Churn Rate in the SaaS Industry: Strategies, Calculations, and Examples

The churn rate is a vital business metric. Also known as attrition rate, it measures how many customers end their relationship with a company within a specific timeframe. This concept applies to customers who stop buying your product and how many customers don’t renew.

This measure is particularly significant for Software as a Service (SaaS) companies, whose business model greatly relies on customer retention. A high churn rate could indicate customer dissatisfaction, reduced loyalty, and a profit drop.

In this article, we will be discussing the concept of churn rate. We will dive into its importance and significance and how it is calculated. Also, we will see how a specific strategy can help SaaS companies reduce it. Real-world instances are also examined where SaaS companies have successfully managed their churn rates.

Table of Contents

- What does churn rate mean?

- How to calculate churn rate

- Timeframe for measuring churn rate

- Factors Affecting Churn Rate

- Reducing churn rate with gamification

- Examples of successful churn rate management

- Frequently asked questions

- Conclusion

- Machine Learning In Finance: 12 Essential Applications

- How To Create Interactive Compliance Training For Bank Employees

- How Fintech Apps Are Using Gamification To Increase User Engagement

- Top Gamification Companies for Employee & Customer Engagement

What does churn rate mean?

As time passes, customers either stay or move on. The churn rate refers to the percentage of customers who choose to move on from using a product or service. It also measures the number of customers lost within a period.

Taking a particular SaaS company as an example, they initially started with 100 customers. Customers fell to 90 in a month, meaning the churn rate for that month was 10%.

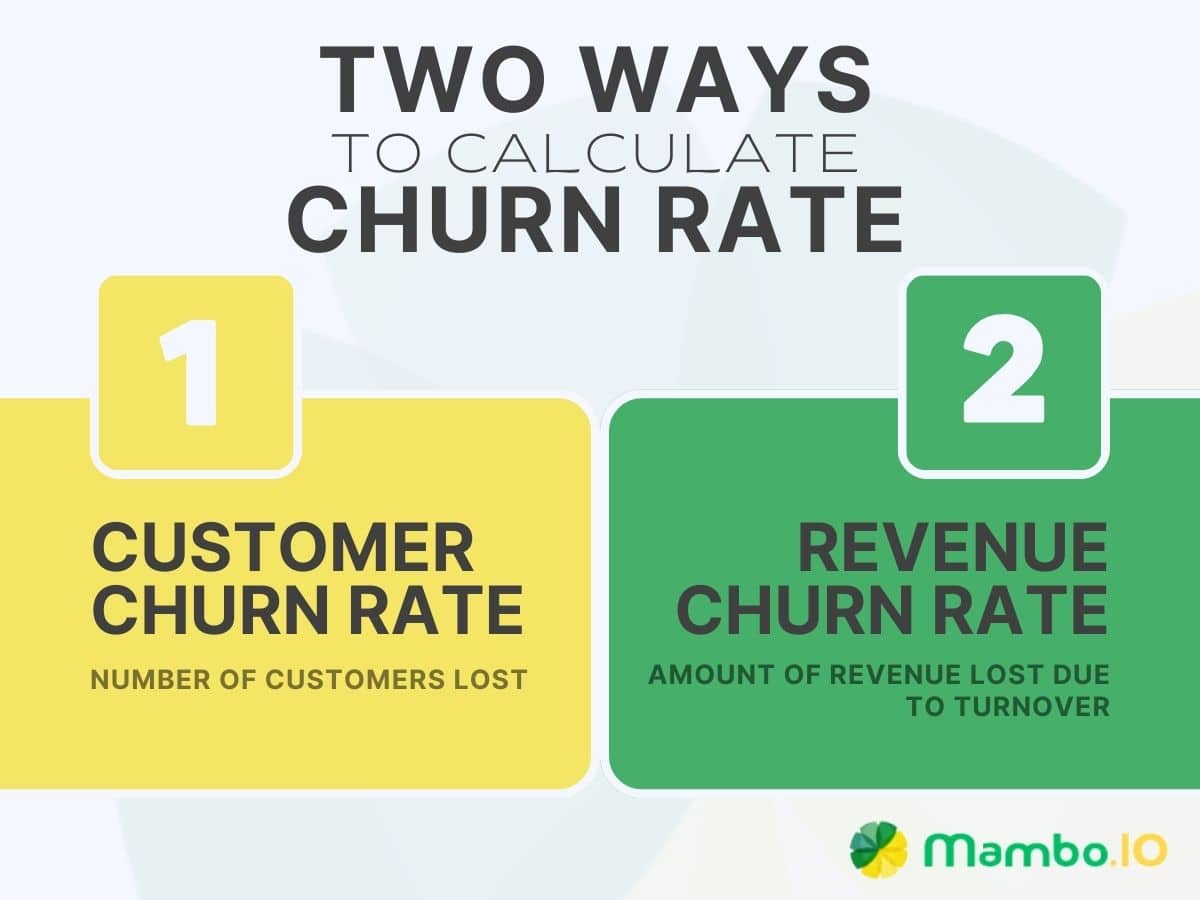

In terms of determining the churn rate value, there are two ways to calculate the churn rate. One is based on the number of customers lost (customer churn rate). And the other is based on the revenue lost due to turnover (revenue churn rate).

Why is churn rate important?

The churn rate plays a pivotal role in shaping the growth and stability of a SaaS company. A high churn rate implies that more customers are departing than new ones are arriving. This leads to a potential financial strain and a dwindling market presence.

On the flip side, a low churn rate indicates that customers are sticking around, ensuring a consistent stream of revenue and an expanded market share.

Moreover, the churn rate indicates customer satisfaction and loyalty, influencing word-of-mouth marketing and referrals. Consequently, monitoring and managing churn rates is indispensable for SaaS companies. This strategy enhances customer retention, optimises profitability, and increases customer lifetime value, contributing to long-term success and business sustainability.

How to calculate churn rate

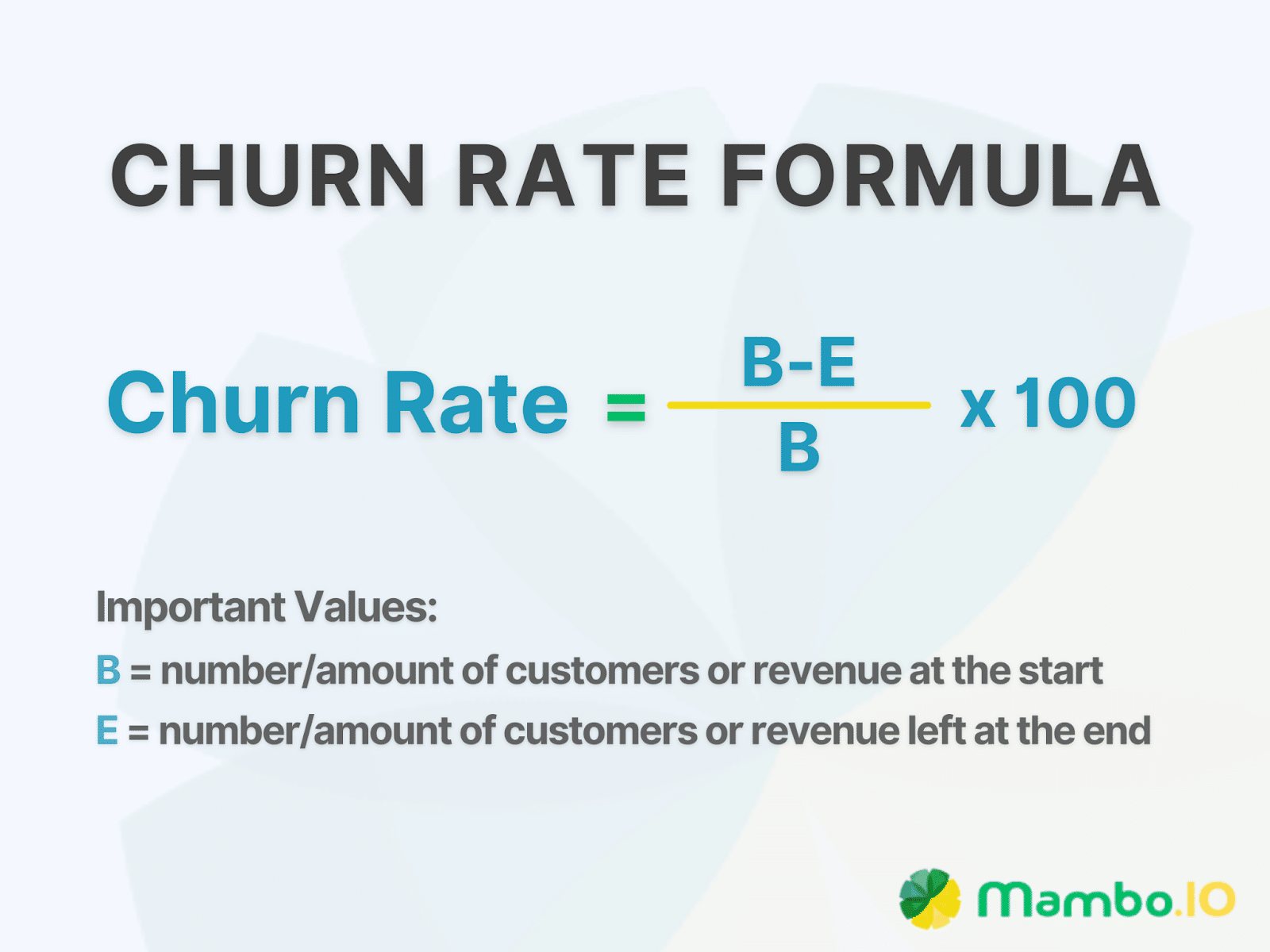

Calculating the churn rate is as pretty straightforward as calculating gets. You only need to have two vital pieces of data. Firstly, the number/amount of customers (or revenue) you have started with, which we’ll call ‘B.’ And then, the number/amount of customers (or revenue) left at the end of the period, which we’ll call ‘E.’

Formula for calculating churn rate

The churn rate formula goes like this:

Now that you have grasped the basic ideas of what churn rate is. Let’s use various examples to help you understand better.

Example #1 – Customer churn rate

Imagine a SaaS company that kicks off the month with 100 customers. As the month wraps up, they find themselves with 90 customers. To calculate the churn rate, just plug these numbers into the customer churn rate formula:

Customer Churn Rate = (100 – 90) / 100 x 100 = 10%

In this scenario, the monthly customer churn rate stands at 10%. It means that 10% of the customers decided to move on or stopped using the service that month.

Example #2 – Revenue churn rate

This time, let’s consider the company’s revenue. During a particular month of the year, revenue was $10,000. However, by month’s end, it had decreased to $9,000.

Here’s how you calculate the monthly revenue churn rate:

Revenue Churn Rate = ($10,000 – $9,000) / $10,000 x 100 = 10%

Similar to the previous computation, the monthly churn rate is also found to be 10%. This means 10% of revenue was lost during that month.

Calculating the churn rate helps to keep tabs on your business accurately. An accurately calculated churn rate provides insights into how your customer base or revenue changes over time. You can identify trends, make informed decisions, and take action to lessen churn.

Churn rate is more than just numbers. It is a vital tool that helps with your business’s health and customers’ behaviours, ensuring long-term success.

Timeframe for measuring churn rate

The timeframe you select for measuring churn rate isn’t a one-size-fits-all. The most suitable one hinges on the nature of your offering and how your customers behave with it. Let’s delve into these different timeframes:

#1. Annual churn rate

When discussing the annual churn rate, we look at the percentage of lost customers or revenue in a year. This timespan is particularly valuable when you’re focused on long-term planning and must make strategic forecasts for your business.

It provides you with a birds-eye view of how your customer retention strategies are performing over a more extended period.

#2. Monthly churn rate

Shifting our focus to the monthly churn rate, we’re now assessing the loss of customers or revenue within a month. This timeframe is akin to keeping your finger on the pulse of your business in the short term.

It’s like a monthly check-up, allowing you to promptly identify any issues, trends, or fluctuations in customer retention. It’s a valuable tool for short-term monitoring and regular evaluation.

#3. Quarterly churn rate

The quarterly churn rate takes a broader view, spanning three months. This timeframe provides a middle ground between the annual and monthly perspectives. It’s ideal for medium-term analysis and comparison.

Turning our attention to this, we scrutinise customer or revenue attrition over three months. This provides insights into emerging trends within your customer base, guiding decisions that aren’t excessively myopic yet not excessively far-sighted.

Selecting the appropriate timeframe to measure churn rate is essential for capturing the necessary details for informed decisions. This is not a one-time task but a continuous process that requires careful monitoring and analysis.

Whether you opt for annual, monthly, or quarterly assessments, each timeframe provides unique insights. These insights can help refine your strategies and ensure your customers remain engaged and satisfied.

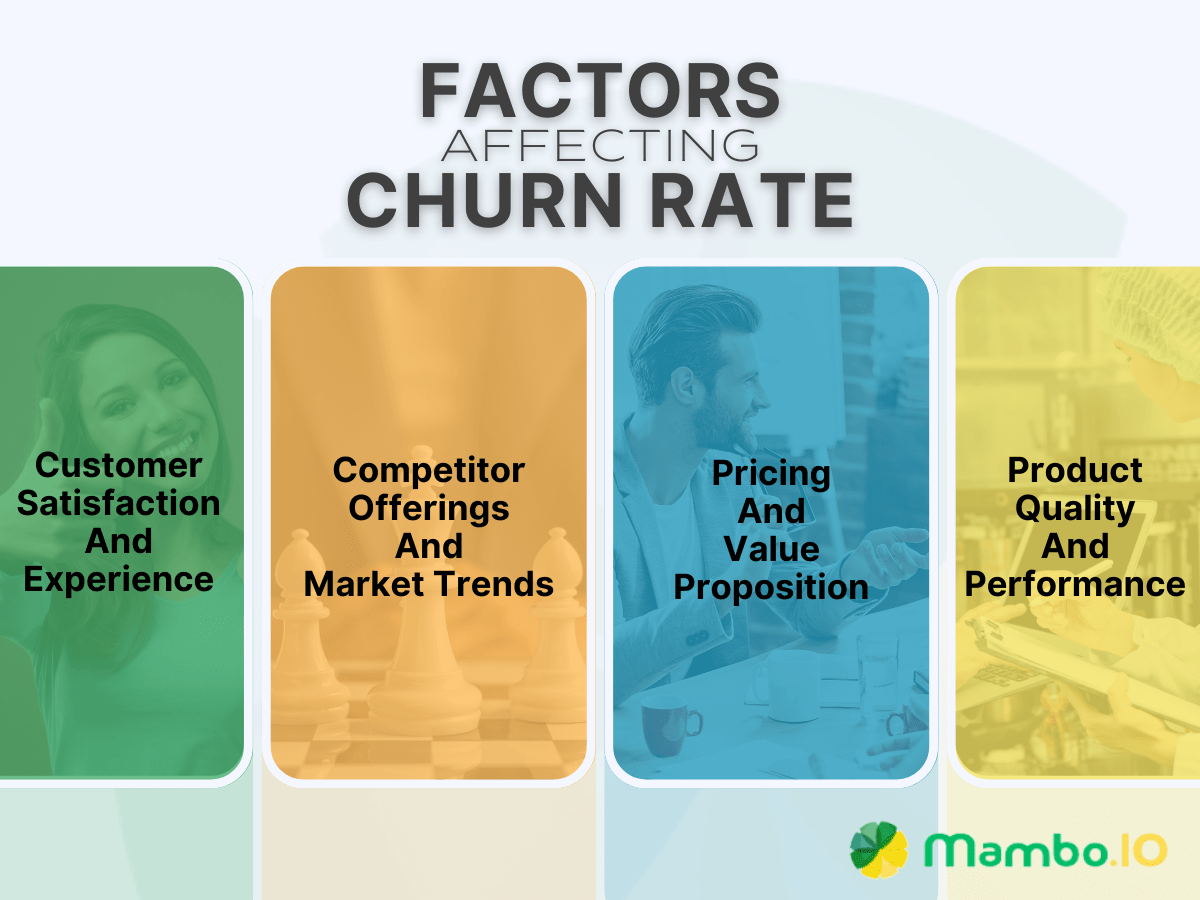

Factors Affecting Churn Rate

Despite your best efforts, the churn rate is not one-dimensional. An offering’s quality may not solely be the determining factor – if one at all. Various internal and external factors come into play, shaping customer behaviour and perceptions. Here are some common factors that play a role in churn rate:

-

Customer satisfaction and experience

Satisfied customers become loyal customers. Customers who find a product or service satisfying tend to remain and might even recommend it to others. Conversely, dissatisfied customers are more inclined to seek alternatives or cease using the product altogether.

To combat churn, SaaS companies must strive for excellence, ensuring their offering meets or exceeds customer expectations. Collecting and analysing customer feedback is also crucial to addressing satisfaction issues.

-

Competitor offerings and market trends

In the dynamic world of SaaS, competitors and market trends pose significant threats to customer retention. Customers who become aware of better or more affordable alternatives from competitors may switch. Likewise, changing market trends and shifting customer preferences can lead to a search for new solutions.

SaaS companies must stay vigilant by monitoring their competitors and the market while innovating and differentiating their products. This is done to provide added value to their target audience.

-

Pricing and value proposition

As with any venture, how people perceive your offering is vital. Customer value perception is pivotal in deciding to stay or leave.

Customers who believe the product justifies its price and delivers value are likelier to remain loyal. However, doubts may arise if they perceive the product as underdelivering or oversold.

SaaS companies should set prices that align with the product’s quality and communicate the value proposition to their customers. These should highlight how the product addresses their needs and solves their problems.

-

Product quality and performance

The quality and performance of a product significantly impact customer satisfaction. A product that smoothly and reliably functions makes users more likely to trust and enjoy it. On the other hand, encountering bugs, glitches, or downtime can lead to user frustration.

SaaS companies should regularly test, debug, and improve their products to combat churn. Offering responsive and effective customer support is also essential to promptly address any issues users may encounter.

Reducing churn rate with gamification

The churn rate of SaaS products or services can be reduced through gamification. Gamification involves:

- Infusing game design elements into non-gaming contexts.

- Making tasks more enjoyable and engaging.

- Motivating for users.

SaaS companies can employ gamification to:

#1. Improve the customer onboarding process.

The first impression is crucial for customer retention. Gamification can help SaaS companies create a smooth, enjoyable onboarding process that guides users through the offering’s features and benefits.

Gamification of tutorials, feedback, and tips can better enable SaaS companies to help users learn how to use offerings effectively.

Source: Salesforce

#2. Identify key user behaviours and actions to incentivise.

Gamification can help SaaS companies identify the most valuable actions or behaviours for their business goals and customer satisfaction.

Tracking user activity, usage frequency, feature adoption, and feedback submission makes measuring user engagement and loyalty easier with gamification.

Gamification can then reward users for performing those actions or behaviours. Incentives vary from points, badges, levels, or leaderboards to encourage them to repeat those actions or behaviours.

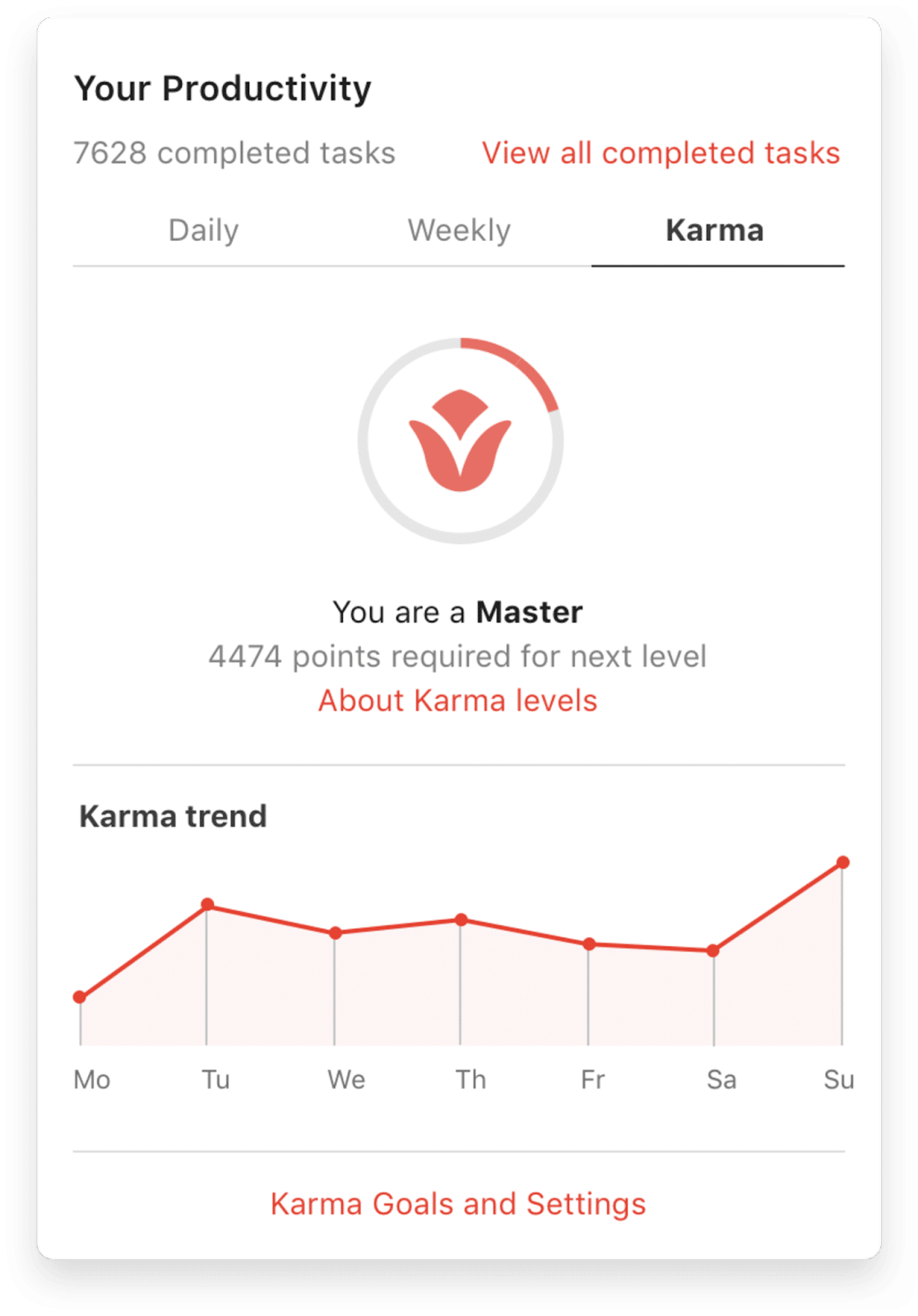

Source: Todoist

#3. Create a system with clear and achievable goals.

Gamification can help SaaS companies create a gamified system with clear and achievable user goals and rules.

Gamification can set specific and measurable objectives for users. It can be reaching a certain level, earning a particular badge, or unlocking a distinguishing feature.

Gamification can also establish clear and consistent rules for users. The goal can be to earn points, redeem rewards, and compete with others, among other regulations.

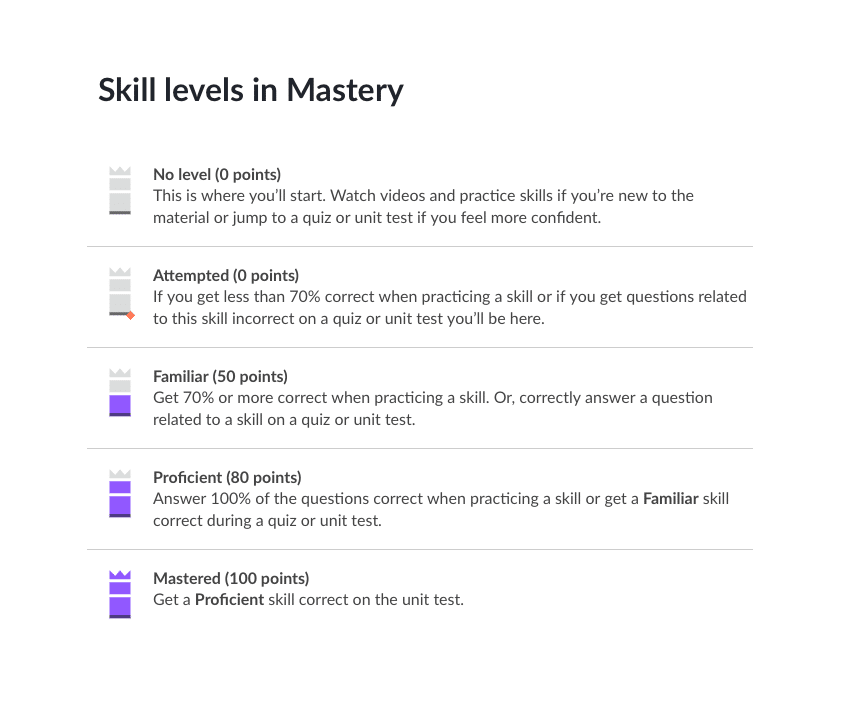

Source: Khan Academy

#4. Make existing products or services interactive and tactile.

Incorporating gamification within the product or service rather than placing it as an external layer can jazz up SaaS offerings.

You can embed progress bars, notifications, challenges, or feedback buttons within the UI and UX. It can make the offerings more interactive and immersive and feel tailor-made for existing customers and new users.

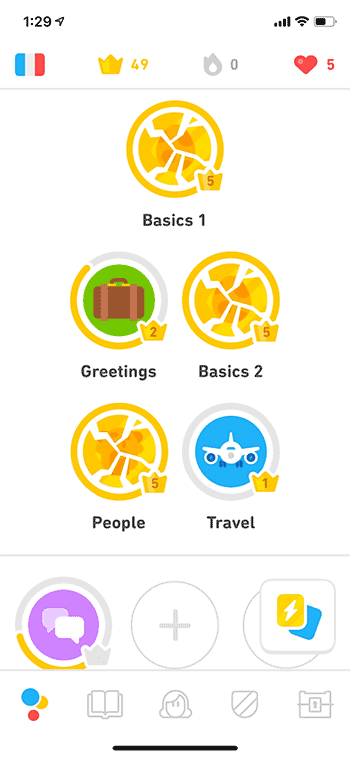

Source: Duolingo

Examples of successful churn rate management

Here are some examples of how SaaS companies have successfully managed their churn rate with gamification:

SaaS industry churn rate

Example #1: HubSpot – Transforming customer onboarding and partner engagement

HubSpot, a renowned SaaS marketing, sales, and customer service provider, has embraced gamification to enhance customer onboarding and engagement.

The company prioritises creating a positive first impression by offering user-friendly onboarding videos. It guides new users through the software, simplifying their learning experience.

HubSpot uses gamification in its ‘Academy and Partner Program’. They have an “optimise” feature on their blog, website, and landing page tools, including the Academy and Partner Program. This feature includes a checklist that turns green once a task is completed.

This method decreases churn rates and boosts engagement by visually showing user progress.

Example #2: Brilliant.org – Gamified Education

Brilliant.org is a gamified educational app and website befitting its name. An innovative SaaS company — it uses gamification to encourage its users (mostly adult students) to stay and learn more. They offer interactive lessons that feel like games, making academic learning more enjoyable.

Brilliant.org employs new and unique challenges for the user to encourage consistent learning and reduce churn. This strategy enables the user to learn and keep their curiosity high.

Aside from this, they provide immediate feedback and offer a chance for the user not to get things right the first time. The reward for finally fulfilling puzzles that require critical thinking is unbridled joy and accomplishment. They make the users feel great about themselves, providing them a sense of tangible and gratifying advancement.

Employment churn rate

Example #1: adobe – Enhancing employee engagement and skill development

Adobe, a leading software company, is committed to creating an inclusive environment where every employee matters. They’ve achieved global pay parity and fostered diversity through unique learning programmes. They have regular engagement events like ‘Adobe For All Week’.

Furthermore, Adobe promotes collaboration via employee networks and interest groups. Their effective initiatives in reducing churn rates are reflected in their “A+” retention score, rated by 1047 employees.

This commitment to employee engagement and skill development underscores Adobe’s position as a leader in its field.

Example #2: Google – Fostering employee retention through a positive work environment

With a retention rate of over 90%, Google has implemented strategies to create a supportive work environment. They’ve expanded their efforts to help employees thrive, doubling their retention and progression team. They are engaging over 40,000 Googlers in their employee resource groups.

These initiatives are aimed at mentorship, leadership development, and community building. It seeks to promote achievement and encourage employees to stay with the company. This approach has improved retention for women globally and Black+ and Latinx+ employees in the U.S.

Frequently asked questions

Here are some frequently asked questions about churn rates in the SaaS industry:

#1. What is a good churn rate?

There is no definitive answer to what a good churn rate is. It depends on industry, market, product type, or customer segment factors. However, some general benchmarks are:

- A good annual churn rate typically falls between 5% to 7%, as various studies and surveys indicate.

- The monthly rates should be less than 1% to be considered favourable.

- According to industry standards, satisfactory quarterly rates must fall between 1.5% to 3%.

#2. What is a negative churn rate?

A low churn rate is good, but a negative one is excellent news.

When the churn rate goes negative, a SaaS company has a consistent customer base. A solid retention strategy usually helps with this, too.

This can happen when SaaS businesses increase customer lifetime value by upselling, cross-selling, or expanding their services to existing customers.

#3. What is the ideal revenue churn rate?

The revenue churn rate is the percentage lost due to customer attrition. It is calculated over a given period. You can divide the revenue lost from customers who left by revenue at the beginning of the period. Then, you can multiply it by 100.

For example, at the beginning of the month, a SaaS company has $10,000 in revenue. And by month’s end, revenue was just $9,000. The monthly revenue churn rate is:

Revenue Churn Rate = ($10,000 – $9,000) / $10,000 x 100 = 10%

#4. What does 5% churn mean?

A 5% churn rate means that 5% of customers or revenue is lost over time. It is due to customer attrition.

For example, if a SaaS company has 100 customers at the beginning of the month. Then, due to customer attrition, customers fell to 95, the monthly customer churn rate is:

Customer Churn Rate = (100 – 95) / 100 x 100 = 5%

Understanding the dynamics of churn rate in the SaaS industry is essential for businesses seeking growth and sustainability. Businesses can make informed decisions to optimise their customer retention strategies by addressing these everyday queries.

Conclusion

Churn rate is a pivotal metric for SaaS companies, reflecting customer attrition within a given timeframe. Its impact extends to customer retention, lifetime value, and profitability. As such, measuring and managing churn rates is crucial to success in the competitive SaaS landscape.

One effective approach to mitigating the churn rate is the strategic use of gamification. SaaS companies can enhance customer engagement and loyalty by infusing gamification elements into their products and services. Ultimately ensuring a brighter future in the ever-evolving market.

Mambo stands out as a leading gamification platform in the dynamic landscape of SaaS. With Mambo, you can supercharge your efforts to retain customers and optimise your business performance.

Take advantage of the opportunity to elevate your churn rate management game! Visit us today and start your journey towards enhanced customer retention and success.

Download your free

“Gamification Guide”

Get your PDF now and start transforming your approach to digital engagement!

Latest Posts

Machine Learning In Finance: 12 Essential Applications

The impact of machine learning on finance is significant. Thanks to this technology, financial institutions are now equipped to make efficient decisions. Through the analysis of data sets, machine learning […]

How To Create Interactive Compliance Training For Bank Employees

Banking compliance training isn’t just another task. It’s the stage where everything else performs. Banks must navigate a myriad of regulations and laws. After all, this is a trust-driven, high-stakes […]

How Fintech Apps Are Using Gamification To Increase User Engagement

Discover how gamification in fintech is revolutionizing financial engagement, making banking fun & boosting user loyalty.