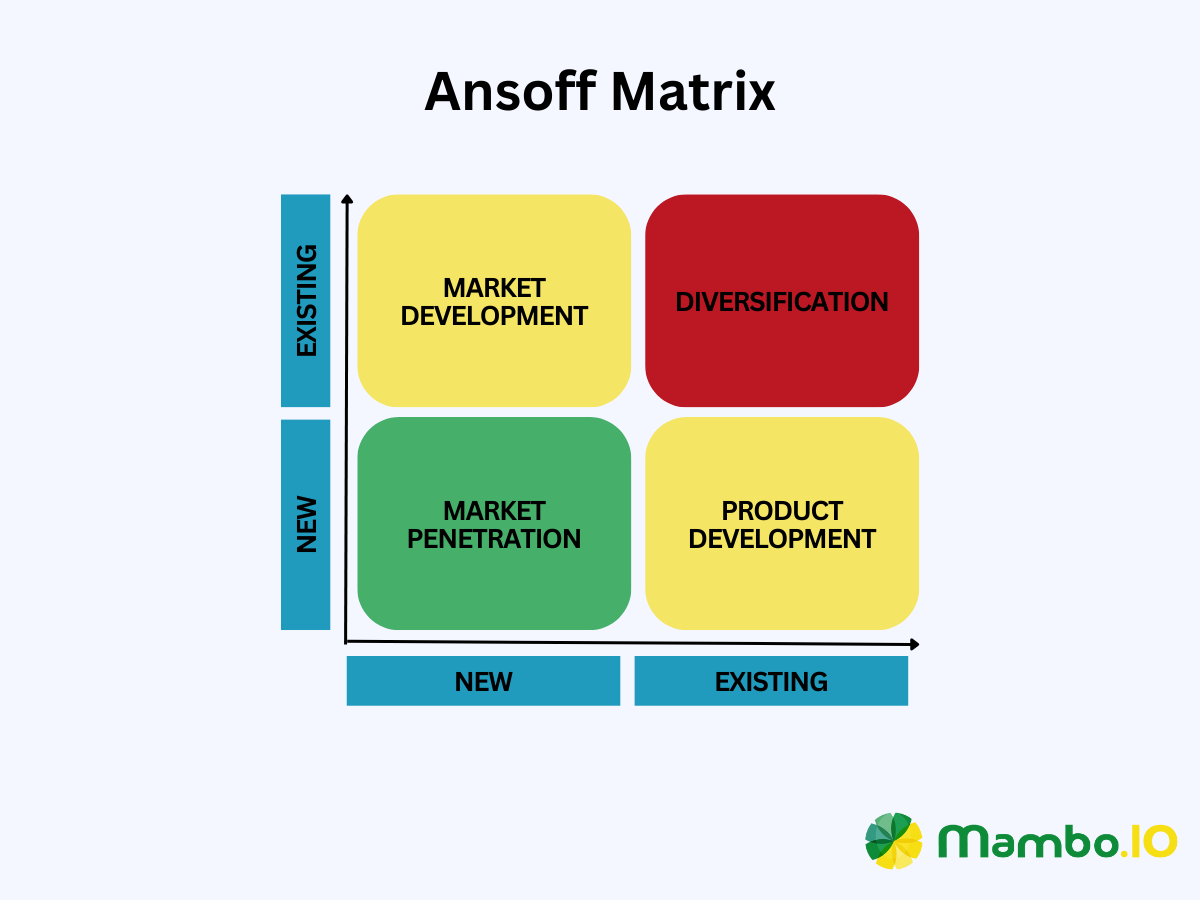

The Ansoff Matrix is a framework that helps gauge the options and risks involved when making strategic business decisions. It was developed by H. Igor Ansoff in 1957 to determine the appropriate strategy for product portfolio management.

The matrix contains two axes. The vertical axis refers to the markets (existing vs new markets). As for the horizontal axis, it pertains to products (existing vs new products). Inside these axes are four boxes, each representing a different approach for companies to consider. These four approaches are the following:

- Market penetration: This implies that companies must sell more of their existing products to their customers. It also means encouraging them to buy more products or more often as possible.

- Market development: Companies must reach new customer groups or expand into different geographic locations.

- Product development: Companies must develop new products for their current customers. It also implies the need to create new or improved offerings that can meet the needs and preferences of their existing customer base.

- Diversification: Companies will have to introduce new products to new markets. They’ll inevitably encounter risks since they’ll be tapping into completely different markets or developing entirely new products.

The Ansoff Matrix can be used by various businesses, regardless of size or industry. However, it’s more beneficial for established companies, startups, and small businesses that want to tread new product growth opportunities carefully.

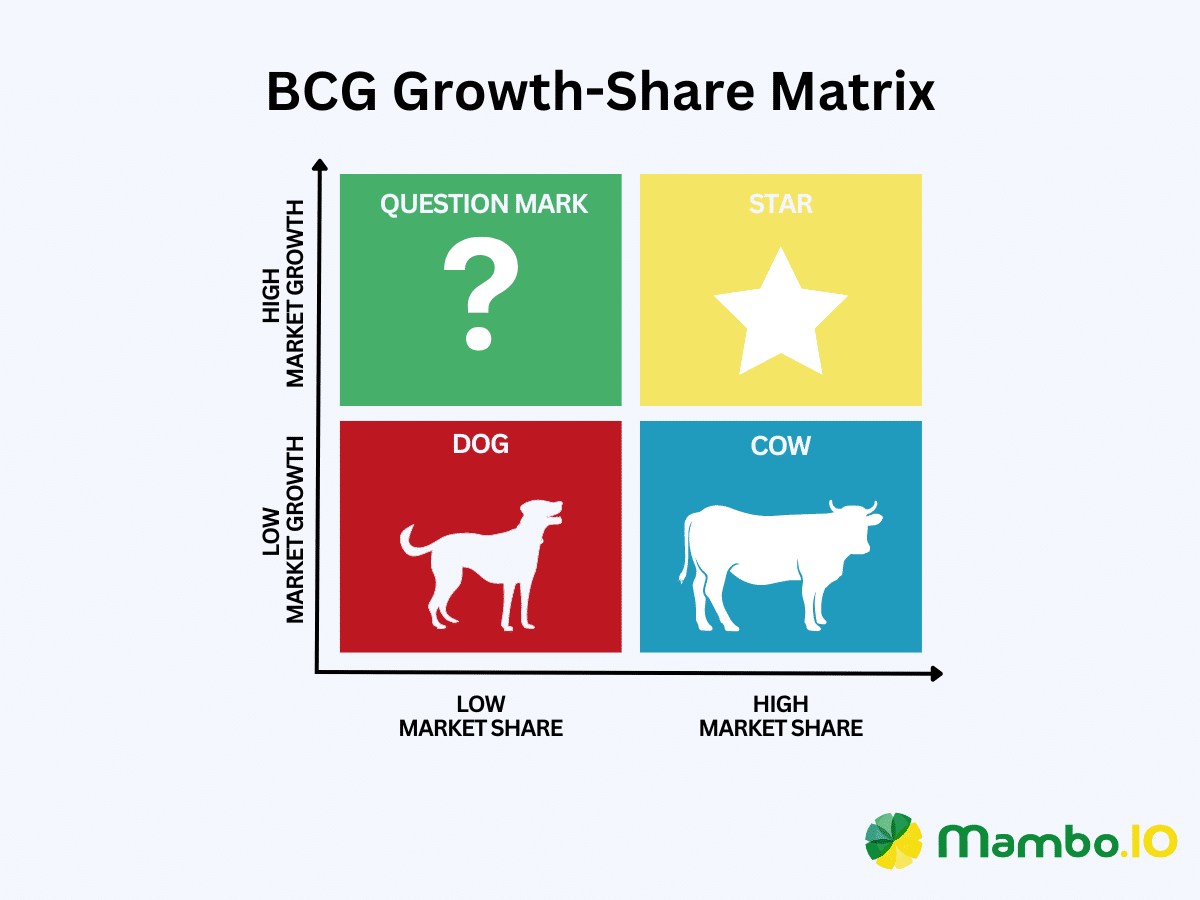

#2. BCG growth-share matrix

The BCG Growth-Share Matrix was designed to help companies evaluate their product portfolio’s performance and allocate resources accordingly. It allows for a balanced allocation of resources across various product categories based on their growth potential and market share. Developed by the Boston Consulting Group (BCG) in 1970, this matrix was intended to analyse products to aid long-term strategic planning.

The matrix categorises products into four quadrants, mainly:

- Stars: Products under this category have the potential to generate significant revenue and profit for the company. However, investment is required to sustain their growth and increase their market share.

- Cash cows: Companies can “milk” cash cows because these products generate stable and consistent cash flow. They can support other products.

- Question marks: Also dubbed as the “problem child”, these products can potentially grow but have a small market share. Therefore, they require careful consideration and investment before becoming future stars or phase-out-worthy products.

- Dogs: Products under these categories have minimal market share and limited growth prospects. They tend to consume resources even if they don’t generate significant returns in investment (ROI). It’s up to companies to decide whether to divest or discontinue these products.

The BCG Growth-Share Matrix is useful for large corporations with diverse product lines. They can use this matrix to identify the products that require investment and those that generate a steady cash flow. Furthermore, it can help them pinpoint those needing further assessment or potential discontinuation.

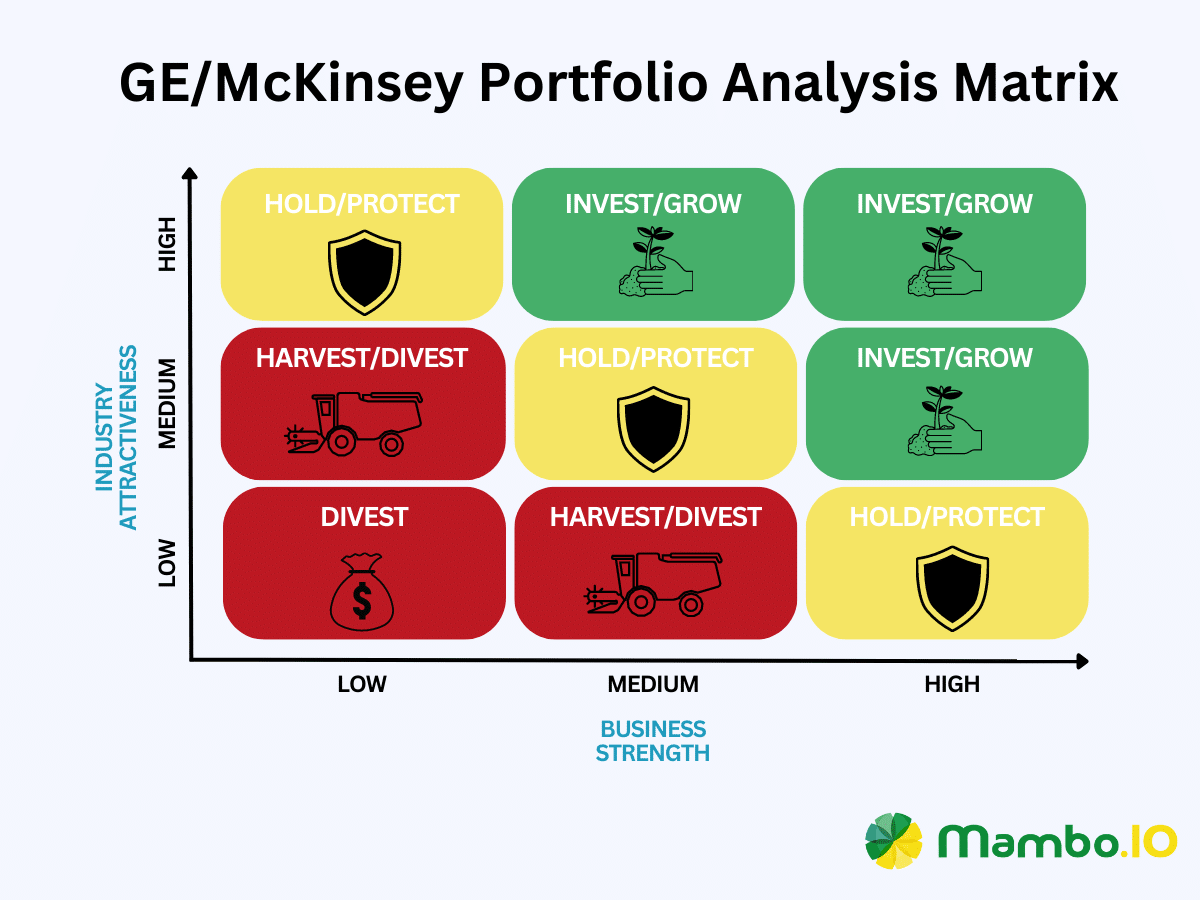

#3. GE/McKinsey portfolio analysis matrix

The GE/McKinsey Portfolio matrix is a valuable alternative to the BCG Growth-Share matrix. This complex matrix considers two distinct dimensions, which we’ll discuss briefly. It enables companies to base their decisions on these dimensions rather than relying solely on future projections like the latter matrix.

The first dimension is industry attractiveness, which assesses the potential profitability of an industry. This dimension helps businesses evaluate the attractiveness of entering or competing in a particular industry based on its profit potential. The primary drivers of industry attractiveness are as follows:

- Market size

- Growth rate

- Competition

- Market dynamics

The second dimension is business strength, which refers to a specific business unit’s competitive advantage and performance within an industry. This helps evaluate how well a specific business unit positions itself to capitalise on industry attractiveness.

The GE/McKinsey matrix benefits multi-business portfolios that want to allocate resources appropriately. It is particularly recommended for multi-product companies and large corporations that prioritise growth.

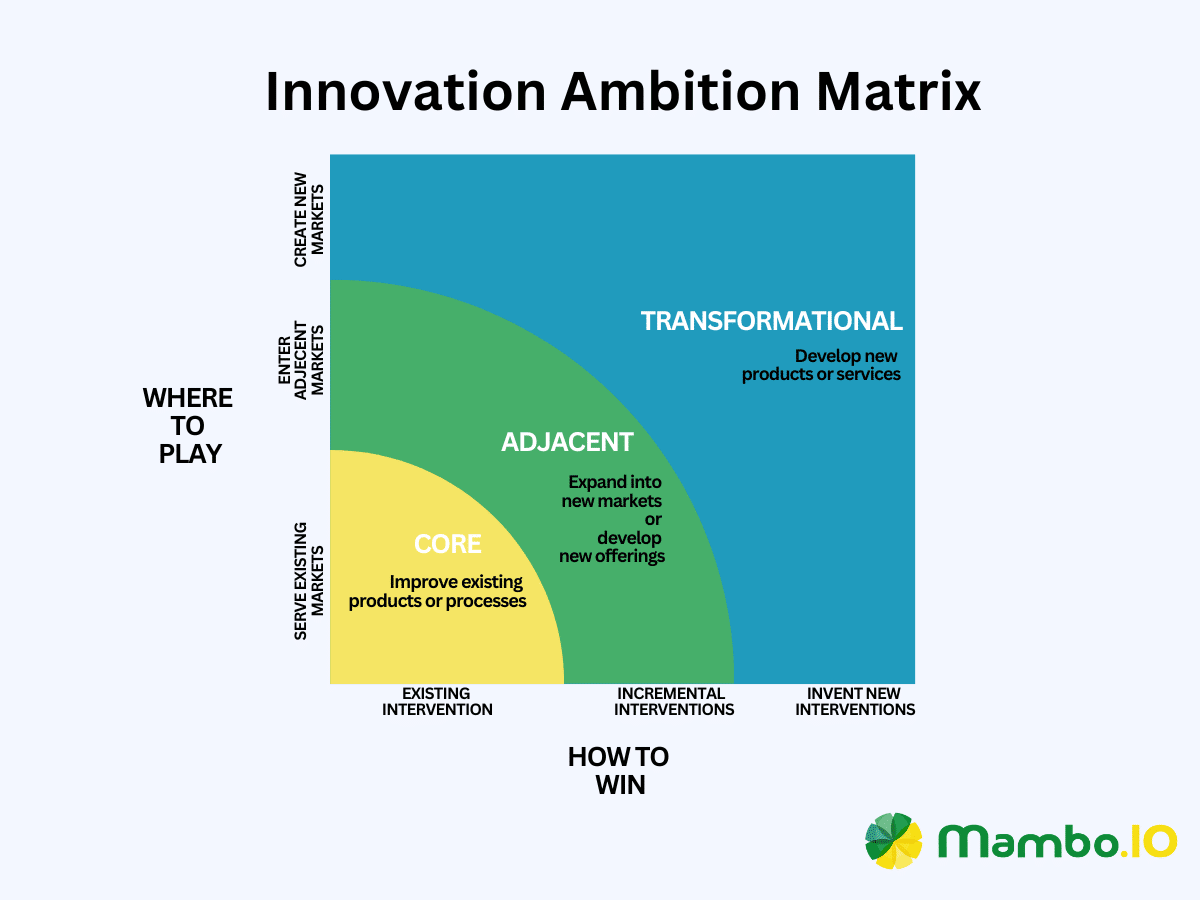

#4. Innovation ambition matrix

Innovative businesses are naturally ambitious, so they must carefully tread their markets. This is where the Innovation Ambition matrix shines the most, a template widely popularised by Harvard Business Review. It is a refined iteration of the Ansoff matrix intended to help companies properly allocate funds for growth initiatives.

The Innovation Ambition matrix helps organisations understand and prioritise their innovation efforts based on ambition level and strategic importance. The vertical axis represents the “where to play”, while the horizontal axis stands for the “how to win”.

The matrix contains three quadrants:

- Core innovations: These innovations aim to improve existing products or processes. They have a moderate ambition level and are strategically important to the company’s current operations, hence the term “core”.

- Adjacent innovations: Such innovations involve expanding into new markets or developing new offerings, all related to the company’s existing products. They have a slightly higher level of ambition and can significantly contribute to strategic growth.

- Transformational innovations: These ambitious innovations require developing new products, services, or business models. Consequently, they require substantial resources but offer a significant strategic impact.

The Innovation Ambition matrix is handy for established companies and technology startups. Particularly those that want to prioritise their innovation initiatives and align them with their growth objectives.

Best product portfolio management software

Managing portfolios can be highly challenging without access to the right tools. Fortunately, there are product portfolio management software that can help product teams manage, organise, and analyse their portfolio. Here are the five best product portfolio management software used by companies today.

#1. Dragonboat

Dragonboat is a powerful product portfolio management platform that can help any product portfolio manager handle their portfolios.

This flexible tool can help product teams build out road maps and make it easy to see where priorities are. Ultimately, it is one of the most preferred platforms for strategising, prioritising, delivering, and improving product portfolio investments.

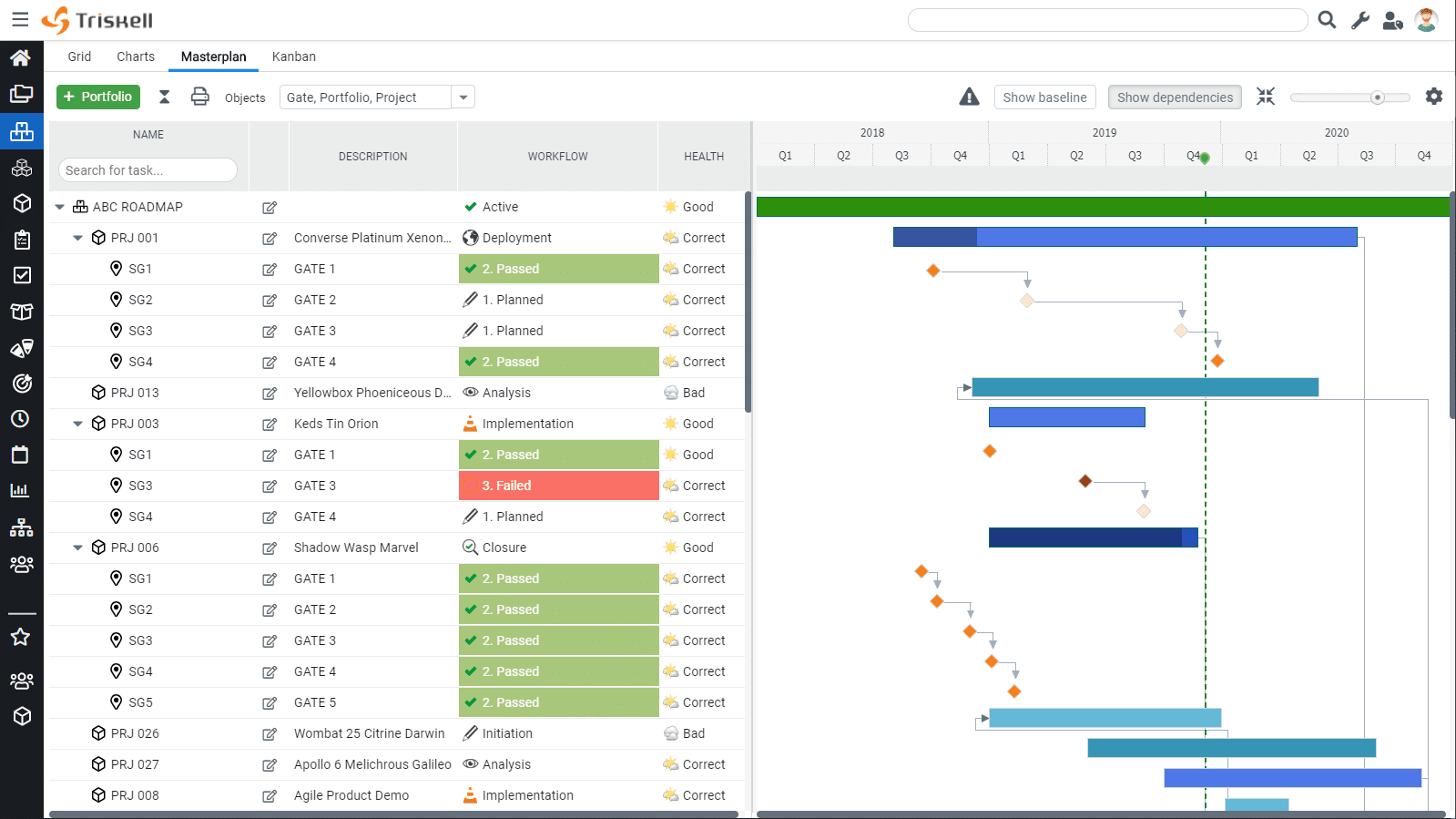

#2. Triskell

Triskell is a comprehensive enterprise-level platform designed to capture, align, and connect objectives, initiatives, and portfolios across an enterprise.

Source: GetApp

This product portfolio management tool comes with customisable options that help companies gain control over projects while ensuring successful outcomes. So, if you need to manage products and initiatives in a single platform, Triskell is the way to go.

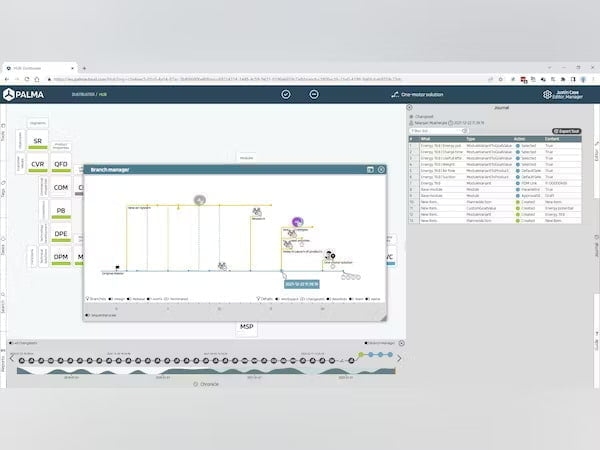

#3. Palma

PALMA empowers product managers to seamlessly align commercial, technical, product, and module plans – all in a single platform.

Source: Capterra

Its integrated capabilities can make product portfolio management more efficient, streamlined, and transparent. It also updates changes and dependencies in real time, enabling teams to identify and resolve planning conflicts efficiently.

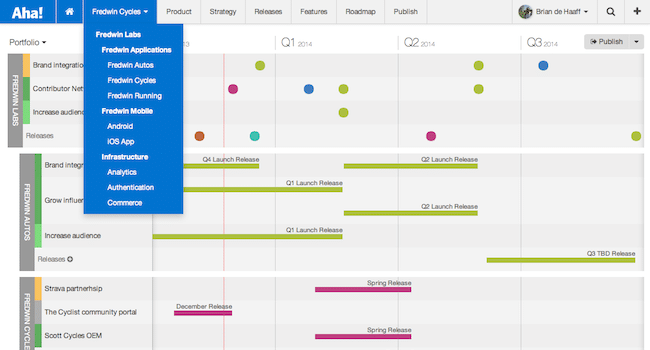

#4. Aha.io

Aha.io is an ideal solution for product portfolio management because of its robust features.

Source: Aha.io

It allows product portfolio managers to tailor their workflows to their specific needs. Moreover, it makes tasks like resource and budget allocation, dependencies tracking and monitoring them, making processes much more efficient.

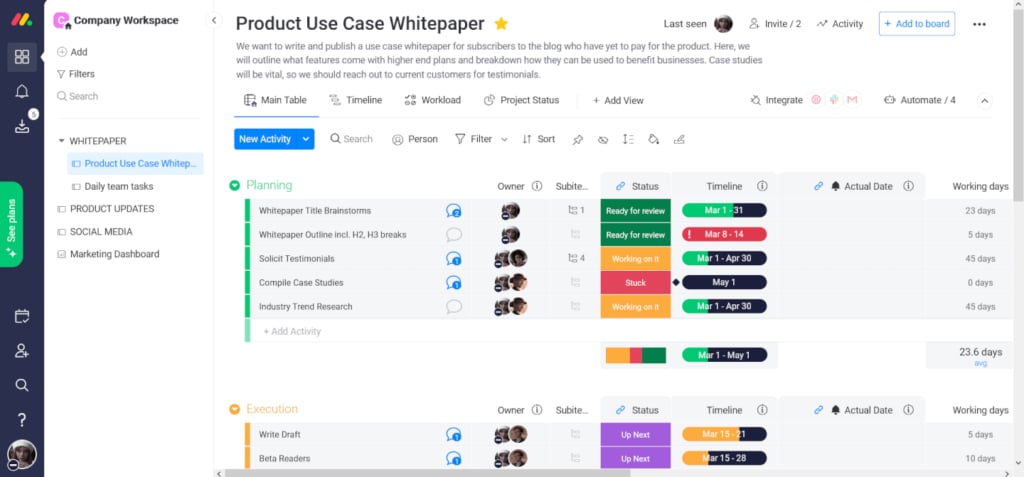

#5. Monday.com

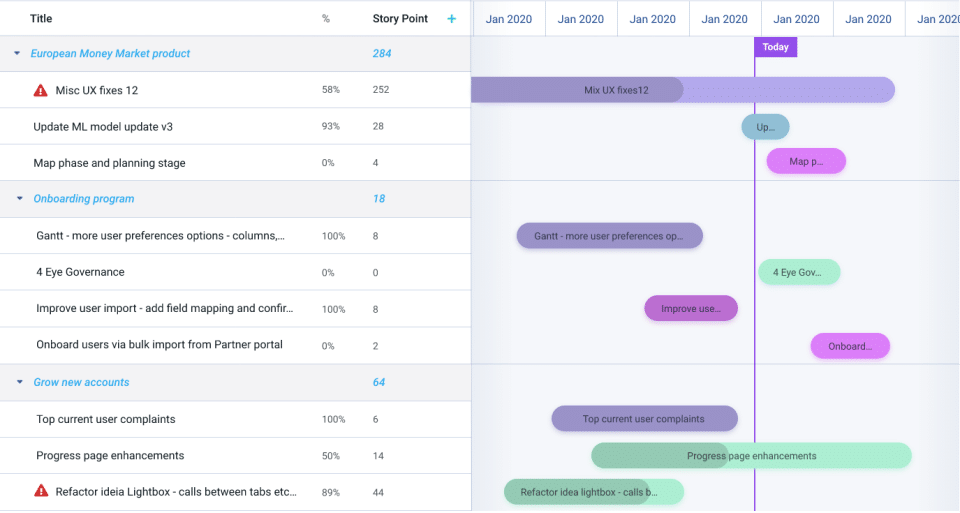

Monday.com is an intuitive and user-friendly platform designed to streamline workflows crucial for product portfolio management.

Source: The Product Manager

It simplifies discussions, task assignments, and task monitoring while informing everyone about critical updates. Additionally, it has readily-available templates so product portfolio managers can effortlessly kick-start projects without starting from scratch.

Final Thoughts

The value of product portfolio management is critical for businesses of all sizes, regardless of their goals or team dynamics. A well-crafted product portfolio enables companies to make strategic decisions for sustainable growth. Here at Mambo.io, we believe investing in product portfolio management can significantly help organisations stay ahead in an ever-changing marketplace.

Download your free

“Gamification Guide”

Get your PDF now and start transforming your approach to digital engagement!

Latest Posts

Machine Learning In Finance: 12 Essential Applications

The impact of machine learning on finance is significant. Thanks to this technology, financial institutions are now equipped to make efficient decisions. Through the analysis of data sets, machine learning […]

How To Create Interactive Compliance Training For Bank Employees

Banking compliance training isn’t just another task. It’s the stage where everything else performs. Banks must navigate a myriad of regulations and laws. After all, this is a trust-driven, high-stakes […]

How Fintech Apps Are Using Gamification To Increase User Engagement

Discover how gamification in fintech is revolutionizing financial engagement, making banking fun & boosting user loyalty.